- United States

- /

- Oil and Gas

- /

- NYSE:WKC

World Fuel Services' (NYSE:INT) Stock Price Has Reduced 28% In The Past Year

It is a pleasure to report that the World Fuel Services Corporation (NYSE:INT) is up 47% in the last quarter. But in truth the last year hasn't been good for the share price. In fact, the price has declined 28% in a year, falling short of the returns you could get by investing in an index fund.

See our latest analysis for World Fuel Services

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the World Fuel Services share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

With a low yield of 1.3% we doubt that the dividend influences the share price much. On the other hand, we're certainly perturbed by the 33% decline in World Fuel Services' revenue. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

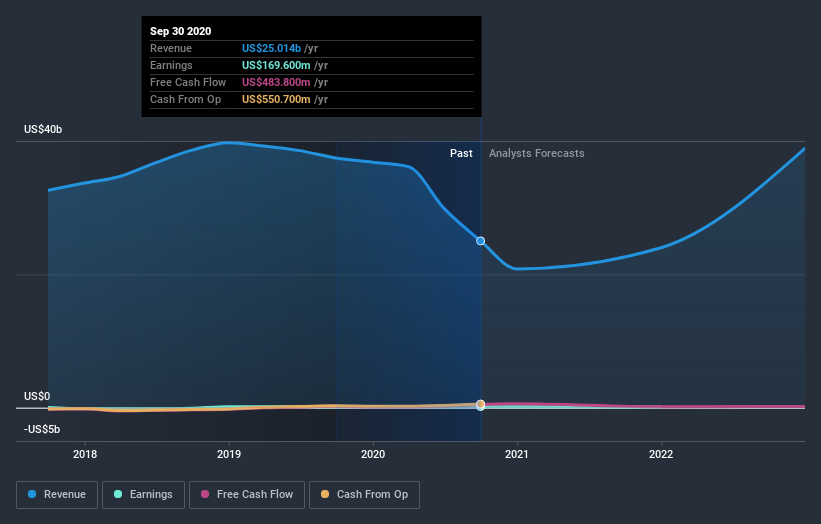

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that World Fuel Services has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling World Fuel Services stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in World Fuel Services had a tough year, with a total loss of 27% (including dividends), against a market gain of about 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with World Fuel Services (including 1 which makes us a bit uncomfortable) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade World Fuel Services, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if World Kinect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:WKC

World Kinect

Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives