- United States

- /

- Oil and Gas

- /

- NYSE:INSW

Investors Continue Waiting On Sidelines For International Seaways, Inc. (NYSE:INSW)

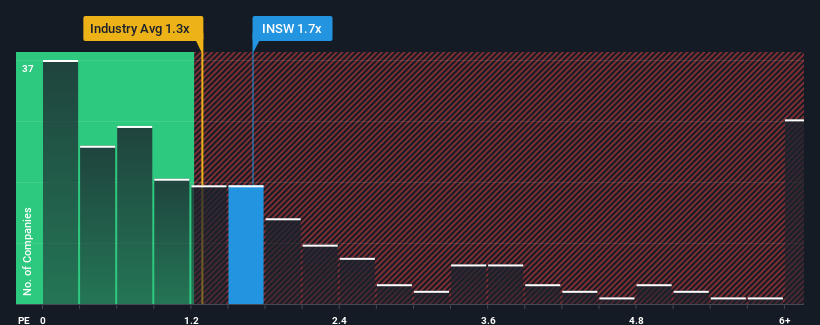

It's not a stretch to say that International Seaways, Inc.'s (NYSE:INSW) price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" for companies in the Oil and Gas industry in the United States, where the median P/S ratio is around 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for International Seaways

What Does International Seaways' P/S Mean For Shareholders?

International Seaways certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on International Seaways will help you uncover what's on the horizon.How Is International Seaways' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like International Seaways' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 221% last year. The strong recent performance means it was also able to grow revenue by 170% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company are not great, suggesting revenue should decline by 7.4% over the next year. Meanwhile, the industry is forecast to moderate by 10%, which indicates the company should perform better regardless.

With this in consideration, we find it intriguing but understandable that International Seaways' trades at a similar P/S to its industry peers. Even though the company may outperform the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares.

What We Can Learn From International Seaways' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like International Seaways currently trades on a lower than expected P/S since its revenue forecast is not as bad as the struggling industry. There's a chance that the market isn't looking too favourably on the potential risks which are preventing the P/S ratio from matching the more attractive outlook compared to its peers. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. It appears some are indeed anticipating revenue instability, because outperforming the industry usually is a catalyst that provides a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for International Seaways you should be aware of, and 1 of them doesn't sit too well with us.

If you're unsure about the strength of International Seaways' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:INSW

International Seaways

Owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade.

Undervalued with excellent balance sheet and pays a dividend.