- United States

- /

- Energy Services

- /

- OTCPK:ICDI.Q

Independence Contract Drilling, Inc.'s (NYSE:ICD) Shares Lagging The Industry But So Is The Business

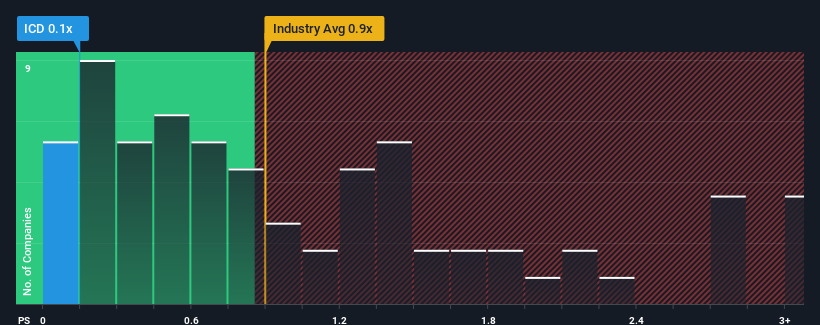

Independence Contract Drilling, Inc.'s (NYSE:ICD) price-to-sales (or "P/S") ratio of 0.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Energy Services industry in the United States have P/S ratios greater than 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Independence Contract Drilling

How Independence Contract Drilling Has Been Performing

With revenue growth that's superior to most other companies of late, Independence Contract Drilling has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Independence Contract Drilling.Is There Any Revenue Growth Forecasted For Independence Contract Drilling?

In order to justify its P/S ratio, Independence Contract Drilling would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 45% last year. The strong recent performance means it was also able to grow revenue by 95% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 9.2% over the next year. That's shaping up to be materially lower than the 13% growth forecast for the broader industry.

With this information, we can see why Independence Contract Drilling is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Independence Contract Drilling's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Independence Contract Drilling you should be aware of.

If you're unsure about the strength of Independence Contract Drilling's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:ICDI.Q

Independence Contract Drilling

Provides land-based contract drilling services for oil and natural gas producers in the United States.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.