- United States

- /

- Oil and Gas

- /

- NYSE:GLP

Is Global Partners (GLP) Now Undervalued? A Fresh Look at the Company’s Recent Valuation

Reviewed by Kshitija Bhandaru

See our latest analysis for Global Partners.

While Global Partners' share price has pulled back 15% over the past month, its long-term track record tells a different story. The company has achieved a remarkable 369% total shareholder return over five years. Momentum has clearly cooled for now, but the company’s impressive multi-year gains keep it on many investors’ watchlists.

If you want to broaden your search and see what else is performing well, this is a great time to check out fast growing stocks with high insider ownership.

The recent decline in Global Partners' share price raises a key question: does the current valuation present an opportunity for investors to buy at a discount, or is the market already accounting for the company's future prospects?

Most Popular Narrative: 17.2% Undervalued

The narrative consensus puts Global Partners’ fair value at $53, which is notably above the recent close of $43.87. This opens a discussion about how aggressively this company can grow in the years to come.

Expansion of the company's terminal network through recent acquisitions in key markets is expected to strengthen market presence, enhance distribution efficiency, and drive long-term revenue growth from higher throughput volumes and improved operating leverage.

What’s powering this bold fair value call? It’s not just top-line optimism. The core assumptions involve ambitious revenue targets, margin trends, and future earnings multiples that would put many pure-play energy giants to shame. Think you can spot the linchpin behind this projection? Discover the unique thesis that could redefine what Global Partners is worth.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reliance on fossil fuels and looming regulatory changes could undermine long-term growth for Global Partners if the transition to cleaner energy accelerates.

Find out about the key risks to this Global Partners narrative.

Another View: What Do the Market Ratios Say?

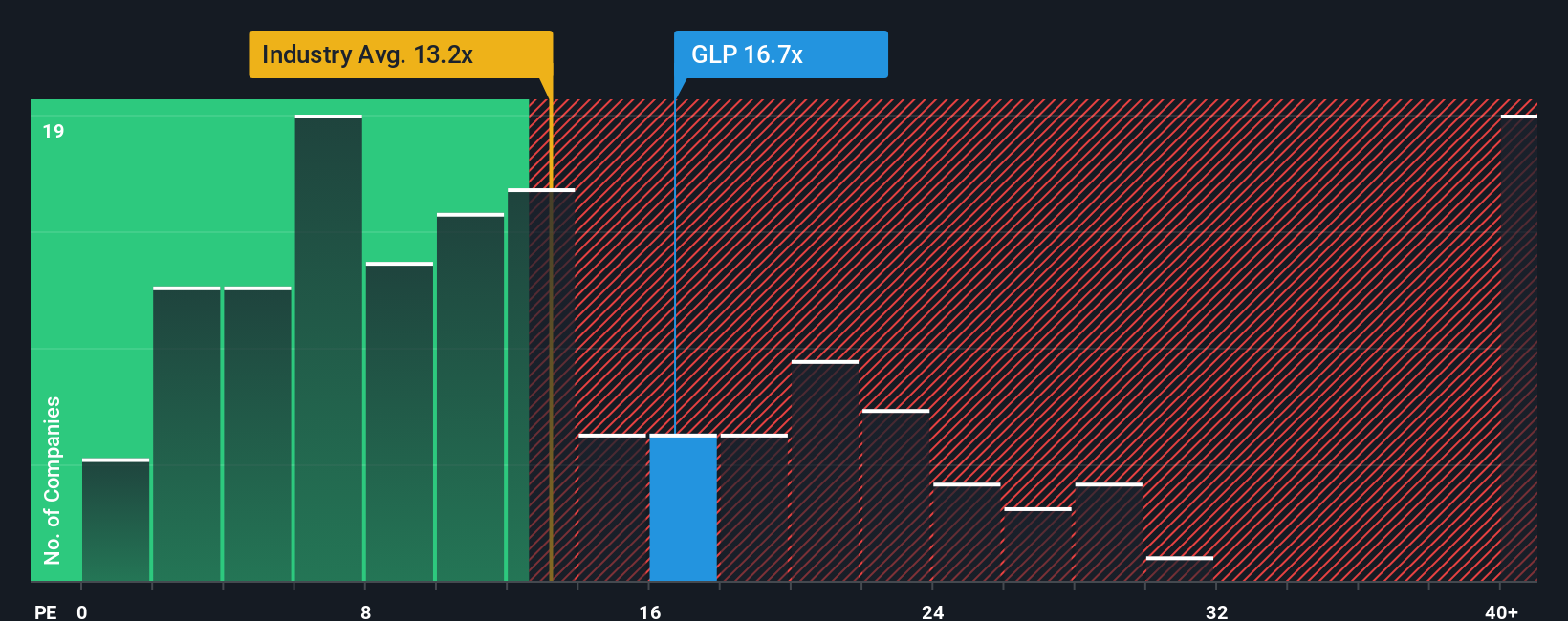

Looking at Global Partners through common valuation ratios paints a less optimistic picture. Its price-to-earnings ratio stands at 16.7x, above the US Oil and Gas industry average of 13.4x, its closest peers at 14.3x, and even above the fair ratio of 16.3x our models suggest. This raises the risk that the stock may be priced a little ahead of reality. Are investors betting on growth, or is this an overreach?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Global Partners Narrative

If you have a different take or prefer hands-on analysis, you can dive into the numbers and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Global Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep a few fresh opportunities on their radar. Don’t miss out on other promising stocks that could fit your strategy and diversify your portfolio.

- Target high-yield potential and grow your passive income by reviewing these 19 dividend stocks with yields > 3% with attractive returns above 3%.

- Unlock early access to emerging trends by joining these 24 AI penny stocks, which features pioneering companies at the forefront of artificial intelligence breakthroughs.

- Get ahead of the market by scanning these 898 undervalued stocks based on cash flows where compelling investments may be trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLP

Global Partners

Engages in the purchasing, selling, gathering, blending, storing, and logistics of transporting gasoline and gasoline blendstocks, distillates, residual oil, renewable fuels, crude oil, and propane to wholesalers, retailers, and commercial customers.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives