- United States

- /

- Oil and Gas

- /

- NYSE:GEL

How Investors May Respond To Genesis Energy (GEL) Affirming Distributions Amid Gulf Project Progress

Reviewed by Sasha Jovanovic

- Genesis Energy, L.P. recently announced that its board declared quarterly cash distributions for both common and preferred unit holders, to be paid in November 2025 for the quarter ended September 30, 2025.

- This distribution affirmation underscores the company's ongoing financial turnaround efforts and anticipated growth from major Gulf of Mexico oil projects.

- We'll explore how the continued progress on the Shenandoah and Salamanca projects shapes Genesis Energy's evolving investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Genesis Energy's Investment Narrative?

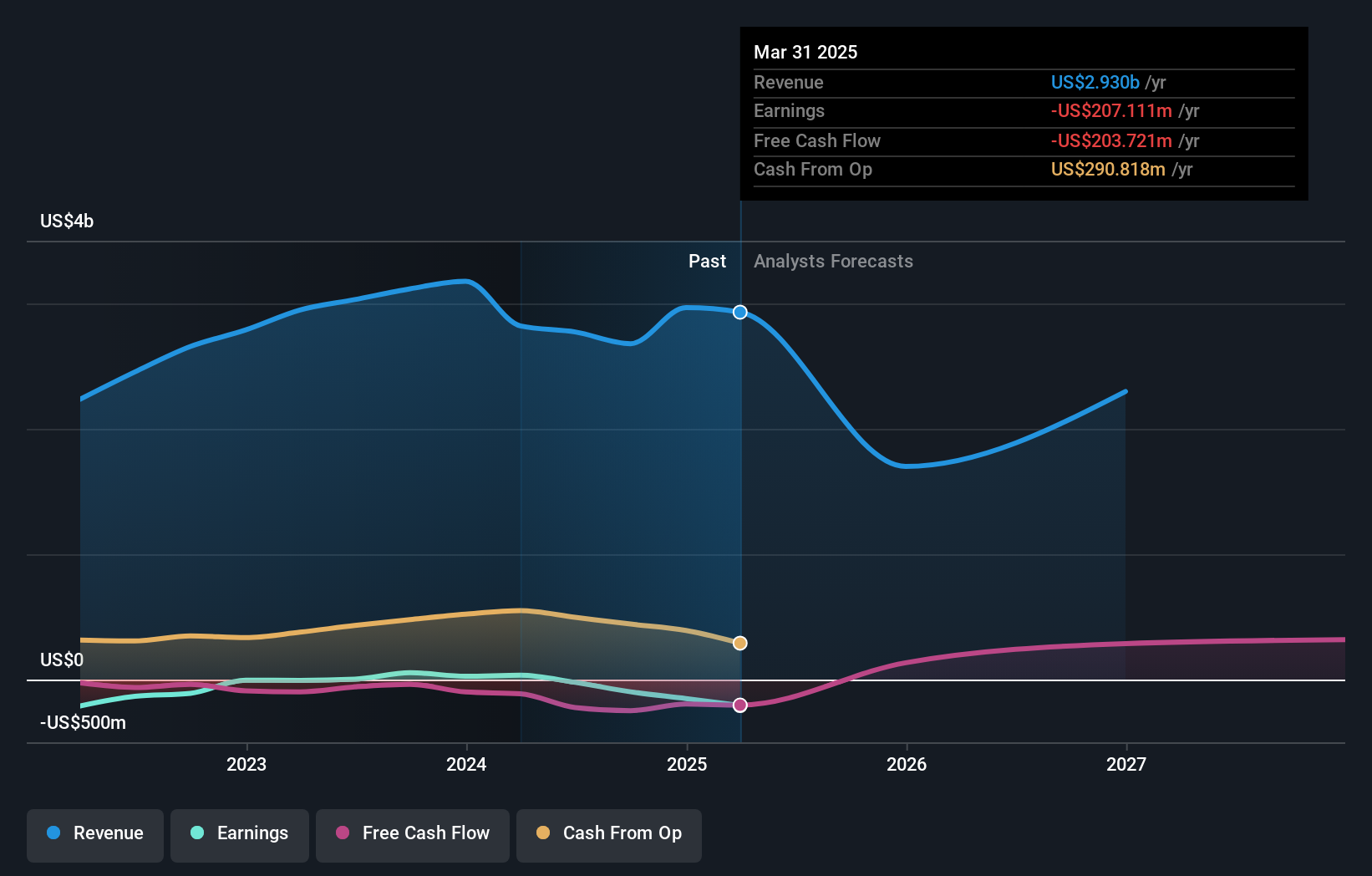

To be a shareholder in Genesis Energy right now, you have to believe in a story of turnaround, where the embrace of risk is balanced by anticipation of a real operational boost from major Gulf of Mexico oil developments. The company’s reaffirmed quarterly dividends for both common and preferred units reinforce management’s intent to maintain investor payouts even as losses persist and debt pressures linger. Though Genesis continues to improve its financial footing by narrowing net losses and managing costs, the catalysts that could reshape the value proposition are directly tied to timely progress at the Shenandoah and Salamanca projects. The latest dividend announcement should reassure income-focused holders in the short term, but it doesn’t fundamentally shift the near-term risks, especially continued negative earnings, a cash runway under one year, and dependence on new projects reaching their targets. The company’s valuation relative to analyst targets remains attractive, but persistent unprofitability and forecasted revenue declines underscore that the path forward is still uncertain.

However, with limited cash runway and expected revenue declines ahead, liquidity is still a key risk.

Exploring Other Perspectives

Explore another fair value estimate on Genesis Energy - why the stock might be worth as much as 26% more than the current price!

Build Your Own Genesis Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genesis Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Genesis Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genesis Energy's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEL

Genesis Energy

Engages in the midstream segment of the crude oil and natural gas industry in the United States.

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives