- United States

- /

- Oil and Gas

- /

- NYSE:GEL

A Fresh Look at Genesis Energy (GEL) Valuation as New Offshore Projects and Asset Sale Reshape Growth Prospects

Reviewed by Kshitija Bhandaru

If you’re eyeing Genesis Energy (NYSE:GEL) right now, there’s plenty to unpack. The buzz is centered on two offshore projects, Shenandoah and Salamanca, which are about to come online. These aren’t just routine launches; management expects both developments to drive a meaningful jolt in how much product moves through Genesis Energy’s offshore pipelines and, in turn, how much profit flows onto the bottom line. Add in the recent sale of their soda ash business, and the company has visibly sharpened its focus and financial flexibility just as these new revenue streams hit the horizon.

All this comes as the stock’s momentum has cooled after a sizable YTD run. Genesis Energy shares have surged 57% so far this year and are up 33% over the past 12 months, even with some pullback in the past month. The multi-year trend leans positive, with returns over the past three and five years far outpacing the broader market. Still, recent revenue contraction has lingered in the background, making investors weigh whether upcoming growth is arriving fast enough to offset lingering concerns.

With major catalysts now so close, does the current price leave room for further upside, or has the market already priced in Genesis Energy’s next leg of growth?

Price-to-Sales Ratio of 0.7x: Is it Justified?

Based on the price-to-sales (P/S) ratio, Genesis Energy currently trades at 0.7x, which is notably lower than both the US Oil and Gas industry average of 1.6x and the peer average of 2x. This suggests that the stock appears undervalued compared to its industry and immediate competitors when using sales as the reference point.

The P/S ratio is a valuation metric that compares a company’s stock price to its revenues. This makes it especially relevant for businesses like Genesis Energy that are not currently profitable. For mature industries where profits can fluctuate but revenues are more stable, a low P/S can signal a bargain if future sales are sustainable.

While the metric points to potential undervaluation, it is important to consider whether the market is skeptical about future earnings or growth. The discount may reflect recent revenue contraction, profitability issues, or concerns that current levels are not sustainable.

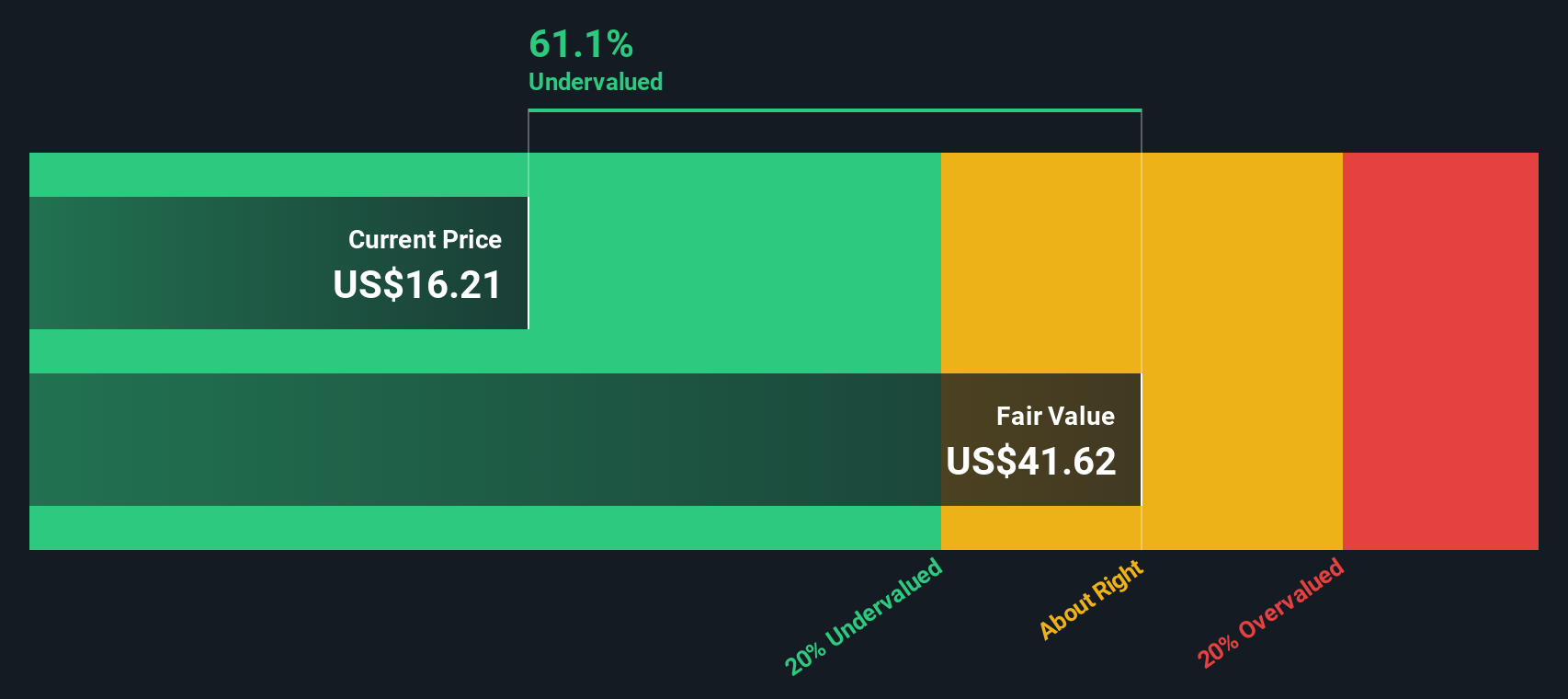

Result: Fair Value of $39.65 (UNDERVALUED)

See our latest analysis for Genesis Energy.However, persistent revenue contraction and negative net income remain clear risks. These factors could dampen enthusiasm for Genesis Energy’s growth story going forward.

Find out about the key risks to this Genesis Energy narrative.Another View: SWS DCF Model Weighs In

Taking a closer look through the SWS DCF model brings fresh perspective. This method also points to undervaluation, which supports what we saw from the price-to-sales approach. But can two models be wrong, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Genesis Energy to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Genesis Energy Narrative

If you see things differently or want to dig deeper into the numbers, you can easily build your own view in just a few minutes. Do it your way.

A great starting point for your Genesis Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to just one stock. Some of the market’s most exciting trends are just getting started, and you could be the first to capture new opportunities.

- Tap into tomorrow’s tech leaders by checking out breakthrough companies making waves in artificial intelligence with AI penny stocks.

- Pounce on potential hidden gems that the market might be missing by using undervalued stocks based on cash flows.

- Seize steady income with companies offering solid returns and reliable payouts through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEL

Genesis Energy

Engages in the midstream segment of the crude oil and natural gas industry in the United States.

Good value with very low risk.

Similar Companies

Market Insights

Community Narratives