- United States

- /

- Energy Services

- /

- NYSE:FTI

Take Care Before Diving Into The Deep End On TechnipFMC plc (NYSE:FTI)

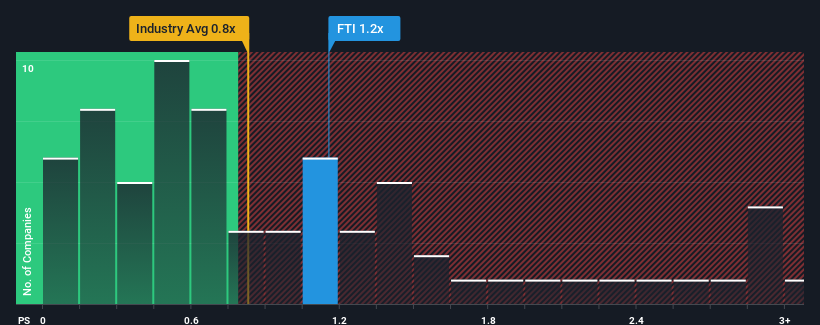

There wouldn't be many who think TechnipFMC plc's (NYSE:FTI) price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S for the Energy Services industry in the United States is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for TechnipFMC

What Does TechnipFMC's P/S Mean For Shareholders?

Recent times haven't been great for TechnipFMC as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think TechnipFMC's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For TechnipFMC?

TechnipFMC's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Still, lamentably revenue has fallen 14% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 12% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 8.9% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that TechnipFMC's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From TechnipFMC's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that TechnipFMC currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for TechnipFMC with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, and systems and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives