- United States

- /

- Oil and Gas

- /

- NYSE:FRO

Earnings Working Against Frontline plc's (NYSE:FRO) Share Price Following 26% Dive

Frontline plc (NYSE:FRO) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 11% in that time.

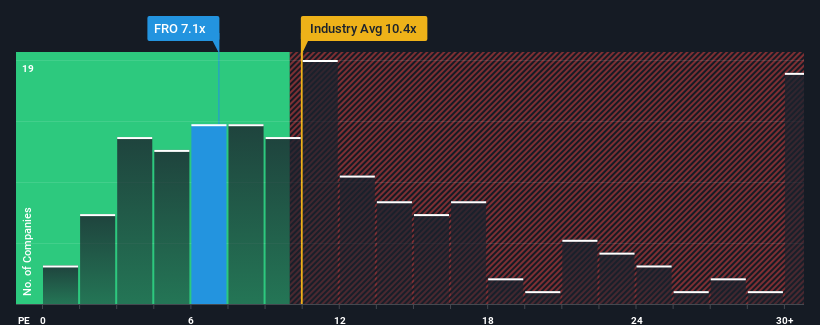

In spite of the heavy fall in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Frontline as a highly attractive investment with its 7.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Frontline hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Frontline

How Is Frontline's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Frontline's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 953% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 6.5% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 11% per annum, which is noticeably more attractive.

With this information, we can see why Frontline is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Frontline's P/E

Shares in Frontline have plummeted and its P/E is now low enough to touch the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Frontline maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Frontline (including 2 which are significant).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FRO

Frontline

A shipping company, engages in the ownership and operation of oil and product tankers worldwide.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives