- United States

- /

- Oil and Gas

- /

- NYSE:FLNG

FLEX LNG (NYSE:FLNG) – Evaluating Valuation After Recent Dip in Share Price Momentum

Reviewed by Kshitija Bhandaru

FLEX LNG (NYSE:FLNG) has caught investor attention as its stock performance trends have shifted over the past month. Shares dipped roughly 3% in that period. Gains for the year remain positive at 4%.

See our latest analysis for FLEX LNG.

While FLEX LNG's share price return has cooled recently, posting a 3.4% dip over the last month, its longer-term momentum still stands out. After a solid 10.9% share price gain in the past quarter and an 8.3% total shareholder return over the past year, the stock continues to reward patient investors. However, momentum has eased a touch from earlier surges.

If you’re looking to expand your search beyond the obvious, now is an ideal time to discover fast growing stocks with high insider ownership

With FLEX LNG’s recent share price softness and its strong longer-term returns, is the market overlooking underlying value? Or are investors already factoring in all the company’s future growth prospects? Is this a genuine buying opportunity, or has everything been priced in?

Most Popular Narrative: 4.8% Overvalued

Compared to the narrative's fair value estimate of $24.00, FLEX LNG's last close at $25.14 suggests the stock price is sitting modestly above consensus fair value. The scene is set for a closer look at the drivers and doubts behind this judgment.

The ongoing global shift to decarbonization and energy diversification, especially in Europe replacing Russian gas with LNG, is sustaining strong demand for LNG shipping and longer-duration contracts. This is supporting high utilization rates and premium charter day rates for FLEX LNG's fleet, likely lifting future revenue and margin prospects.

Why do analysts see value just below the current share price? The future hinges on ambitious improvements such as higher profit margins, solid earnings growth, and a dramatic financial transformation driven by fleet strategy and global trends. But which assumptions tip the scales? Dive into the full narrative for the forecast figures and the bold scenarios powering this valuation.

Result: Fair Value of $24.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a global oversupply of new LNG vessels or persistent weakness in key markets such as China and India could undermine FLEX LNG’s growth outlook.

Find out about the key risks to this FLEX LNG narrative.

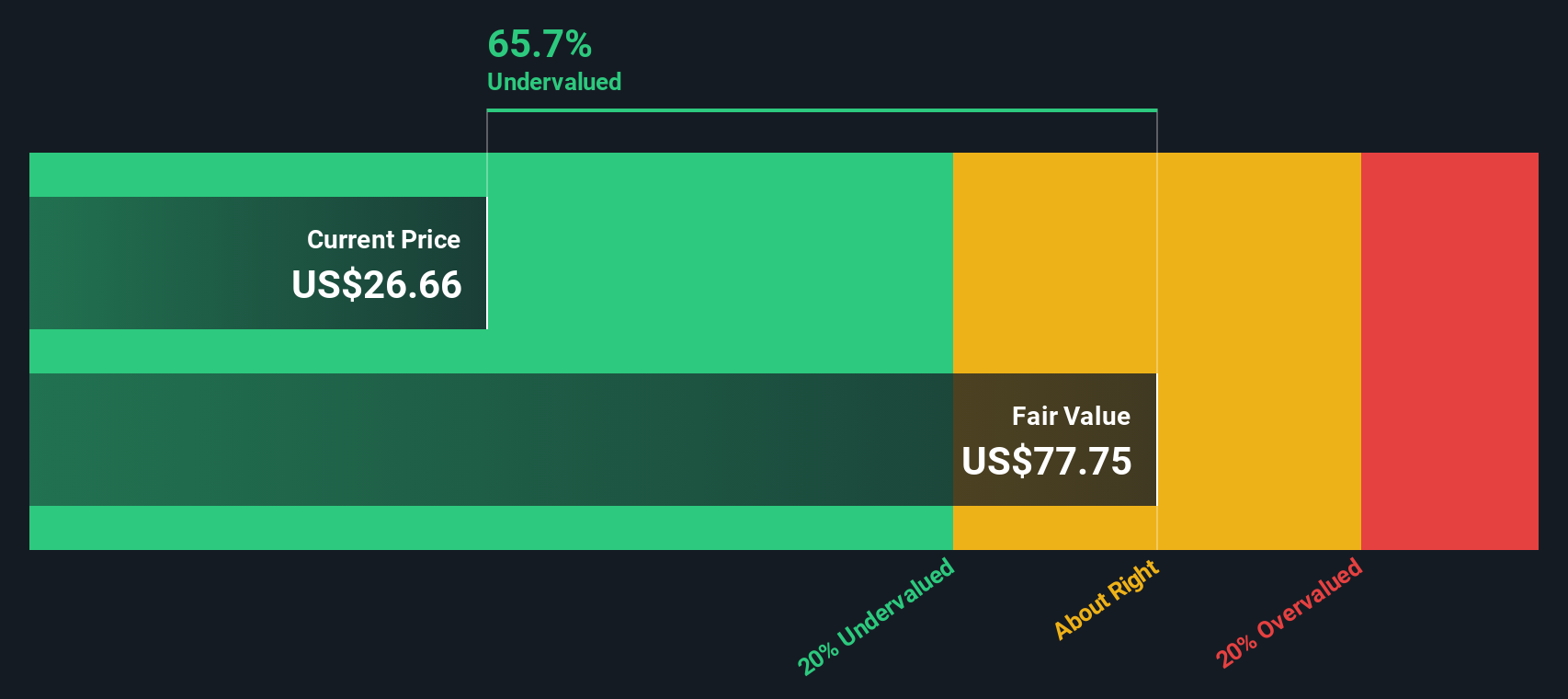

Another View: SWS DCF Model Points to Deep Undervaluation

Taking a step back from analyst price targets, the SWS DCF model places FLEX LNG’s fair value at $78.15, which is much higher than the current share price. This method suggests the market may be overlooking significant future cash flows. This raises a critical question: is FLEX LNG far more undervalued than consensus estimates believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FLEX LNG Narrative

If you think a different story is taking shape, or would rather dive into the details yourself, you can build your own narrative in just minutes. Do it your way

A great starting point for your FLEX LNG research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next breakout stock slip by. Supercharge your research with hand-picked companies positioned for tomorrow’s opportunities and powerful trends gaining momentum.

- Capture dividend income and long-term growth by checking out these 19 dividend stocks with yields > 3%, featuring yields over 3% and resilient earnings power.

- Expand your portfolio with innovative breakthroughs in medicine and artificial intelligence by reviewing these 32 healthcare AI stocks.

- Spot undervalued gems trading below their intrinsic value by analyzing these 892 undervalued stocks based on cash flows, driven by healthy cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLNG

FLEX LNG

Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

Good value with questionable track record.

Similar Companies

Market Insights

Community Narratives