- United States

- /

- Oil and Gas

- /

- NYSE:ET

Is There an Opportunity in Energy Transfer After Recent Earnings Beat?

Reviewed by Simply Wall St

Thinking about what to do with your Energy Transfer shares, or considering starting a position? You are definitely not alone. This is a name that has been on investors’ radars for years, and for good reason. While the stock’s recent price action has been choppy—down 2.7% over the last week and off 2.3% in the past month—the bigger picture is hard to ignore. Year-to-date, the stock is down 13.2%. Over the last year, it is up 13.5%. The three-year and five-year returns are even more striking at 109.8% and 358.8%, respectively. Clearly, Energy Transfer is no stranger to meaningful moves, and the mix of volatility and growth has potential implications for both risk and reward.

We have also watched industry news and market developments push energy stocks around, occasionally intensifying the swings seen in the last several months. What makes Energy Transfer stand out right now is its valuation story. Running the company through six widely used valuation checks, it comes out undervalued in every single one, giving it a score of 6 out of 6. Of course, knowing something looks cheap is only half the battle. In the next section, I will break down the actual valuation checks that support this score and share a smarter way to think about the company’s value at the end of the piece.

Energy Transfer delivered 13.5% returns over the last year. See how this stacks up to the rest of the Oil and Gas industry.Approach 1: Energy Transfer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts those flows back to today's value, providing an estimate of what the business is truly worth. This approach helps investors look past short-term market movements and focus on the business's actual earning power over time.

For Energy Transfer, current Free Cash Flow sits at approximately $7.16 Billion. Analysts provide FCF estimates for the next five years, and these numbers continue to rise. Simply Wall St then extrapolates those trends further. Projections show Free Cash Flow increasing to roughly $10.19 Billion in ten years, reflecting expected organic growth and continued operational strength.

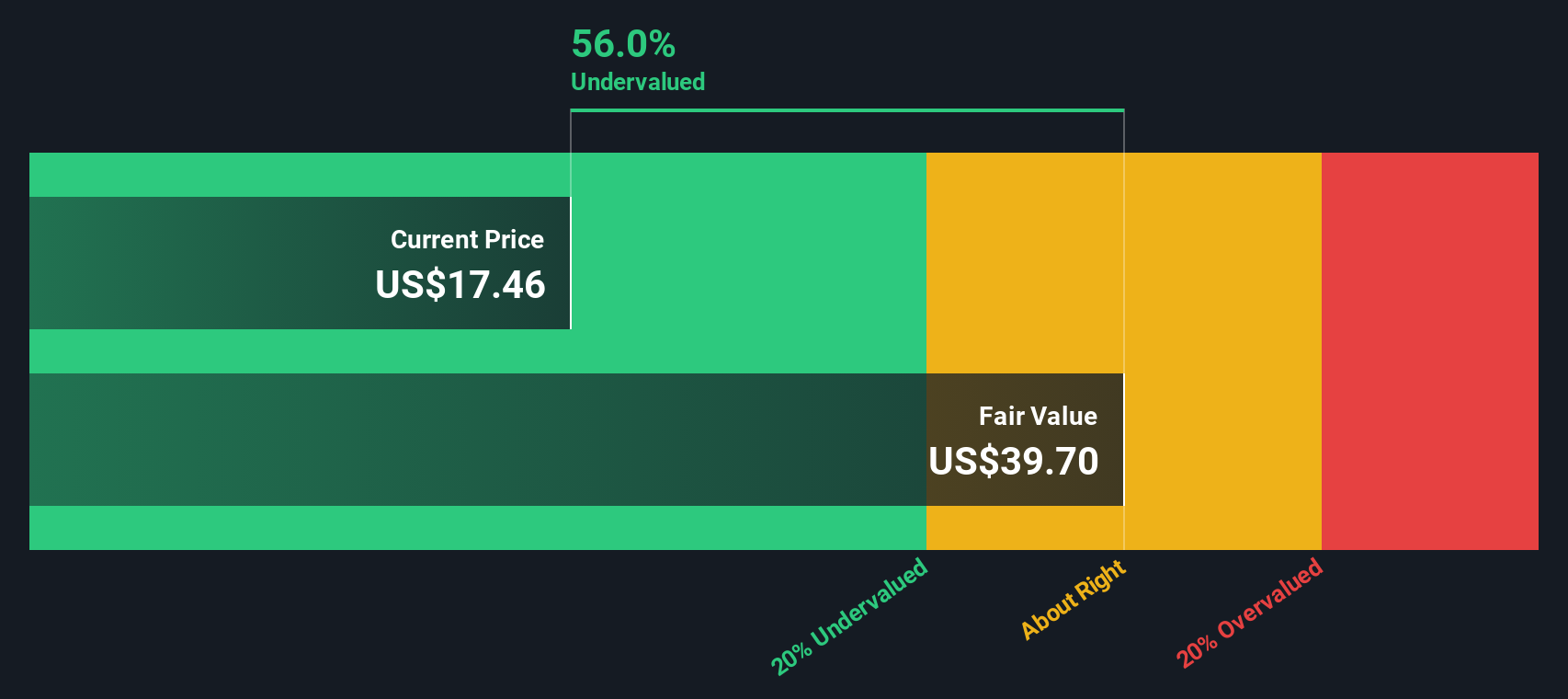

After discounting all these future cash flows using the 2 Stage Free Cash Flow to Equity model, Energy Transfer's estimated intrinsic value per share is $39.62. Compared to its recent share price, this implies the stock is trading at a 56.8% discount, meaning it is significantly undervalued by this measure.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Energy Transfer.

Approach 2: Energy Transfer Price vs Earnings

For profitable companies like Energy Transfer, the Price-to-Earnings (PE) ratio is a widely used and meaningful way to assess value. The PE ratio compares a company's current share price to its earnings per share, which makes it a handy “shorthand” for how much investors are willing to pay for a dollar of earnings. Growth expectations and risk both play key roles in setting what a “normal” or “fair” PE ratio should be. Higher growth typically justifies a higher PE, while more risk demands a discount.

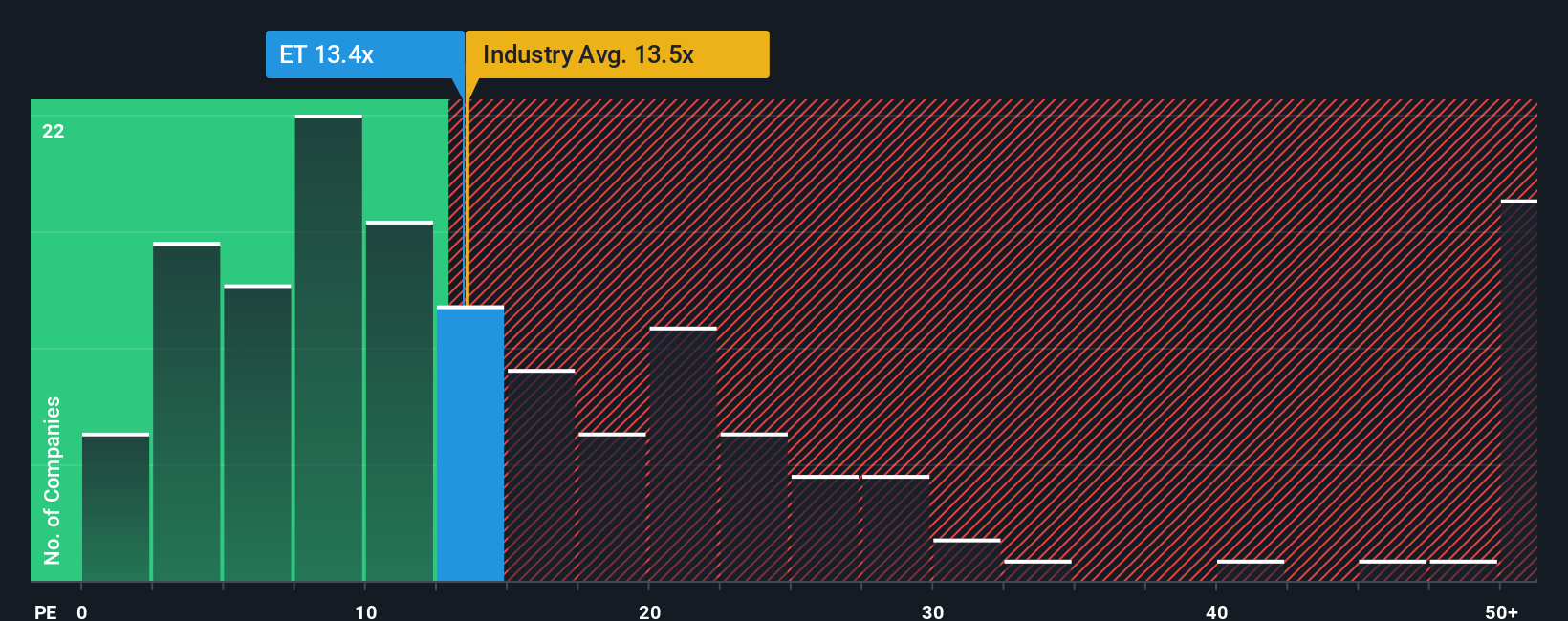

Energy Transfer’s current PE ratio is 13.1x. That is nearly identical to the average PE for the Oil and Gas industry, which comes in at 13.4x. When we look at a broader peer set, the average climbs to 19.3x, suggesting the overall market may be assigning a higher premium to some peers.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, at 19.3x for Energy Transfer, is calculated using a proprietary method that considers not just the company’s industry and market cap, but also its earnings growth, profit margins, and risk profile. Unlike simple peer or industry averages, the Fair Ratio gives a far more tailored sense of what would be justified for Energy Transfer right now.

With Energy Transfer’s actual PE at 13.1x and its Fair Ratio at 19.3x, the stock looks undervalued based on this metric.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Energy Transfer Narrative

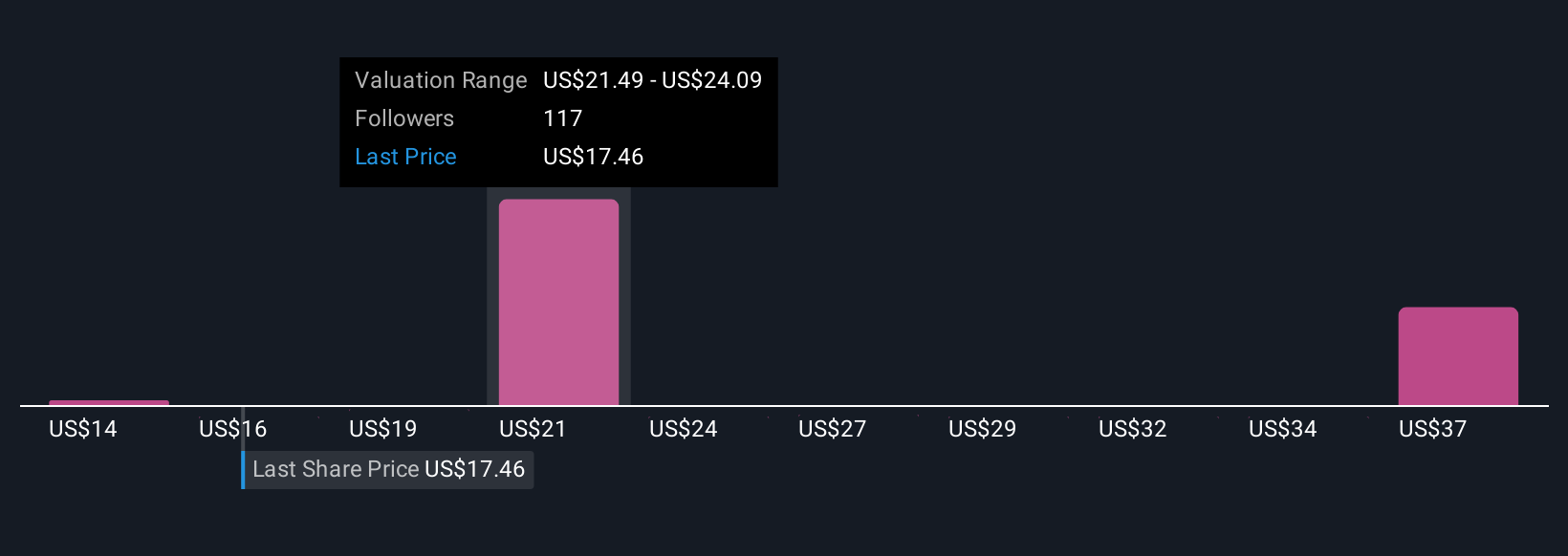

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your chance to connect the numbers to a story: your view of where a company is heading and why. Rather than just relying on models or rigid forecasts, Narratives let you describe your expectations for Energy Transfer’s future growth, margins, and value drivers, tying your personal “story” directly to a fair value estimate.

On Simply Wall St's Community page, Narratives make this process simple and accessible for millions of investors by blending your assumptions with real-world events and forecasts to create a dynamic, living financial picture. They show you the fair value of a stock (based on your Narrative) alongside the current market price, helping you decide when it actually makes sense to buy or sell, and updating automatically as news or results come in.

For example, if you see Energy Transfer’s future tied to rapid export growth, your fair value might trend toward the most optimistic analyst target. In contrast, a more cautious take on regulatory or competitive risks could align with the lowest estimates. Narratives put these viewpoints side-by-side, empowering you to invest with confidence.

Do you think there's more to the story for Energy Transfer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ET

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives