- United States

- /

- Oil and Gas

- /

- NYSE:ET

Is There an Opportunity in Energy Transfer After Pipeline Expansion Approval in 2025?

Reviewed by Bailey Pemberton

If you’ve found yourself staring at Energy Transfer’s stock chart lately, you’re not alone. With the price at $16.53 and plenty of volatility in the rearview mirror, you might be wondering if now is the right moment to get in, get out, or double down. Over the last week, the stock dipped by 0.8%. Zooming out, it’s down 5.3% over the past month and off by 16.1% for the year to date. Looking a bit further back, Energy Transfer has returned 8.6% in the past year, a solid 80.3% over three years, and 319.3% over five years.

These swings are not happening in a vacuum. Broader energy market dynamics, including shifts in pipeline development approvals and changing transport regulations, have buffeted pipeline operators like Energy Transfer. The result has been periodic spikes in both optimism and caution, which appear in those turbulent price charts. Beneath the short-term trading noise, there are clear signals indicating potential value.

In fact, when you size up Energy Transfer’s valuation using six different metrics, the company comes out undervalued in every single check, earning a valuation score of 6. This means that, at least on paper, Energy Transfer looks like a bargain worth serious consideration. How do these valuation methods actually stack up, and what is the most effective way to interpret them? Let’s dig in to the numbers and then take it a step further to the approach that can truly help you understand what the stock is worth.

Approach 1: Energy Transfer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation approach that calculates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This method gives investors a sense of what the business might be worth based purely on its expected ability to generate cash, independent of market-driven share prices.

For Energy Transfer, the most recent Free Cash Flow is $7.16 Billion. Analyst estimates forecast continued growth, with projected Free Cash Flow reaching approximately $8.04 Billion by 2029. Beyond that, projections are extrapolated further, showing Free Cash Flow potentially at $10.19 Billion by 2035, according to Simply Wall St modeling. These numbers reflect sustained operational performance and robust pipeline activity over the long term.

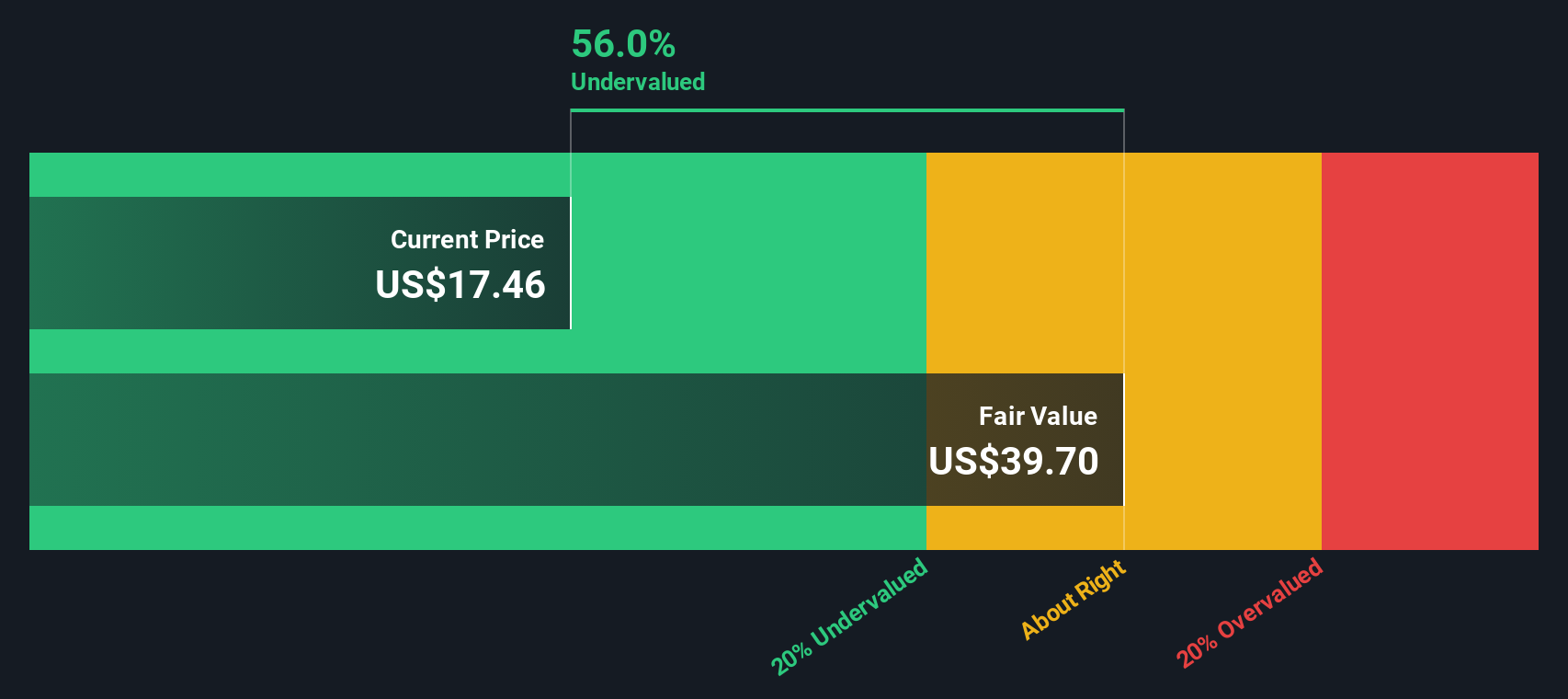

Using a two-stage DCF model, these projections suggest Energy Transfer’s intrinsic value is $41.38 per share. Compared to its current price of $16.53, the market price is roughly 60 percent below this estimate, signaling significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Energy Transfer is undervalued by 60.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Energy Transfer Price vs Earnings

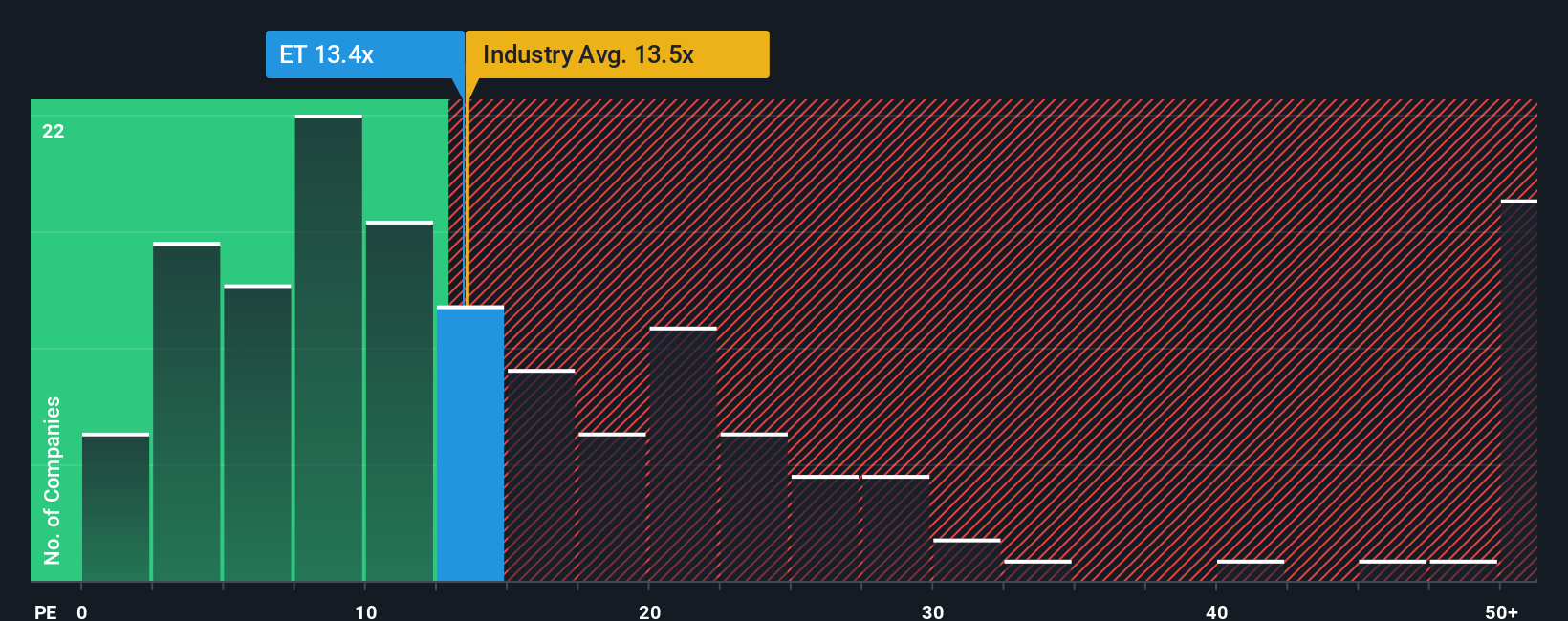

For profitable companies like Energy Transfer, the Price-to-Earnings (PE) ratio is often the go-to valuation tool because it directly links a firm’s market value to its bottom-line earnings. This makes it a clear, straightforward way for investors to quickly assess how much they are paying for each dollar of profit the company generates. A "normal" or "fair" PE ratio, however, is not universal. It can vary based on factors such as the company’s expected earnings growth, stability, risk profile, and the sector in which it operates.

Currently, Energy Transfer trades at a PE ratio of 12.7x, which is just below the oil and gas industry average of 13.1x and well below the broader peer average of 19.2x. While those comparisons are useful, Simply Wall St’s proprietary Fair Ratio gives an even clearer picture. The Fair Ratio takes into account a range of company-specific factors like profit margins, market cap, expected earnings growth, and risk, then calculates an individualized benchmark multiple. For Energy Transfer, the Fair Ratio comes in at 19.9x, suggesting the market is pricing the stock meaningfully below what would be expected given its fundamentals.

Unlike simple industry or peer comparisons, judging Energy Transfer against its Fair Ratio provides a more nuanced evaluation. Since the current PE ratio is substantially lower than the Fair Ratio, this points to the stock being undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Energy Transfer Narrative

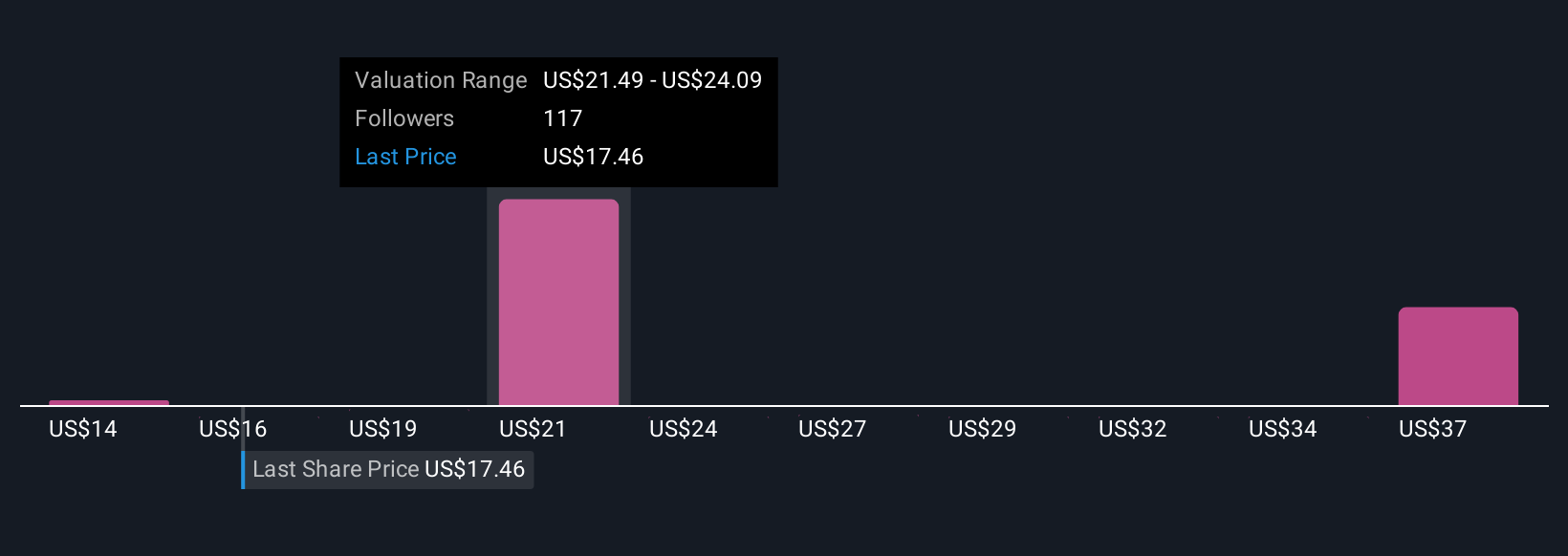

Earlier we mentioned that there is an even better way to understand what a stock is worth, and that is through Narratives, a modern, more powerful approach that goes beyond numbers to tie a company’s story directly to its financial outlook and valuation. A Narrative is simply your own investment thesis, capturing how you see a company’s potential future (with your estimates for key metrics like revenue growth, margins, and fair value), and connecting it logically to what you believe the business is worth today.

With Narratives, which are available right now in the Simply Wall St Community, you can easily construct and track your own perspective or explore those created by millions of other investors. Narratives provide a transparent, ongoing comparison between your calculated Fair Value and the actual share price, highlighting when it may be time to buy, hold, or sell. They update automatically as soon as new developments like earnings, deals, or news emerge. For Energy Transfer, for example, one Narrative might highlight bullish long-term growth from expanding infrastructure and export capacity, while another might focus on risks from competition and renewables and suggest a more cautious view.

Do you think there's more to the story for Energy Transfer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ET

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives