- United States

- /

- Oil and Gas

- /

- NYSE:ET

How the New Permian-to-Desert Southwest Pipeline Expansion at Energy Transfer (ET) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Transwestern Pipeline Company, a subsidiary of Energy Transfer LP, recently announced the launch of a major pipeline expansion to boost natural gas transport from the Permian Basin to the Desert Southwest, with new infrastructure capable of moving at least 1.5 billion cubic feet per day upon targeted completion in late 2029, pending regulatory approvals.

- This expansion highlights Energy Transfer’s ongoing efforts to support long-term cash flow growth with large-scale projects backed by strong customer commitments and a strengthened balance sheet.

- We'll now explore how the newly announced pipeline expansion shapes Energy Transfer's investment narrative and future growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Energy Transfer Investment Narrative Recap

To be a shareholder in Energy Transfer, you need to believe that ongoing investments in large-scale pipeline projects, like the Transwestern expansion, can drive steady, fee-based cash flows despite competition and regulatory headwinds. The recent pipeline announcement reinforces confidence in Energy Transfer's ability to win long-term customer commitments, but does not fundamentally alter the most important short-term catalyst: resilient gas volumes from the Permian. The main risk, project execution delays or cost overruns, remains unchanged by this news.

Among recent developments, the firm’s final decision to move forward on the $5.3 billion Transwestern Pipeline expansion is the most relevant here. This announcement provides visibility on Energy Transfer’s project backlog and highlights its focus on long-term fee-based growth tied to major basins and large customers, aligning with the company’s strategy to support future distributable cash flow and offset volume fluctuations.

However, investors should also be mindful of potential regulatory or construction setbacks...

Read the full narrative on Energy Transfer (it's free!)

Energy Transfer's narrative projects $99.8 billion in revenue and $6.7 billion in earnings by 2028. This requires 7.4% yearly revenue growth and a $2.2 billion increase in earnings from the current $4.5 billion.

Uncover how Energy Transfer's forecasts yield a $22.55 fair value, a 29% upside to its current price.

Exploring Other Perspectives

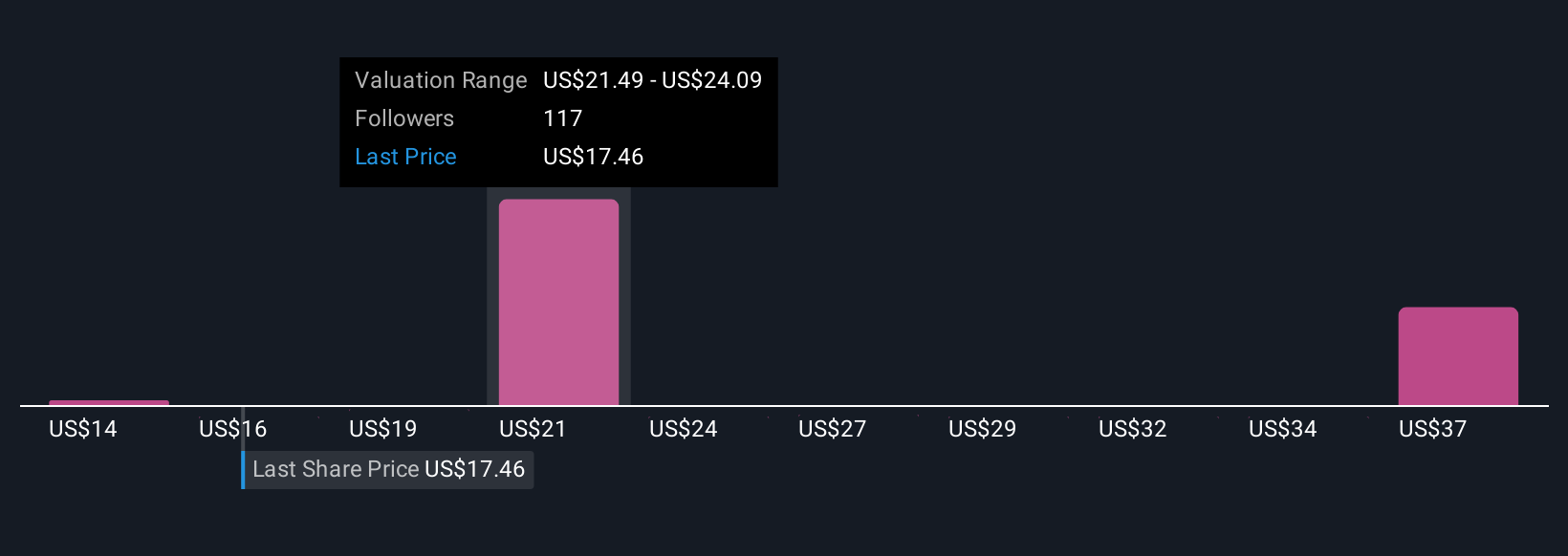

Twenty-three members of the Simply Wall St Community place Energy Transfer’s fair value estimates between US$13.69 and US$39.70 per share. While the company is advancing multi-billion dollar expansion plans that could support future earnings, these projections underline how investor expectations for growth and risk can diverge significantly, explore a range of perspectives before deciding for yourself.

Explore 23 other fair value estimates on Energy Transfer - why the stock might be worth over 2x more than the current price!

Build Your Own Energy Transfer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Transfer research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Energy Transfer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Transfer's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ET

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives