- United States

- /

- Oil and Gas

- /

- NYSE:EQT

How Investors Are Reacting To EQT (EQT) Raising $1.27 Billion and Launching a Share Buyback

Reviewed by Simply Wall St

- In August 2025, EQT Corporation closed a shelf registration, issuing 25,229,166 shares of common stock for a total value of US$1.27 billion, while EQT AB repurchased 497,182 of its own shares as part of a broader buyback program.

- The combination of issuing new shares and executing a share repurchase program highlights EQT’s dual focus on capital raising and capital management initiatives.

- We’ll now assess how EQT’s capital actions, particularly the large-scale share issuance, may shape its investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

EQT Investment Narrative Recap

To be a shareholder in EQT, you need to believe in the long-term demand for natural gas, particularly from new power generation and AI data centers, and EQT's ability to maintain cost leadership in the Appalachian Basin. The recent US$1.27 billion share issuance broadens the company’s access to capital and liquidity, but it is unlikely to materially affect the near-term catalyst of locking in new supply contracts, nor does it fully mitigate the business’s largest risks, exposure to regulatory and environmental headwinds.

Among recent announcements, EQT's new partnership to supply natural gas to a major AI and computing data center directly supports its biggest near-term growth catalyst: the expansion of long-term supply agreements tied to electrification and AI infrastructure in Appalachia. Increased contract flow could create more predictable revenues and strengthen EQT’s case for future cash flow stability, even as those same contracts depend on seeing through high-capital projects and navigating regulatory hurdles.

However, investors should be aware that, despite these advances, tightening emissions regulations and accelerating decarbonization targets may yet pose challenges for EQT’s growth story...

Read the full narrative on EQT (it's free!)

EQT's outlook projects $9.8 billion in revenue and $3.8 billion in earnings by 2028. This would require annual revenue growth of 11.4% and an earnings increase of $2.7 billion from current earnings of $1.1 billion.

Uncover how EQT's forecasts yield a $62.72 fair value, a 20% upside to its current price.

Exploring Other Perspectives

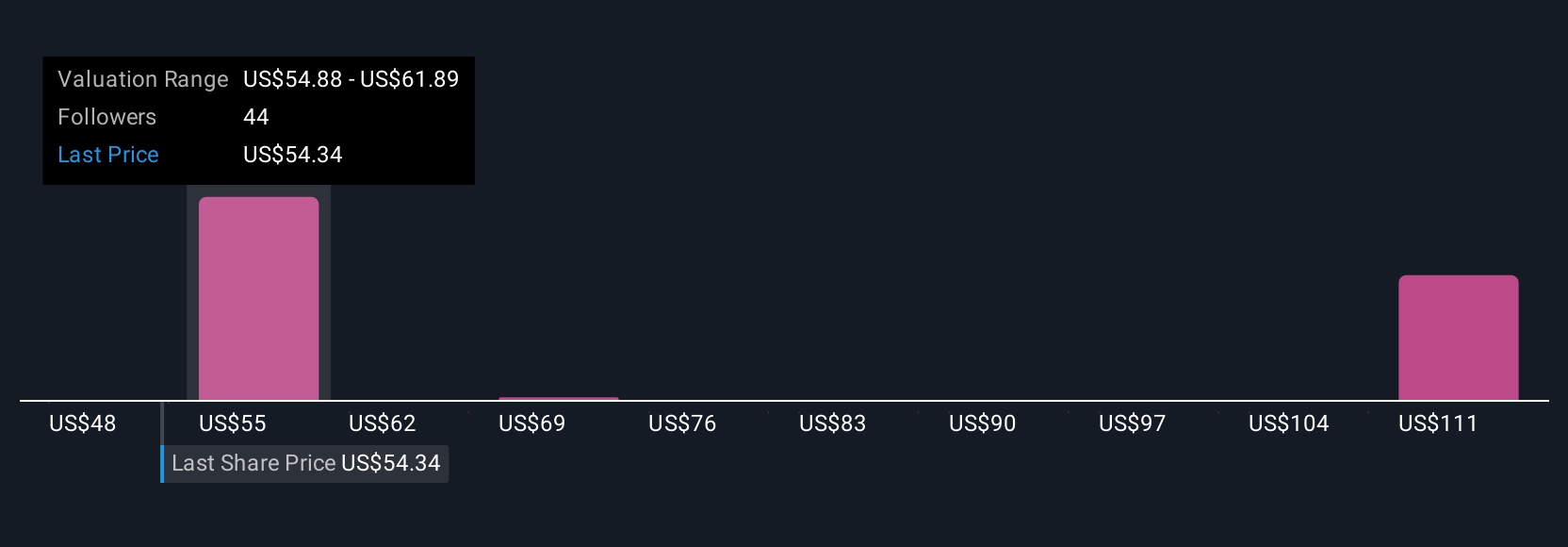

Simply Wall St Community members provided five fair value estimates for EQT, spanning from US$47.87 up to US$93.83 per share. While some expect significant upside based on expansion of long-term supply contracts, others remain cautious given ongoing regulatory and environmental risks. Consider reviewing several viewpoints to form your own perspective.

Explore 5 other fair value estimates on EQT - why the stock might be worth 8% less than the current price!

Build Your Own EQT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EQT research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free EQT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EQT's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQT

EQT

Engages in the production, gathering, and transmission of natural gas.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives