- United States

- /

- Oil and Gas

- /

- NYSE:EQT

EQT (EQT) Reports Strong Q2 2025 Earnings With Revenue And Net Income Increase

Reviewed by Simply Wall St

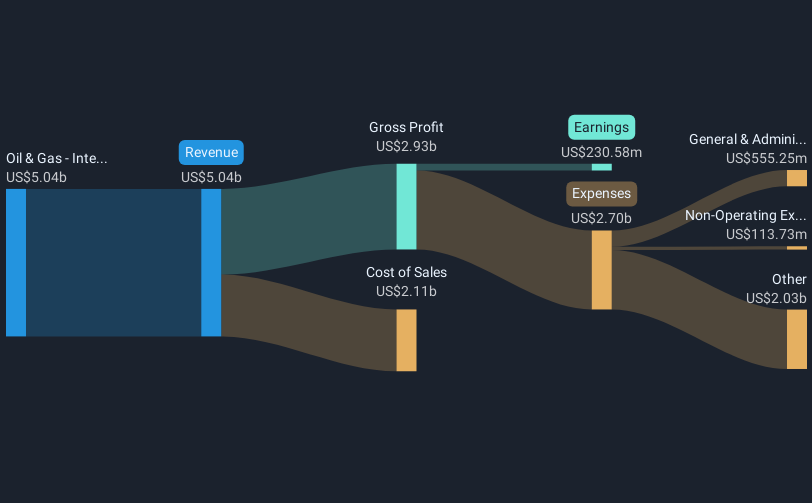

EQT (EQT) recently announced strong Q2 2025 earnings, reporting a significant increase in revenue and net income compared to the previous year, alongside a revised upward corporate sales volume guidance for 2025. The declaration of a quarterly dividend and the strategic partnership with Homer City Redevelopment further marked a period of robust developments for the company. Despite these positive contributions, EQT's share price increase of 6% over the last quarter aligns closely with broader market trends, including the market's 1.7% rise over the past seven days and 18% increase over the past 12 months, suggesting these events added weight to the existing positive market momentum.

Buy, Hold or Sell EQT? View our complete analysis and fair value estimate and you decide.

The recent developments at EQT, including strong Q2 2025 earnings, an increased quarterly dividend, and a strategic partnership with Homer City Redevelopment, underscore the company's focus on long-term stability and growth. These factors are expected to reinforce the narrative of EQT's strategic positioning through long-term gas contracts and infrastructure investments, which are projected to drive stable revenue and margin expansion. The company's shares have increased by approximately 279.43% over the past five years, highlighting sustained growth and investor confidence. This long-term return reflects the company's ability to capitalize on rising demand and operational efficiencies, outperforming both the US Oil and Gas industry and the broader market over the past year.

EQT's revenue and earnings forecasts might see upward revisions due to the improved corporate sales volume guidance for 2025. With a current share price of US$51.96, there is still room to reach the consensus price target of US$61.72, suggesting potential upside. Given the backdrop of a stronger financial profile and ongoing efficiency gains, recent announcements could have a positive impact on future earnings projections, further validating analysts' expectations. Nevertheless, the stock's high Price-To-Earnings Ratio of 28.3x compared to the industry average may suggest caution for some investors. Despite this, EQT continues its trajectory towards robust earnings growth, supported by favorable market conditions and strategic initiatives.

Examine EQT's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQT

EQT

Engages in the production, gathering, and transmission of natural gas.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives