- United States

- /

- Oil and Gas

- /

- NYSE:EE

Here's What Analysts Are Forecasting For Excelerate Energy, Inc. (NYSE:EE) After Its Annual Results

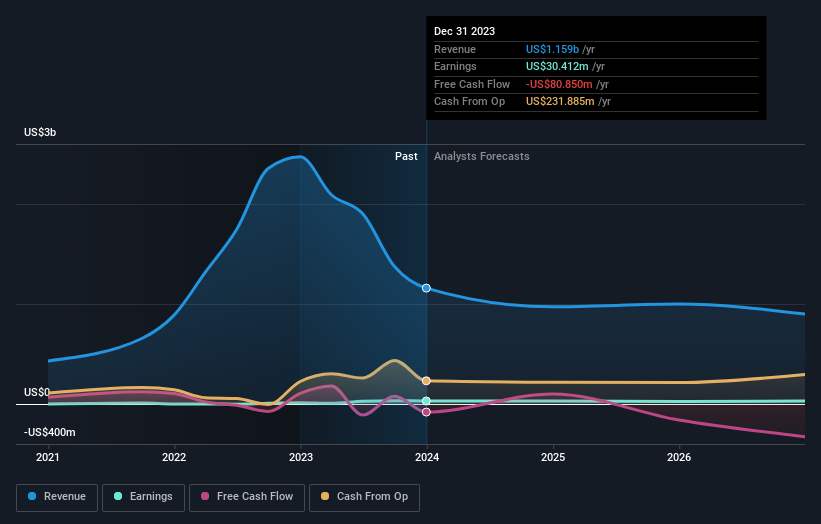

It's been a pretty great week for Excelerate Energy, Inc. (NYSE:EE) shareholders, with its shares surging 13% to US$15.58 in the week since its latest full-year results. Excelerate Energy missed revenue estimates by 2.7%, coming in atUS$1.2b, although statutory earnings per share (EPS) of US$1.11 beat expectations, coming in 2.5% ahead of analyst estimates. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for Excelerate Energy

Taking into account the latest results, the four analysts covering Excelerate Energy provided consensus estimates of US$971.6m revenue in 2024, which would reflect a not inconsiderable 16% decline over the past 12 months. Statutory per-share earnings are expected to be US$1.14, roughly flat on the last 12 months. In the lead-up to this report, the analysts had been modelling revenues of US$990.8m and earnings per share (EPS) of US$0.93 in 2024. There was no real change to the revenue estimates, but the analysts do seem more bullish on earnings, given the considerable lift to earnings per share expectations following these results.

There's been no major changes to the consensus price target of US$22.33, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Excelerate Energy at US$25.00 per share, while the most bearish prices it at US$18.00. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 16% by the end of 2024. This indicates a significant reduction from annual growth of 28% over the last three years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 1.7% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Excelerate Energy is expected to lag the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Excelerate Energy following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at US$22.33, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Excelerate Energy going out to 2026, and you can see them free on our platform here.

It might also be worth considering whether Excelerate Energy's debt load is appropriate, using our debt analysis tools on the Simply Wall St platform, here.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Excelerate Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EE

Excelerate Energy

Provides liquefied natural gas (LNG) solutions worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>