- United States

- /

- Oil and Gas

- /

- NYSE:EE

Can Mixed Fundamentals Have A Negative Impact on Excelerate Energy, Inc. (NYSE:EE) Current Share Price Momentum?

Most readers would already be aware that Excelerate Energy's (NYSE:EE) stock increased significantly by 12% over the past week. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Excelerate Energy's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Excelerate Energy

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Excelerate Energy is:

7.0% = US$127m ÷ US$1.8b (Based on the trailing twelve months to December 2023).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.07.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Excelerate Energy's Earnings Growth And 7.0% ROE

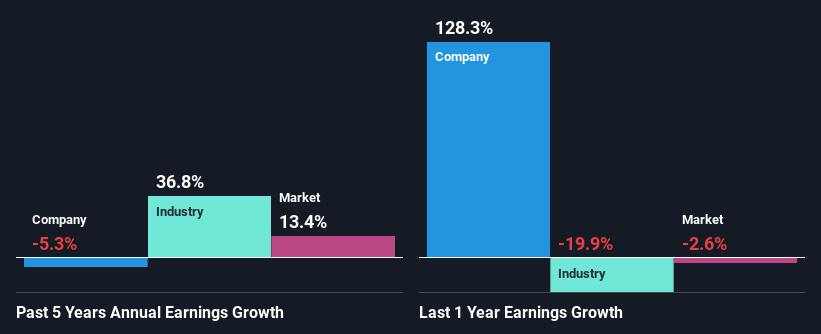

On the face of it, Excelerate Energy's ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 21% either. Therefore, it might not be wrong to say that the five year net income decline of 5.3% seen by Excelerate Energy was probably the result of it having a lower ROE. We reckon that there could also be other factors at play here. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

However, when we compared Excelerate Energy's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 37% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for EE? You can find out in our latest intrinsic value infographic research report.

Is Excelerate Energy Using Its Retained Earnings Effectively?

When we piece together Excelerate Energy's low three-year median payout ratio of 9.3% (where it is retaining 91% of its profits), calculated for the last three-year period, we are puzzled by the lack of growth. This typically shouldn't be the case when a company is retaining most of its earnings. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Only recently, Excelerate Energy stated paying a dividend. This likely means that the management might have concluded that its shareholders have a strong preference for dividends. Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 54% over the next three years. Therefore, the expected rise in the payout ratio explains why the company's ROE is expected to decline to 3.4% over the same period.

Conclusion

Overall, we have mixed feelings about Excelerate Energy. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Excelerate Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EE

Excelerate Energy

Provides liquefied natural gas (LNG) solutions worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>