Devon Energy Corporation (NYSE:DVN) is a lesser known stock to retail investors, judging from the fact that 87% of shares are held by institutions. However, it seems that this US$39b market cap oil company could be very interesting for investors, especially given the rise in energy prices, the company's dedication to returning cash to investors and their latest 6.8% dividend yield.

We will go through the fundamentals of the stocks, and see if this dividend yield makes sense for investors.

Overview

Devon is an oil and natural gas exploration and production company. Operations are focused onshore in the United States. As per their latest presentation, the company prioritizes a cash return strategy with modest target growth. This has led to a 2 tiered dividend system, with a base dividend of $0.44 per year, and a variable dividend up to 50% of free cash flows.

Devon also estimates to rise the fixed dividend to $0.64 in 2022, and has authorized a $1.6b buyback program.

The company points out that their stable growth strategy, with a focus on shareholders, is what has made them valuable as a company. This is because they tend not to overextend and have enough reserves to cover their liabilities.

Devon energy also completed a merger of equals with WPX Energy on January 7, 2021. After the final announcement, Devon's stock has been gradually rising from $9.4 to around $22 levels in March - more than 130%. However, if we account for the changes in oil prices, we notice that the stock changes almost in lock-step with price changes. In essence, this is an investment in oil & gas as commodities, but with the added 6.8% dividend yield.

Dividend Analysis

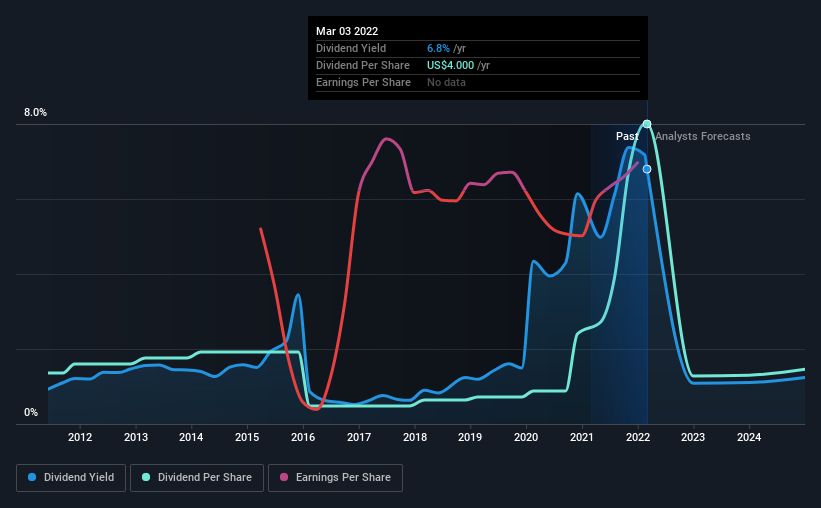

A high yield and a long history of paying dividends is an appealing combination for Devon Energy. During the year, the company also conducted a buyback equivalent to around 1.6% of its market capitalization.

Explore this interactive chart for our latest analysis on Devon Energy!

Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Devon Energy paid out 47% of its profit as dividends. It focused the rest of the free cash flows on debt reduction and buybacks.

Devon's 16.7% debt to market value of equity level is not currently at risk, and the company is targeting a debt to EBITDAX level of 0.5 in 2022, which means that should things get tight, the company would be able to pay off its debt in about 2 years after reaching the target.

The return on capital employed has also improved from 8% 3 years ago to 18.5%, indicating that the company is creating value and will have less trouble paying out dividends.

Devon's oil breakeven price point is around $30 for WTI, and $2.5 for Henry Hub. The current situation makes the company quite profitable and is estimated to have a 17% free cash flow yield ($6.4b) given an average price of $95 per barrel.

Consider getting our latest analysis on Devon Energy's financial position here.

Dividend Volatility

During the past 10-year period, the first annual payment was US$0.7 in 2012, compared to US$4.0 last year. Devon Energy has grown distributions significantly despite cutting the dividend at least once in the past.

While the energy business is volatile, Devon has committed to paying out $0.64 per share of fixed dividend, this means, that even if oil prices drop, investors will still get a 1% dividend yield.

Conclusion

To summarize, Devon is running a moderate growth company with an emphasis on cash returns for investors. Their $30 oil breakeven price level means that the company will be exceedingly profitable in this environment. Investors that have a positive outlook on energy prices may want to put the stock on their watch list.

The main reason for the appeal is the high 6.8% dividend yield, which seems justified from the fundamentals, and the fixed/variable dividend policy that allows the company to adapt to changing energy prices.

Investors should note that the stock is trading at a multi-year-high, and may want to wait for a good entry point if they feel that oil prices will significantly decline.

Additionally, we've identified 4 warning signs for Devon Energy that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:DVN

Devon Energy

An independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Very undervalued with adequate balance sheet.