- United States

- /

- Oil and Gas

- /

- NYSE:DVN

John Krenicki Jr. Retires From Devon Energy (NYSE:DVN) Board To Focus On CD&R Ventures

Reviewed by Simply Wall St

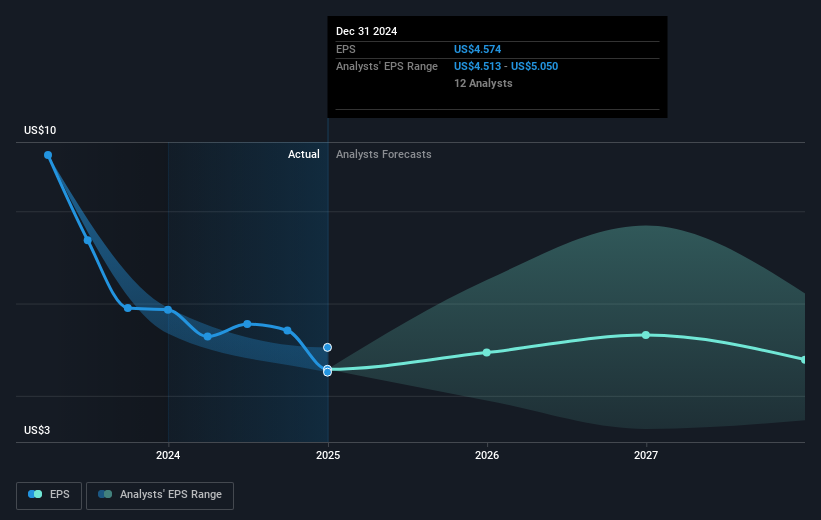

Devon Energy (NYSE:DVN) recently announced that John Krenicki Jr. will retire from the board of directors, effective after their June 2025 stockholder meeting, marking a governance shift. Over the past month, the company's share price experienced a modest increase of 0.44%. During the same period, Devon published key results and updates: fourth-quarter earnings showed increased revenues, but a decline in net income, while production numbers were robust across oil and gas sectors. These operational disclosures coincided with a 9% dividend hike and updates on its share buyback efforts, potentially influencing investor sentiment. In contrast, major indices like the Dow Jones wavered with no strong direction amidst tariff news and mixed economic indicators. With the market having seen a 3.1% dip over seven days, Devon's price stability and slight uptick could reflect investor confidence in its strategic production growth and shareholder-focused initiatives.

Click to explore a detailed breakdown of our findings on Devon Energy.

Over the last five years, Devon Energy (NYSE:DVN) achieved a total return of 409.02%. This robust performance was fueled by a series of impactful decisions and market conditions. A key driver was the significant share buyback program, which repurchased 70.8 million shares totaling US$3.4 billion since November 2021, reducing available shares and potentially boosting share value. Furthermore, Devon's quarterly fixed dividend increases, including a recent 9% hike to US$0.24 per share, underscored its commitment to returning capital to shareholders.

Production growth also played a crucial role, evidenced by Q4 oil production reaching 398 MBbls/d—a substantial increase from the previous year. Despite facing challenges, the company's proactive approach to corporate governance, with leadership changes like appointing Clay Gaspar as CEO, positioned it favorably. Nevertheless, within the past year, the company's return trailed both the US market and the Oil and Gas industry, underlining a year of varied performance among peers.

- See whether Devon Energy's current market price aligns with its intrinsic value in our detailed report

- Explore the potential challenges for Devon Energy in our thorough risk analysis report.

- Already own Devon Energy? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVN

Devon Energy

An independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Very undervalued with adequate balance sheet.