- United States

- /

- Oil and Gas

- /

- NYSE:DVN

Does Devon’s Recent 22% Drop Signal a Mispriced Opportunity for 2025?

Reviewed by Bailey Pemberton

If you are eyeing Devon Energy right now, you are not alone. A lot of investors are pausing to review their strategy after months of wild swings in the energy sector. The stock recently closed at $32.50, and in the last week alone it’s slipped 6.0%. Over the last month, Devon is down 8.5%, and year to date the return is slightly negative at -2.7%. Step back a little further, though, and the picture broadens: shares have dropped 22.2% in the past year, but if you zoom out to five years, Devon’s up an astonishing 370.8%.

Market volatility and shifting expectations around oil supply and demand have clearly left their mark on the share price. Yet, with many investors growing more cautious about risk, it is worth asking: does Devon Energy’s current price really reflect its true worth, or could there be overlooked potential? To help answer this, we use a valuation “score” based on a simple system where each of six fundamental checks signals if the stock looks undervalued. Devon scores a 5 out of 6, placing it well ahead of many competitors when it comes to potential value for money.

So what exactly goes into those six valuation checks, and can they help you make a more confident call about Devon’s upside? Let’s walk through those methods now. Before we wrap up, I will show you an even sharper way to cut through all the noise around valuation.

Why Devon Energy is lagging behind its peers

Approach 1: Devon Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting those values back to today. This gives investors a picture of the stock’s intrinsic worth. For Devon Energy, the DCF method uses a 2 Stage Free Cash Flow to Equity approach. It first relies on analyst forecasts, then extends projections further using established trends.

Currently, Devon’s Free Cash Flow (FCF) is around $926.9 Million. Analysts provide annual FCF estimates for the next five years, with these numbers projected to climb each year and reach nearly $3.8 Billion by 2029. After those five years, future cash flows out to 2035 are extrapolated based on recent growth rates, suggesting solid increases to come. All values are reported and projected in US dollars ($).

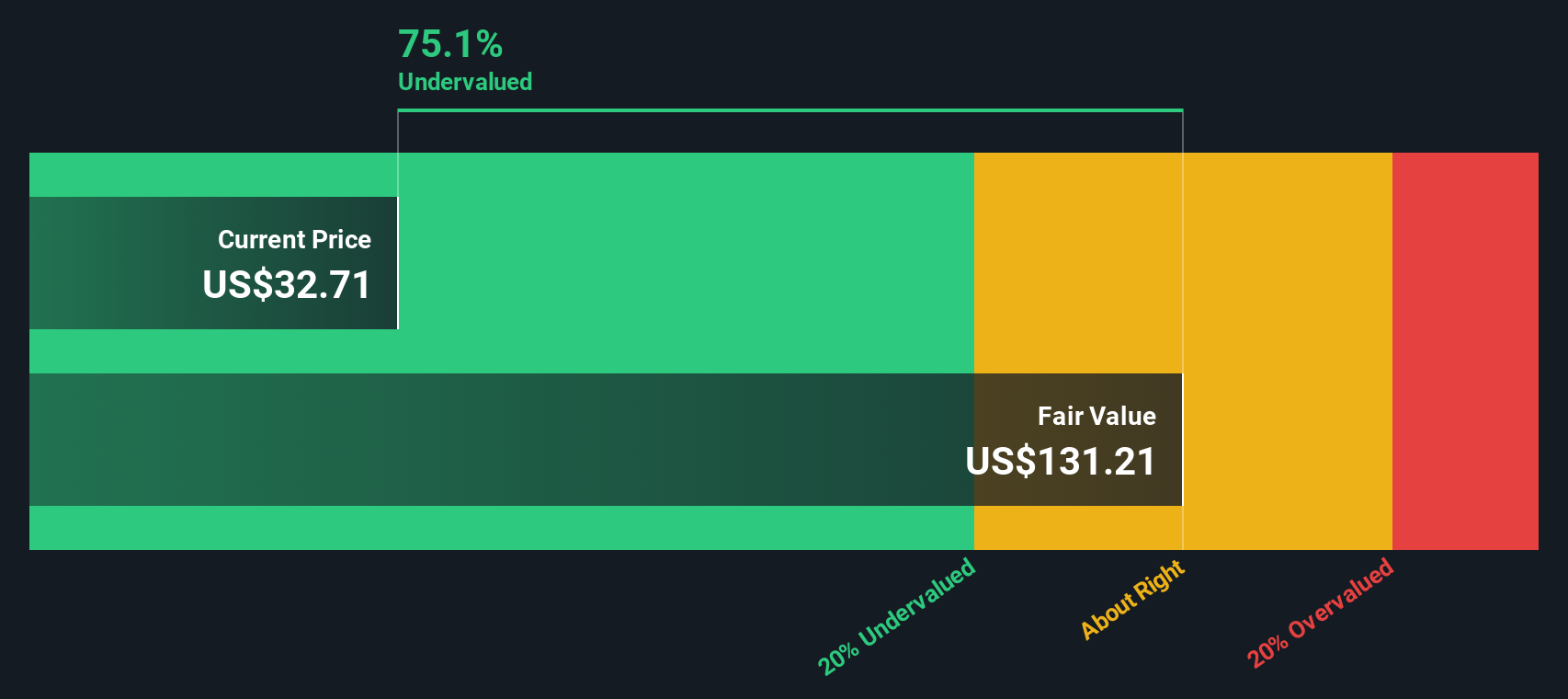

Based on these cash flows, the DCF model places Devon’s intrinsic value at an estimated $129.94 per share. Compared to its recent market price of $32.50, this signals the stock is trading at a discount of roughly 75%. This indicates the current market is significantly undervaluing the company’s future earnings potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Devon Energy is undervalued by 75.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Devon Energy Price vs Earnings

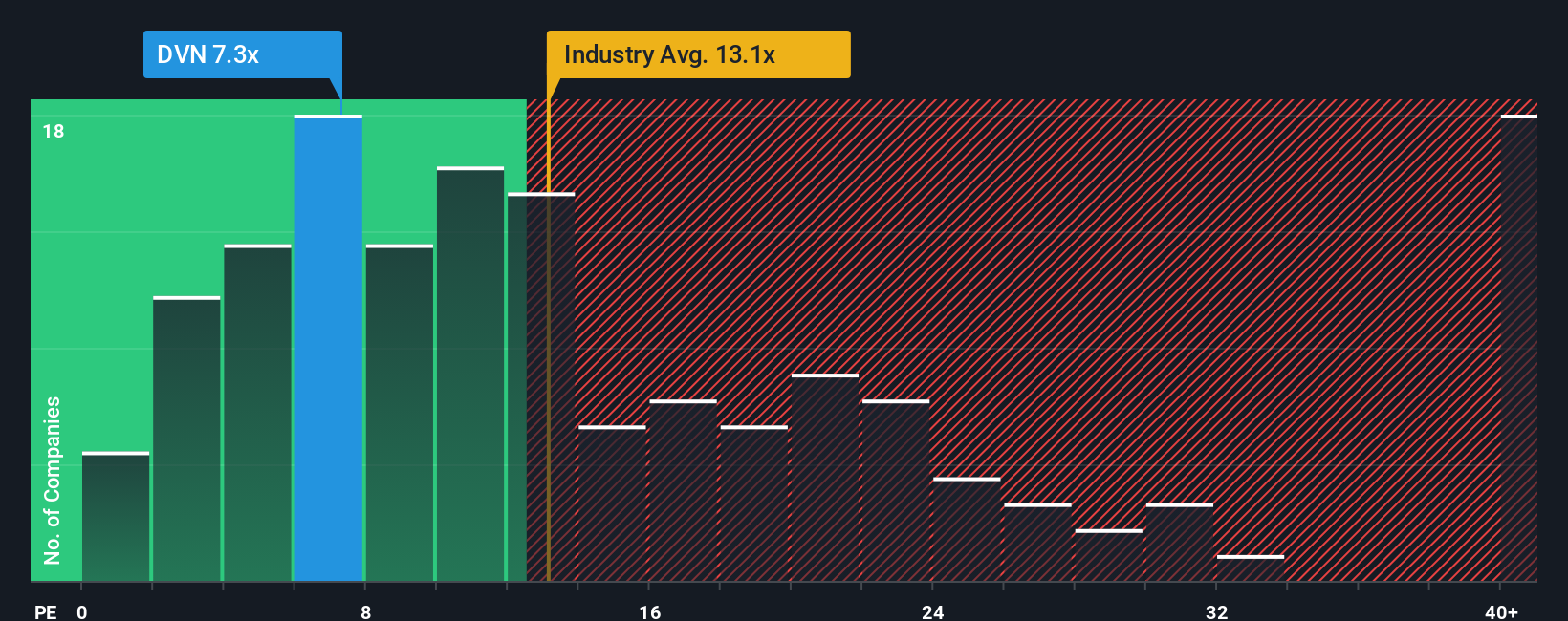

The Price-to-Earnings (PE) ratio is one of the most reliable measures for valuing profitable companies like Devon Energy. By comparing the company’s share price with its per-share earnings, investors can see how much the market is willing to pay for each dollar of profit. Typically, a “normal” or fair PE ratio isn’t universal. Higher growth prospects and lower risks can justify a bigger multiple, while slower growth or greater risks suggest a lower one.

Devon Energy currently trades at a PE ratio of 7.25x. For context, the average PE across the Oil and Gas industry stands at about 13.17x, and Devon’s peers average 22.44x. On the surface, this suggests Devon’s stock is priced at a substantial discount compared to both its industry and its direct competitors.

However, Simply Wall St’s proprietary Fair Ratio provides a sharper lens here. Unlike basic industry or peer averages, the Fair Ratio is tailored from a range of factors such as Devon’s earnings growth, profit margin, risk profile, market cap, and sector dynamics to set a more meaningful benchmark. For Devon Energy, this Fair Ratio is calculated at 16.48x. Because Devon’s PE ratio of 7.25x is significantly below this Fair Ratio, it supports the view that the company is undervalued based on its earnings, growth prospects, and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Devon Energy Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company’s future, built from your estimates for key numbers like fair value, future revenue, earnings, and profit margins. It makes investing personal by linking that story directly to a financial forecast, helping you see how your expectations translate into a fair value for any stock, including Devon Energy.

On Simply Wall St’s Community page, Narratives are an easy, interactive tool available to anyone. They help you decide when to buy or sell by showing the gap between your fair value and the current share price. They update automatically as new company news or earnings roll in. For example, some investors believe Devon’s advanced use of AI and efficient midstream operations will spur strong margin expansion and push fair value as high as $70. Others focus on risks tied to volatile commodity prices and regulatory hurdles, seeing fair value closer to $33. Your Narrative lets you confidently act on your own view rather than just following the crowd.

Do you think there's more to the story for Devon Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVN

Devon Energy

An independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives