- United States

- /

- Energy Services

- /

- NYSE:DO

Investor Optimism Abounds Diamond Offshore Drilling, Inc. (NYSE:DO) But Growth Is Lacking

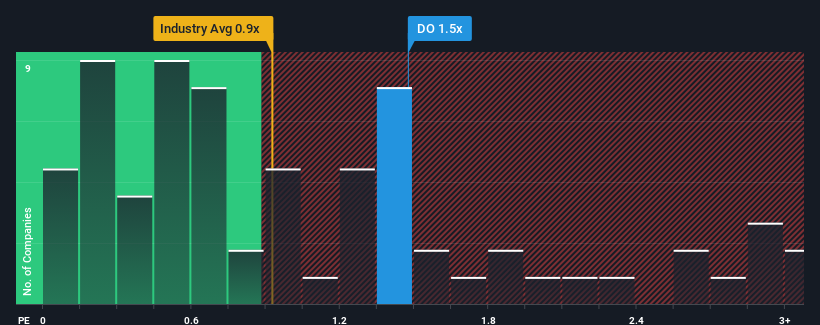

Diamond Offshore Drilling, Inc.'s (NYSE:DO) price-to-sales (or "P/S") ratio of 1.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Energy Services industry in the United States have P/S ratios below 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Diamond Offshore Drilling

How Diamond Offshore Drilling Has Been Performing

Recent times have been advantageous for Diamond Offshore Drilling as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Diamond Offshore Drilling.How Is Diamond Offshore Drilling's Revenue Growth Trending?

Diamond Offshore Drilling's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. As a result, it also grew revenue by 15% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 7.0% per annum over the next three years. That's shaping up to be materially lower than the 9.7% each year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Diamond Offshore Drilling's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Diamond Offshore Drilling's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Diamond Offshore Drilling currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 1 warning sign for Diamond Offshore Drilling that you need to take into consideration.

If you're unsure about the strength of Diamond Offshore Drilling's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Diamond Offshore Drilling, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DO

Diamond Offshore Drilling

Provides contract drilling services to the energy industry worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives