- United States

- /

- Oil and Gas

- /

- NYSE:DK

Will RIN SRE Refund Windfall Reshape Delek US Holdings' (DK) Capital Strategy and Investment Narrative?

Reviewed by Sasha Jovanovic

- Delek US Holdings recently secured EPA approvals for Renewable Identification Number (RIN) Small Refinery Exemption refunds, unlocking between US$600 million and US$900 million in cash to support a US$565 million share repurchase program.

- This substantial cash infusion is expected to enhance financial flexibility, enabling Delek to pursue capital return initiatives and strengthen its balance sheet amid a backdrop of operational improvements and ongoing legal proceedings.

- We'll examine how the influx of RIN SRE refund cash could influence Delek US Holdings' long-term investment narrative and capital strategy.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Delek US Holdings Investment Narrative Recap

Owning Delek US Holdings today means believing in its ability to leverage operational improvements, capital management, and regulatory catalysts to offset core refining risks. The recent EPA approval for RIN SRE refunds injects significant cash and catalyzes the near-term share buyback program, but does not materially reduce Delek’s longer-term exposure to volatile refining margins and sector transition risks.

Among Delek’s recent initiatives, the acceleration of its US$565 million share repurchase program stands out, as it is directly enabled by the SRE refund windfall. This move highlights Delek's focus on capital returns as a key catalyst, even as ongoing legal proceedings and structural industry pressures remain central to the investment narrative.

However, investors should be aware that despite the cash infusion, Delek’s ongoing net losses and rising capital expenditures mean...

Read the full narrative on Delek US Holdings (it's free!)

Delek US Holdings is projected to reach $10.3 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes a -1.5% annual decline in revenue and an increase in earnings of $2.36 billion from the current earnings of -$863.6 million.

Uncover how Delek US Holdings' forecasts yield a $29.62 fair value, a 8% downside to its current price.

Exploring Other Perspectives

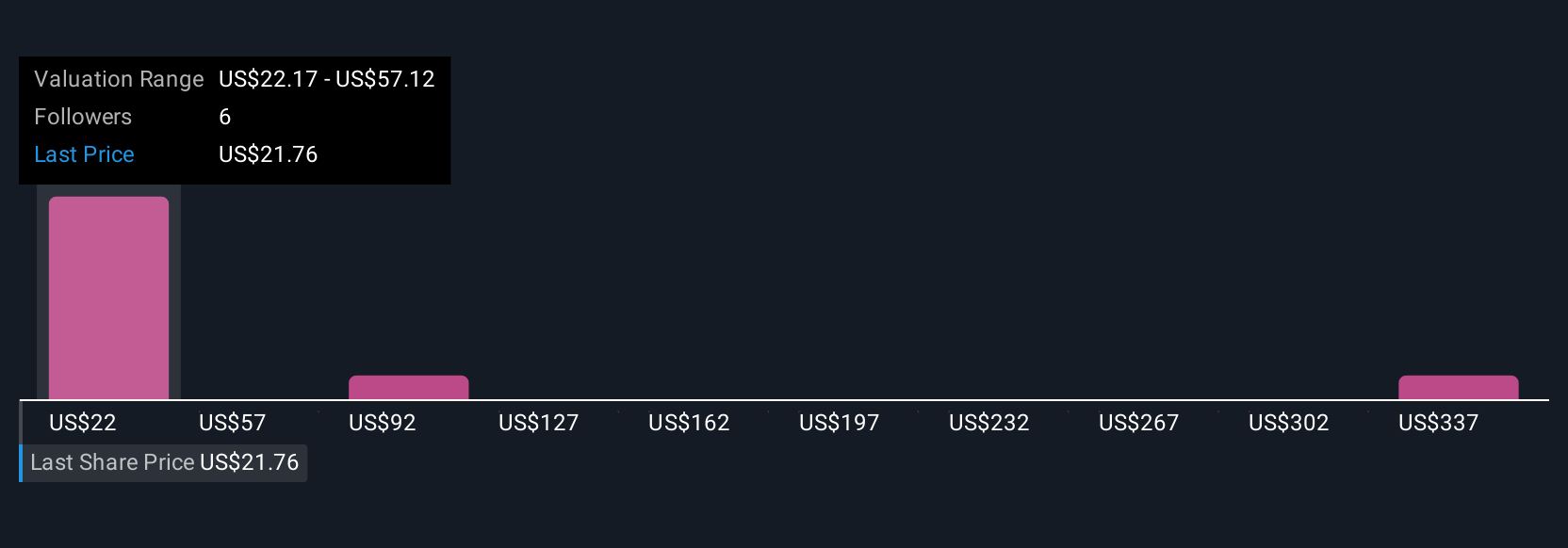

Four fair value estimates from the Simply Wall St Community span from US$9.97 to US$371.71 per share, showing a wide spread. With operational improvements targeting US$130 to US$170 million in annualized cash flow, you can explore how diverse views shape the conversation around Delek’s future.

Explore 4 other fair value estimates on Delek US Holdings - why the stock might be a potential multi-bagger!

Build Your Own Delek US Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delek US Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Delek US Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delek US Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DK

Delek US Holdings

Engages in the integrated downstream energy business in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives