- United States

- /

- Oil and Gas

- /

- NYSE:DHT

Is There Opportunity in DHT Holdings After Recent 18% Jump in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with DHT Holdings stock right now? You’re hardly alone. For investors, weighing the recent performance and future potential is the name of the game. DHT Holdings hasn’t flown under the radar. After running up an eye-catching 18.0% so far this year, it’s delivered a five-year return of 212.3%. If you zoom in, you’ll see the stock has given back a little ground in the past month, down 7.8%, but that hardly dims the shine of a nearly 80% gain over the last three years. It’s no wonder this shipping company keeps finding its way onto more watchlists.

What’s sparking these moves? Market observers have pointed to shifting global demand and periodic disruptions in shipping lanes, which have had a ripple effect on tanker rates and investor sentiment. For a company like DHT Holdings, these macro trends can cause the market’s mood to swing between optimism and caution. The latest dip may reflect short-term uncertainty, but the longer arc shows a business adapting to a rapidly evolving industry.

All that price action brings us to an essential question: is DHT Holdings actually undervalued, fairly priced, or trading at a premium? By the numbers, the company hits all six of the traditional undervaluation checks, earning a valuation score of 6 out of 6. Over the next sections, I’ll break down what goes into that assessment, how it compares to more popular evaluation tools, and introduce a less conventional (but possibly superior) approach to finding a stock’s true value.

Approach 1: DHT Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This helps investors gauge what the business is truly worth based on how much cash it is expected to generate in the years ahead.

For DHT Holdings, the latest reported Free Cash Flow (FCF) is $192.3 million. Analysts forecast the company’s FCF to rise significantly, projecting $457 million by 2027. Beyond that, further growth is anticipated, with estimates reaching up to $1.13 billion by 2035. These long-term figures come from extrapolations rather than direct analyst coverage.

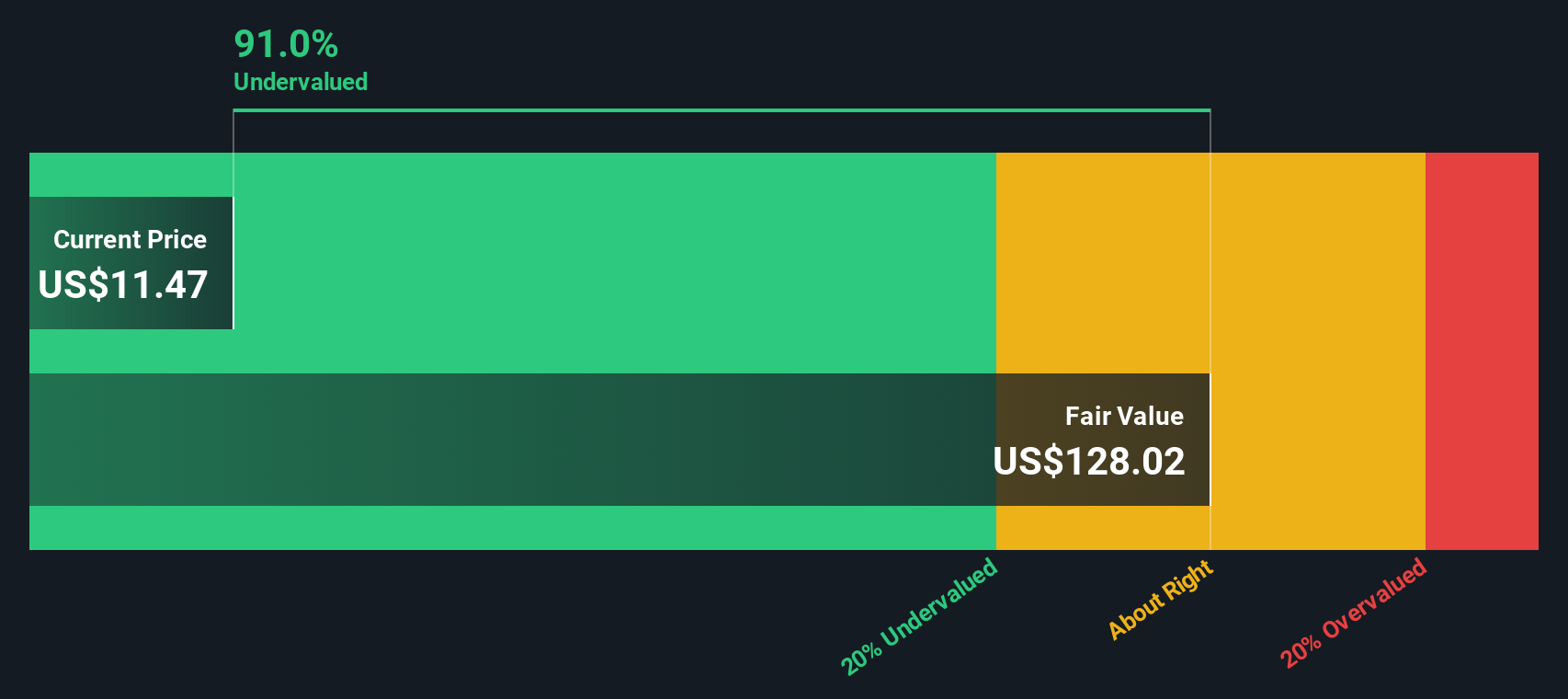

The model applied here uses a “2 Stage Free Cash Flow to Equity” framework, factoring in higher early growth and a more moderate rate over time. According to these projections, the intrinsic value of DHT Holdings comes out to $128.51 per share, using the dollar as the reporting currency. Based on this calculation, the stock currently trades at a 91.1% discount to its intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DHT Holdings is undervalued by 91.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DHT Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a well-established metric for valuing consistently profitable companies like DHT Holdings. It helps investors compare the market price of a stock relative to its earnings, offering a quick sense of whether the share price is justified by underlying profits.

Determining what makes for a “fair” PE ratio is not an exact science, as growth prospects and risk profile play significant roles. Fast-growing, low-risk companies will generally command higher PE ratios, whereas mature or riskier firms often trade at a discount.

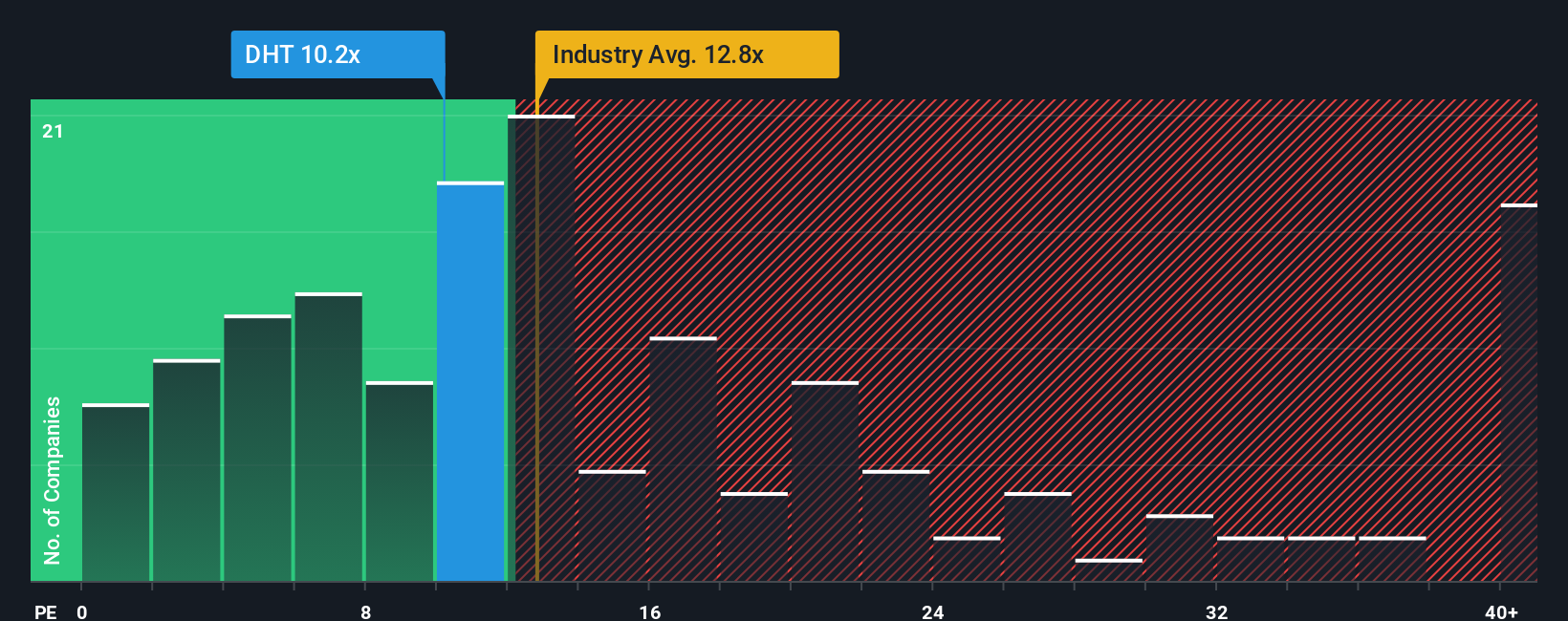

DHT Holdings currently trades at a PE ratio of 9.61x. For context, this sits below the average PE for the oil and gas industry at 13.00x and the peer group average of 11.91x. On paper, DHT looks cheaper than much of its competition, but surface-level comparisons do not reveal the full picture.

This is where the Simply Wall St “Fair Ratio” comes in. The Fair Ratio for DHT is 17.45x, reflecting a more tailored expectation. Unlike a simple industry or peer average, the Fair Ratio weighs up factors unique to DHT, such as its earnings growth, profit margins, industry positioning, market cap, and specific risks. That makes it a more holistic and precise valuation benchmark.

With DHT’s current PE ratio of 9.61x well below its Fair Ratio of 17.45x, the stock appears to be trading at a notable discount based on earnings fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DHT Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply the story you believe about a company's future, built from your own view of its business, industry environment, and prospects, and then connected to concrete financial projections like revenue, earnings, and profit margins.

By linking a company’s story to its future performance and resulting fair value, Narratives help investors bring their qualitative perspective to life and make it actionable. Narratives are accessible to everyone on Simply Wall St’s Community page, where millions of investors use them to articulate and share their investment thesis, adjusting fair value estimates as markets shift.

This tool empowers you to compare each Narrative’s calculated fair value with the current price to decide when the stock appears attractive to buy or if it might be time to sell. In addition, Narratives update automatically as new news or earnings data come in, so your investment logic is never out of date.

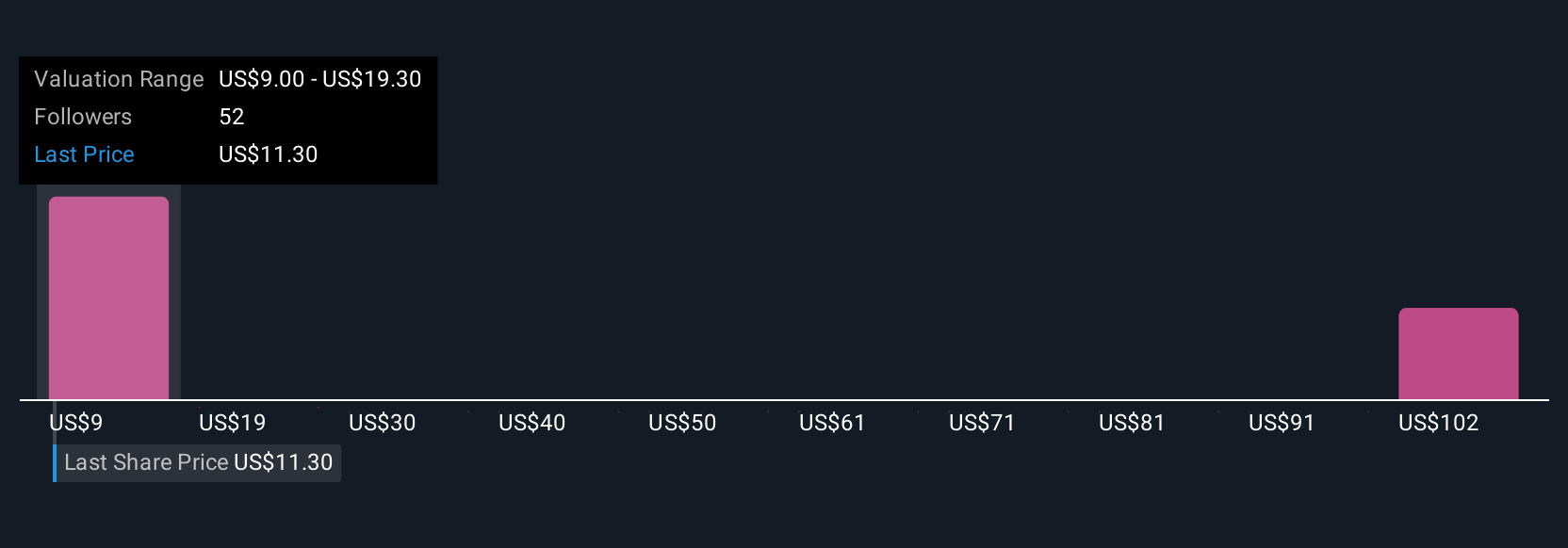

For example, one DHT Holdings Narrative, “Modern VLCC Fleet Renewal Will Capture Premium Charter Rates,” estimates a fair value of $16.00 per share. Another Narrative suggests a more cautious outlook with a fair value of $12.80, reflecting the range of possible futures and investor perspectives.

Do you think there's more to the story for DHT Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)