- United States

- /

- Oil and Gas

- /

- NYSE:DHT

How Updated 2025 Earnings Guidance at DHT Holdings (DHT) Has Changed Its Investment Story

Reviewed by Simply Wall St

- DHT Holdings recently provided updated earnings guidance for the second quarter of 2025, estimating time charter equivalent earnings at US$46,300 per day, with higher rates in the spot market for its VLCC fleet.

- This detailed forecast increases transparency regarding the company's operating performance and offers investors insights into the distinct revenue streams from spot versus time-charter operations.

- To better understand the significance of this updated earnings guidance, we'll consider how these higher VLCC spot rates might impact DHT's investment narrative.

DHT Holdings Investment Narrative Recap

To feel confident as a DHT Holdings shareholder, you need to believe in the outlook for VLCC tanker freight rates and the company’s ability to capture revenue from spot market strength. The new Q2 2025 earnings guidance, highlighting higher spot rates, reinforces the short-term earnings catalyst but does not eliminate the biggest risk: potential revenue pressure if compliant fleet demand expectations are not met due to unforeseen market or geopolitical changes.

Among recent announcements, DHT’s sale of its oldest vessel, DHT Scandinavia, stands out. The resulting US$19.8 million gain could free up capital for further investment or debt reduction, complementing the improved earnings guidance and supporting management’s focus on efficiency and capital discipline as potential earnings drivers.

Conversely, investors should be aware that tightening in the compliant VLCC fleet may not have the expected impact on earnings growth if...

Read the full narrative on DHT Holdings (it's free!)

DHT Holdings' outlook forecasts $456.7 million in revenue and $270.8 million in earnings by 2028. This is based on a 6.7% annual revenue decline and a $92.2 million earnings increase from the current $178.6 million.

Uncover how DHT Holdings' forecasts yield a $14.15 fair value, a 27% upside to its current price.

Exploring Other Perspectives

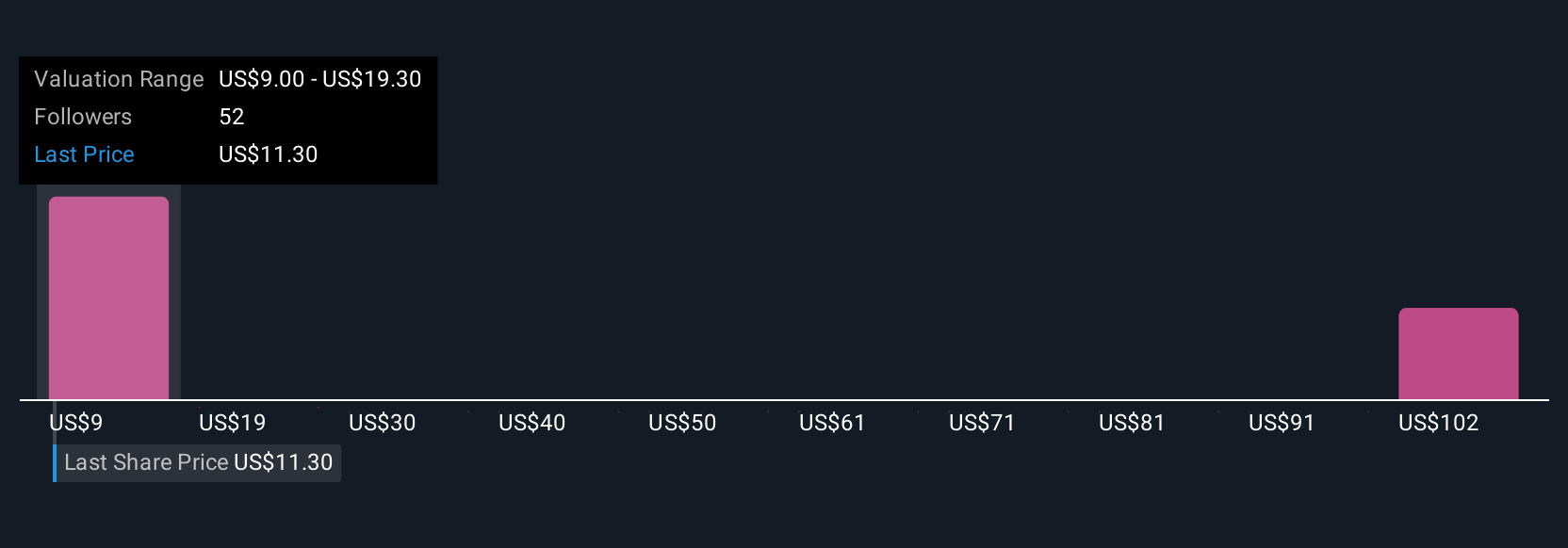

Simply Wall St Community members offered eight different fair value estimates for DHT Holdings, from US$8.80 to US$111.95. While the majority of recent catalysts support optimism around cash flow, many recognize that unforeseen changes in tanker demand or sanctions could have a material effect on future returns, reminding you to compare multiple viewpoints before making a decision.

Build Your Own DHT Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DHT Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DHT Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DHT Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives