- United States

- /

- Oil and Gas

- /

- NYSE:DEC

Why Diversified Energy (DEC) Is Up 7.8% After SEC Deregistration And The Canvas Energy Deal – And What's Next

Reviewed by Sasha Jovanovic

- Diversified Energy Company PLC recently filed a Form 15 to voluntarily deregister its ordinary shares from the US Securities and Exchange Commission, following a period of active capital markets activity including multiple ESOP-related shelf registrations and the ABS-funded Canvas Energy acquisition.

- This combination of deregistration, employee share programs, and asset-backed financing around the Canvas Energy deal highlights a shift toward alternative funding channels and a more targeted investor base for the company.

- With the shares returning about 7.83% over the past week, we’ll explore how the Canvas Energy acquisition reshapes Diversified Energy’s investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Diversified Energy's Investment Narrative?

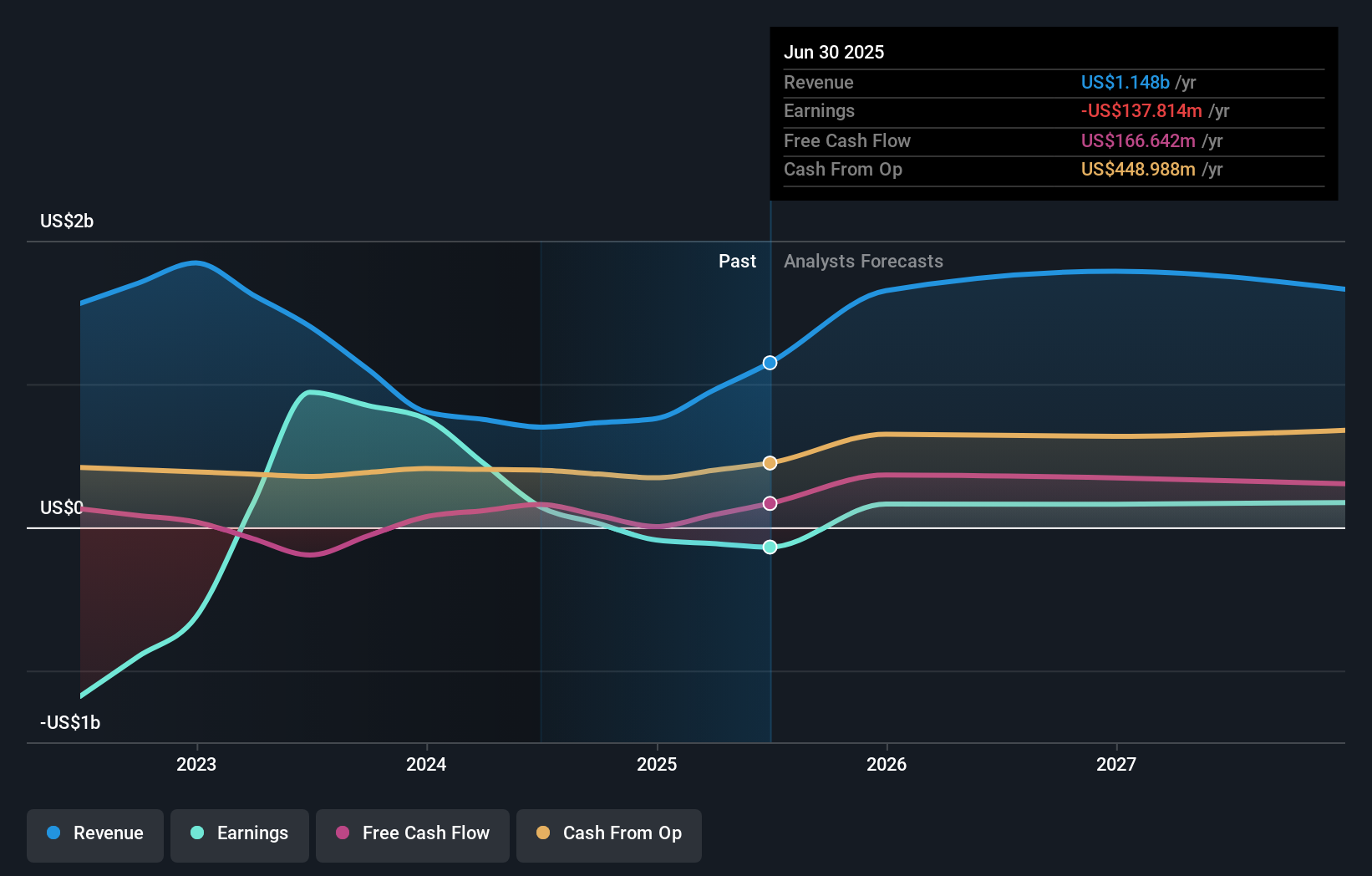

To own Diversified Energy you need to be comfortable with a company that leans hard into acquisitions, high-yield dividends and financial engineering to unlock value from mature oil and gas assets rather than drilling new wells. The Canvas Energy deal, funded with a US$400 million asset-backed securitization, reinforces that model by adding around 13% more production and long-life Oklahoma acreage, but it also adds leverage and execution risk just as Diversified remains loss-making and its interest bill is not well covered by earnings. The fresh wave of ESOP-related shelf registrations, active buybacks and now the SEC deregistration all point to a tighter, more targeted shareholder base and a shift toward non-US capital pools, which could change how quickly sentiment feeds into the share price. With the stock up 7.83% in a week and trading meaningfully below both analyst and community fair value estimates, the key short term catalyst is whether the market gains confidence that the enlarged portfolio can support the current 7.32% dividend and move the company toward the profitability analysts expect, without forcing further dilution or balance sheet strain.

However, that generous yield comes with balance sheet and refinancing risks investors should understand. Diversified Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

The Simply Wall St Community currently offers 1 fair value view for Diversified Energy, centered around US$19.83 per share, giving you a single, focused reference point. Set that against the recent Canvas Energy acquisition, ABS-funded growth and the SEC deregistration, and it becomes clear why different investors may reach very different conclusions about how sustainable the dividend and balance sheet really are. Exploring several viewpoints can help you decide where you stand on that trade off.

Explore another fair value estimate on Diversified Energy - why the stock might be worth as much as 25% more than the current price!

Build Your Own Diversified Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diversified Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Diversified Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diversified Energy's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEC

Diversified Energy

An independent energy company, focuses on the production, transportation, and marketing of natural gas and liquids primarily in the Appalachian and Central regions of the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)