- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Why Chevron's (NYSE:CVX) Dividend is Interesting Even After the Stock Jump

Energy companies are in the center of attention, and Chevron Corporation (NYSE:CVX) stock increased by 23% from February 24th. In order to assess if the company is possibly a good long term investment, we will look at the fundamentals and its dividend paying capacity.

Fundamental Snapshot

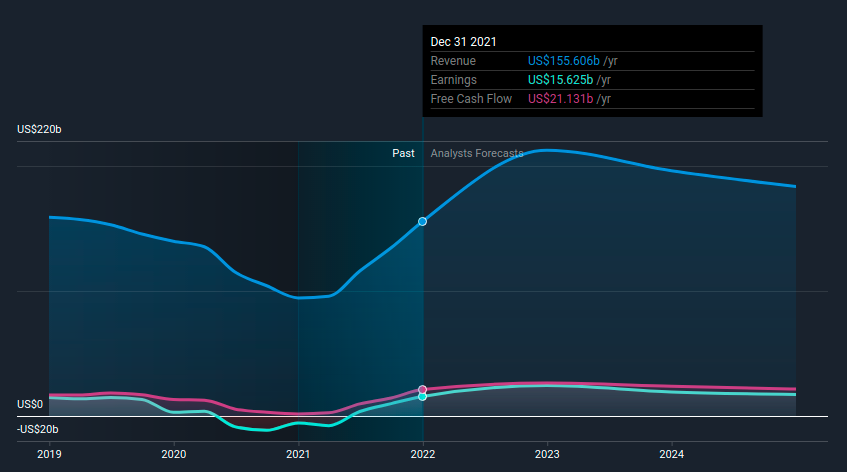

Last year, the company's revenues increased by 64.7%, which is more than the 3-year average growth rate of -2.9%. This is a sign that growth seems to be accelerating. However, if we go back a bit more, we will see that Chevron is expressing a clear cyclical pattern regarding top line revenues, which are highly influenced by the oil price.

Currently, Chevron's breakeven oil price is around $50, which will yield high excess returns for investors at current oil price levels of around US$110.

The profit margin is currently at 10%, but this will likely increase in 2022. To get a better sense of profitability, we look at how growth scales in relation to the costs of production. In this regard, we take the last 12-month revenue growth and subtract the growth of costs in the same period. Here we see that Chevron Corporation grew revenues by 11.4% more than costs of goods sold. This will show up in the margins and increase in the future as oil prices keep an elevated level.

Cash flows are arguably more important to investors, and seem to be even higher than profits - this may indicate that Chevron is very efficient at cash conversion.

Free cash flows are what investors have a claim on from the firm. They can be returned in the form of dividends and buybacks as well as used in debt financing and projects that further boost the cash flow generating capacity of the company. Chevron Corporation has made US$21.1b of Free Cash Flows attributable to all investors, a.k.a FCFF. Which is a good result, increasing value for investors, and a good part of them will show up as future dividends.

A large part of Chevron's investors are dividend investors, and this will be the focus on our following section.

Dividend Analysis

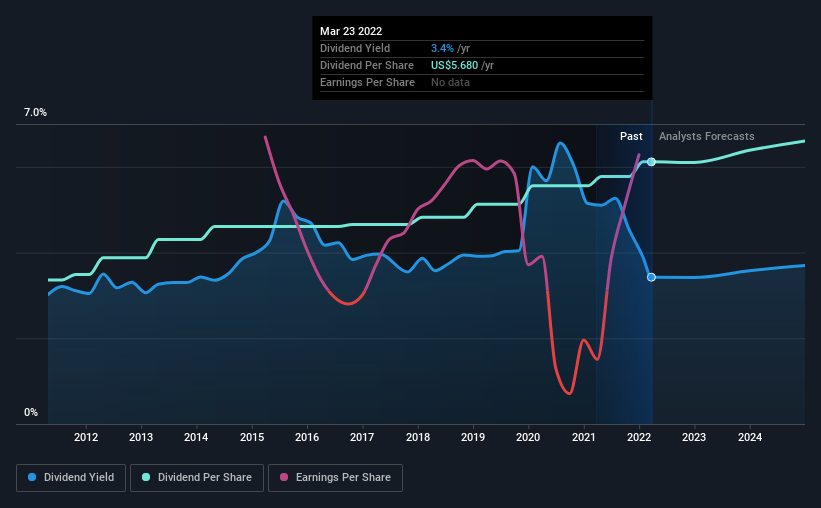

In this case, Chevron likely looks attractive to investors, given its 3.4% dividend yield and a payment history of over ten years. The company's dividends per share have been gradually increasing over the years, and the latest boost to earnings can give the company a significant safety moat or an opportunity to increase the dividend. If management opts for a higher dividend, that may indicate that they expect oil prices to keep their higher levels.

During the past 10-year period, the first annual payment was US$3.1 in 2012, compared to US$5.7 last year. Dividends per share have grown at approximately 6.2% per year over this time.

That said, the recent jump in the share price will make Chevron's dividend yield look smaller, even though the company prospects could be improving.

Some simple analysis can reduce the risk of holding Chevron for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 65% of Chevron's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Chevron's cash payout ratio in the last year was 48%, which suggests dividends were well covered by cash generated by the business. It's positive to see that Chevron's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Consider getting our latest analysis on Chevron's financial position here.

Conclusion

Long time Chevron investors are probably happy with both the dividend and stock price. Even at the current price, the company will yield a good 3.4% annual dividend yield, which may be great in a world that is slowly dividing and even more dependent on energy prices.

The company itself is stable and has a low breakeven point, which gives investors good moat in the event of an oil price pullback.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come accross 2 warning signs for Chevron you should be aware of, and 1 of them makes us a bit uncomfortable.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion