- United States

- /

- Oil and Gas

- /

- NYSE:CVI

How Coffeyville’s Distillate Recovery Project at CVR Energy (CVI) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- CVR Energy recently completed the Coffeyville refinery's distillate recovery project, which is projected to increase distillate yield by around 2% by the end of the third quarter.

- This improvement could enhance the company's revenue and profitability, though ongoing regulatory uncertainties and operational costs continue to weigh on its outlook.

- We’ll explore how increased distillate yields from the Coffeyville project shape CVR Energy’s broader investment narrative and future prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CVR Energy Investment Narrative Recap

To own CVR Energy, you have to believe that operational improvements can offset challenging market dynamics and regulatory headwinds in U.S. refining and renewables. The recent completion of the Coffeyville refinery’s distillate recovery project may help boost short-term revenue and margins, but continued regulatory pressures, like evolving Renewable Fuel Standard requirements and compliance costs, remain the most immediate risk. For investors, the project’s impact may be incremental rather than transformational, especially in the context of ongoing cost and policy challenges.

One of the most impactful recent announcements is CVR Energy’s Q3 production guidance, which could provide early evidence of smoother operations after refinery downtime. With throughput expected between 200,000 and 215,000 barrels per day, investors will be watching to see if operational gains from the Coffeyville upgrade translate to improved financial performance, even as regulatory uncertainties persist.

However, investors should also keep in mind the potential for shifting regulations to impact net margins and cash flow...

Read the full narrative on CVR Energy (it's free!)

CVR Energy's narrative projects $8.1 billion in revenue and $101.0 million in earnings by 2028. This requires 4.0% yearly revenue growth and a $434.0 million increase in earnings from -$333.0 million currently.

Uncover how CVR Energy's forecasts yield a $25.67 fair value, a 30% downside to its current price.

Exploring Other Perspectives

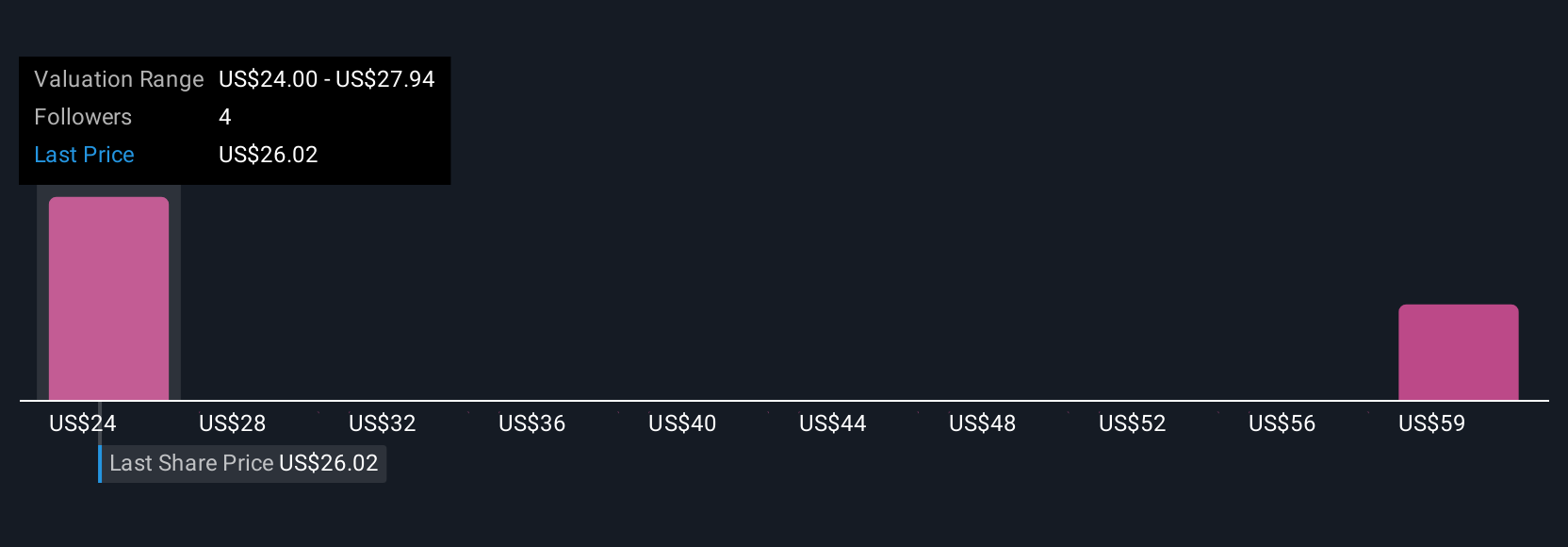

Simply Wall St Community members have contributed two fair value estimates for CVR Energy, ranging widely from US$25.67 to US$108.52 per share. While throughput gains after the Coffeyville project could support higher earnings, the company’s ongoing regulatory risks remind you that market expectations can be volatile, make sure to review several viewpoints before deciding on your stance.

Explore 2 other fair value estimates on CVR Energy - why the stock might be worth 30% less than the current price!

Build Your Own CVR Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CVR Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Energy's overall financial health at a glance.

No Opportunity In CVR Energy?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVI

CVR Energy

Engages in renewable fuels and petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives