- United States

- /

- Oil and Gas

- /

- NYSE:CRT

Cross Timbers Royalty Trust's (NYSE:CRT) Upcoming Dividend Will Be Larger Than Last Year's

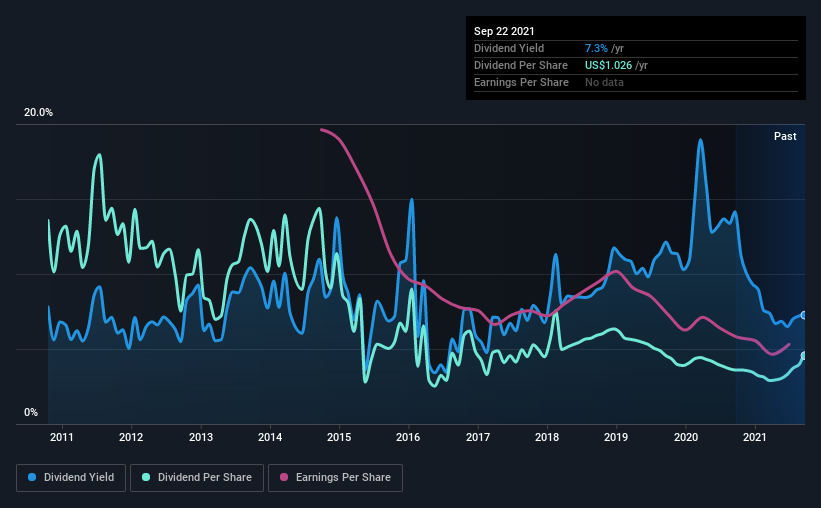

Cross Timbers Royalty Trust's (NYSE:CRT) dividend will be increasing to US$0.16 on 15th of October. This will take the annual payment from 7.3% to 7.3% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Cross Timbers Royalty Trust

Cross Timbers Royalty Trust Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, Cross Timbers Royalty Trust's dividend was higher than its profits, but the free cash flows quite comfortably covered it. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

EPS is set to fall by 8.6% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 127%, which could put the dividend under pressure if earnings don't start to improve.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was US$3.05 in 2011, and the most recent fiscal year payment was US$1.03. This works out to a decline of approximately 66% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth May Be Hard To Come By

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. It's not great to see that Cross Timbers Royalty Trust's earnings per share has fallen at approximately 8.6% per year over the past five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

Cross Timbers Royalty Trust's Dividend Doesn't Look Sustainable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for Cross Timbers Royalty Trust (of which 1 shouldn't be ignored!) you should know about. We have also put together a list of global stocks with a solid dividend.

If you decide to trade Cross Timbers Royalty Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:CRT

Cross Timbers Royalty Trust

Operates as an express trust in the United States.

Flawless balance sheet and good value.