- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Crescent Energy Company's (NYSE:CRGY) Shares Not Telling The Full Story

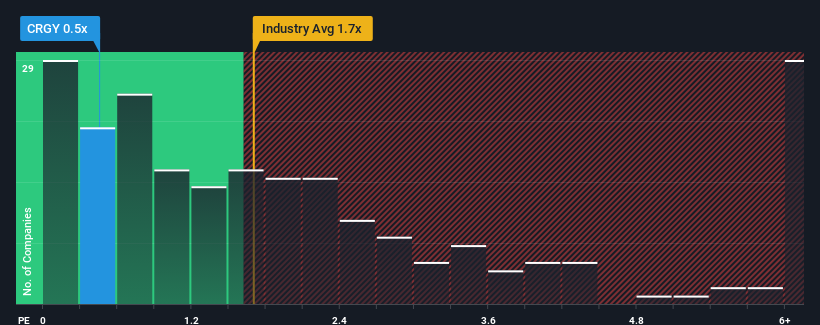

When close to half the companies operating in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") above 1.7x, you may consider Crescent Energy Company (NYSE:CRGY) as an attractive investment with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Crescent Energy

What Does Crescent Energy's P/S Mean For Shareholders?

Crescent Energy has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Crescent Energy will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Crescent Energy?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Crescent Energy's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Still, the latest three year period has seen an excellent 219% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company are not great, suggesting revenue should decline by 1.2% per year over the next three years. With the rest of the industry predicted to shrink by 1.1% per year, it's set to post a similar result.

In light of this, the fact Crescent Energy's P/S sits below the majority of other companies is unanticipated but certainly not shocking. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Crescent Energy's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Crescent Energy currently trades on a lower than expected P/S since its revenue forecast is matching the struggling industry but its P/S is struggling to keep up. Even though the company's revenue outlook is on par, we assume potential risks are what might be placing downward pressure on the P/S ratio. The market could be pricing in revenue growth falling below that of the industry, a possibility given tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should typically see a P/S closer to the industry average.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Crescent Energy (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRGY

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives