- United States

- /

- Oil and Gas

- /

- NYSE:CNX

CNX Resources (CNX): Reassessing Valuation After Strong Q3 Beat, Leadership Changes and a New 52-Week High

Reviewed by Simply Wall St

CNX Resources (CNX) just checked several big boxes for investors, topping Q3 expectations, announcing a C suite shake up, and pushing to a fresh 52 week high on renewed market confidence.

See our latest analysis for CNX Resources.

At $40.39, CNX’s recent 17.04% 1 month share price return and 307.98% 5 year total shareholder return indicate that momentum may still be building as the market reassesses its growth and risk profile.

If CNX’s run has you rethinking where the next big movers might come from, it could be worth exploring fast growing stocks with high insider ownership for more ideas with strong insider conviction.

But with shares now above many analyst targets, double digit earnings growth, and a hefty short interest backdrop, should investors see CNX as still trading below intrinsic value, or is the market already pricing in years of future growth?

Most Popular Narrative: 20.3% Overvalued

With CNX Resources closing at $40.39 against a narrative fair value of $33.57, the story centers on strong cash flow hopes colliding with weaker gas realizations.

Analysts are assuming CNX Resources's revenue will grow by 8.9% annually over the next 3 years.

Analysts assume that profit margins will increase from 8.6% today to 36.7% in 3 years time.

Curious how modest revenue growth suddenly supports elite level margins and a compressed future earnings multiple, all at today’s higher share price? The narrative’s math might surprise you.

Result: Fair Value of $33.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or weaker than expected in basin demand could quickly undermine the optimistic cash flow path embedded in today’s valuation narrative.

Find out about the key risks to this CNX Resources narrative.

Another Lens on Value

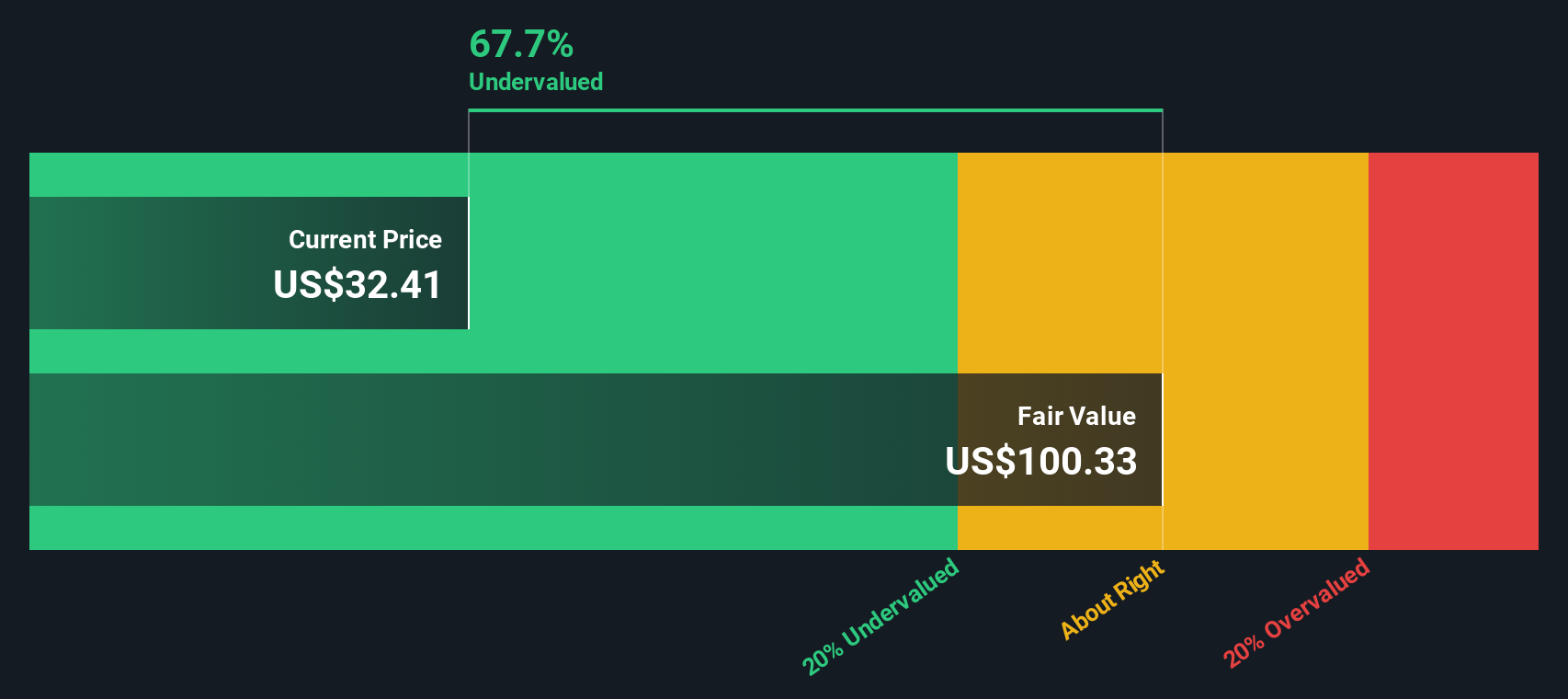

While the narrative fair value suggests CNX is 20.3% overvalued, our DCF model presents a very different picture, indicating a fair value of $204.53 compared with today’s $40.39. If that substantial gap is even partly accurate, is the market still underestimating CNX’s long-term cash engine?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CNX Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CNX Resources Narrative

If you see the setup differently, or want to stress test your own assumptions directly in the model, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your CNX Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Instead of stopping with CNX, put Simply Wall St to work and consider your next moves before everyone else chases the same opportunities you could spot first.

- Review these 919 undervalued stocks based on cash flows that already show strong cash flow support yet still trade at attractive discounts.

- Explore these 30 healthcare AI stocks where data driven treatments and diagnostics can be evaluated for potential competitive advantages.

- Scan these 81 cryptocurrency and blockchain stocks focusing on companies building real world applications on blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026