- United States

- /

- Oil and Gas

- /

- NYSE:CNR

Will Jimmy Brock’s Expanded Role at Core (CNR) Strengthen Board-Management Alignment for Investors?

Reviewed by Sasha Jovanovic

- On October 8, 2025, Core Natural Resources announced the appointment of board chair Jimmy Brock as chief executive officer, succeeding Paul A. Lang, who will remain as a consultant through year-end to support a smooth leadership transition.

- Brock brings over 40 years of coal industry expertise, including CEO experience at CONSOL Energy, providing continuity and industry insight following the merger that created Core earlier this year.

- We'll explore how Jimmy Brock’s expanded leadership role shapes Core Natural Resources' long-term direction and influences its investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Core Natural Resources Investment Narrative Recap

To be a shareholder in Core Natural Resources, you need to believe that the company can leverage robust energy demand and U.S. policy tailwinds, while navigating industry-wide transition risks, especially the shift to renewables and evolving regulatory challenges. The recent CEO transition to Jimmy Brock is not expected to materially impact the central short-term catalyst: operational recovery at key mines, particularly Leer South, but does bring potential stability during this pivotal phase. The most prominent near-term business risk remains company-specific, namely the pace and effectiveness of operational recovery and cost controls, elements unlikely to be strongly affected by this leadership change.

Recent updates on the Leer South mine are most relevant here, as resumption of operations and successful equipment repositioning directly influence the company's ability to meet its sales guidance for 2025. With production ramp-ups underway, management continuity under Brock will be crucial to maintaining progress on these catalyst targets. Despite this, investors should be aware that unforeseen setbacks in operational recovery...

Read the full narrative on Core Natural Resources (it's free!)

Core Natural Resources' outlook forecasts $5.1 billion in revenue and $920.4 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 15.9% and a massive earnings increase of $899.8 million from current earnings of $20.6 million.

Uncover how Core Natural Resources' forecasts yield a $98.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

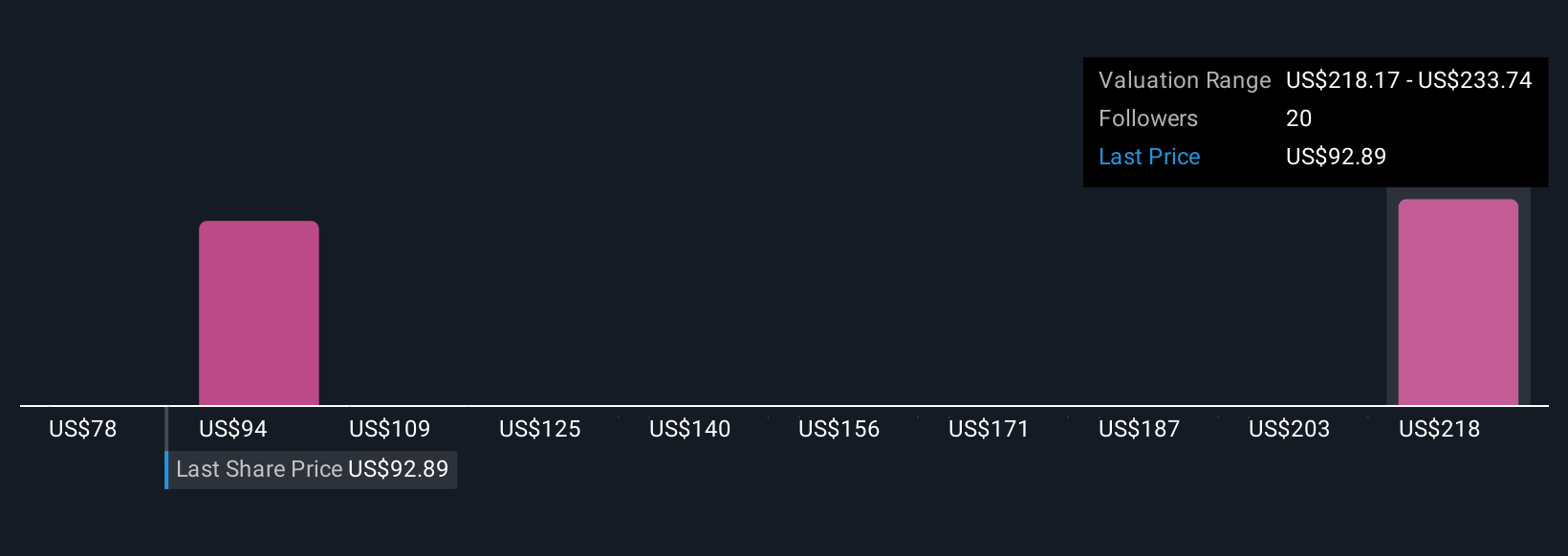

Simply Wall St Community members’ fair value estimates for Core range widely from US$78 to US$233.74, with four unique perspectives. With the company’s operational turnaround still ongoing, your own view on execution risk could sharply affect how much upside or downside you see here, so it pays to review multiple viewpoints.

Explore 4 other fair value estimates on Core Natural Resources - why the stock might be worth over 2x more than the current price!

Build Your Own Core Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Core Natural Resources research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Core Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Core Natural Resources' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNR

Core Natural Resources

Produces, sells, and exports metallurgical and thermal coals in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives