- United States

- /

- Oil and Gas

- /

- NYSE:BSM

Will Black Stone Minerals’ (BSM) Leadership Transition Reshape Its Strategic Direction?

Reviewed by Sasha Jovanovic

- Black Stone Minerals, L.P. recently announced a leadership succession plan effective January 1, 2026, including the transition of Tom Carter to Executive Chairman, and the appointment of Fowler Carter and Taylor DeWalch as co-CEOs, alongside a Board change following the resignation of long-time director Will Mathis in October 2025.

- The company also released third quarter 2025 results showing financial performance and oil production largely similar to the previous year, suggesting investor interest may be shifting to the incoming management and any potential changes in direction.

- We'll examine how Black Stone Minerals' leadership transition and stable quarterly results could shape its future investment thesis and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Black Stone Minerals Investment Narrative Recap

To own Black Stone Minerals, shareholders need to believe in the resilience of its royalty-based oil and gas business, with exposure to U.S. production growth and global energy demand. The newly announced management succession plan, while notable, does not materially alter near-term catalysts or the biggest current risk: underperformance in natural gas production, especially in core regions like the Shelby Trough and Haynesville/Bossier, which could limit cash flow growth if challenges persist.

One of the most relevant recent announcements is Black Stone’s updated production guidance for 2025, which was revised lower due to slower-than-expected natural gas output in key basins. This directly aids investors in assessing near-term revenue visibility and underscores how operational challenges, rather than management changes alone, remain central to the company’s outlook.

By contrast, any further production disappointments in core regions, a risk investors should be aware of, could...

Read the full narrative on Black Stone Minerals (it's free!)

Black Stone Minerals' outlook anticipates $530.3 million in revenue and $283.0 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 8.6% and represents a $37.4 million earnings increase from the current earnings of $245.6 million.

Uncover how Black Stone Minerals' forecasts yield a $13.00 fair value, a 5% downside to its current price.

Exploring Other Perspectives

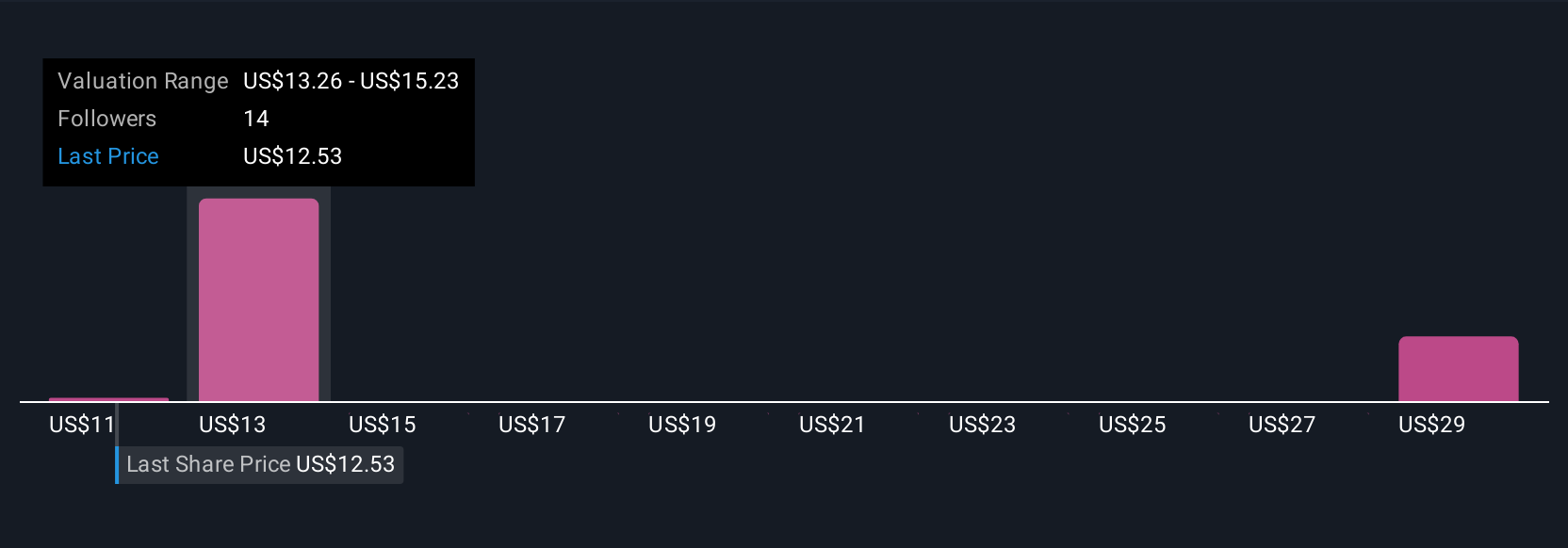

Simply Wall St Community members posted four separate fair value estimates for Black Stone Minerals, ranging from US$11.51 to US$19.74 per share. With production guidance already revised lower for 2025, you may want to explore how other market participants frame possible future outcomes for the business.

Explore 4 other fair value estimates on Black Stone Minerals - why the stock might be worth as much as 44% more than the current price!

Build Your Own Black Stone Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Stone Minerals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Black Stone Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Stone Minerals' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Stone Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSM

Black Stone Minerals

Owns and manages oil and natural gas mineral interests.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives