- United States

- /

- Oil and Gas

- /

- NYSE:BKV

Will BKV's (BKV) New Shelf Registration Redefine Its Capital Flexibility Amid Market Headwinds?

Reviewed by Sasha Jovanovic

- Earlier in October 2025, BKV Corporation filed a shelf registration to offer up to US$1 billion in mixed securities and register 63.88 million shares for sale by a selling stockholder, amid broader market turbulence and declining natural gas prices.

- This combination of capital-raising activity and market pressures has introduced new variables into the company's operational and financial outlook.

- With the launch of the shelf registration, we'll explore how potential equity offerings and commodity price shifts affect BKV's investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is BKV's Investment Narrative?

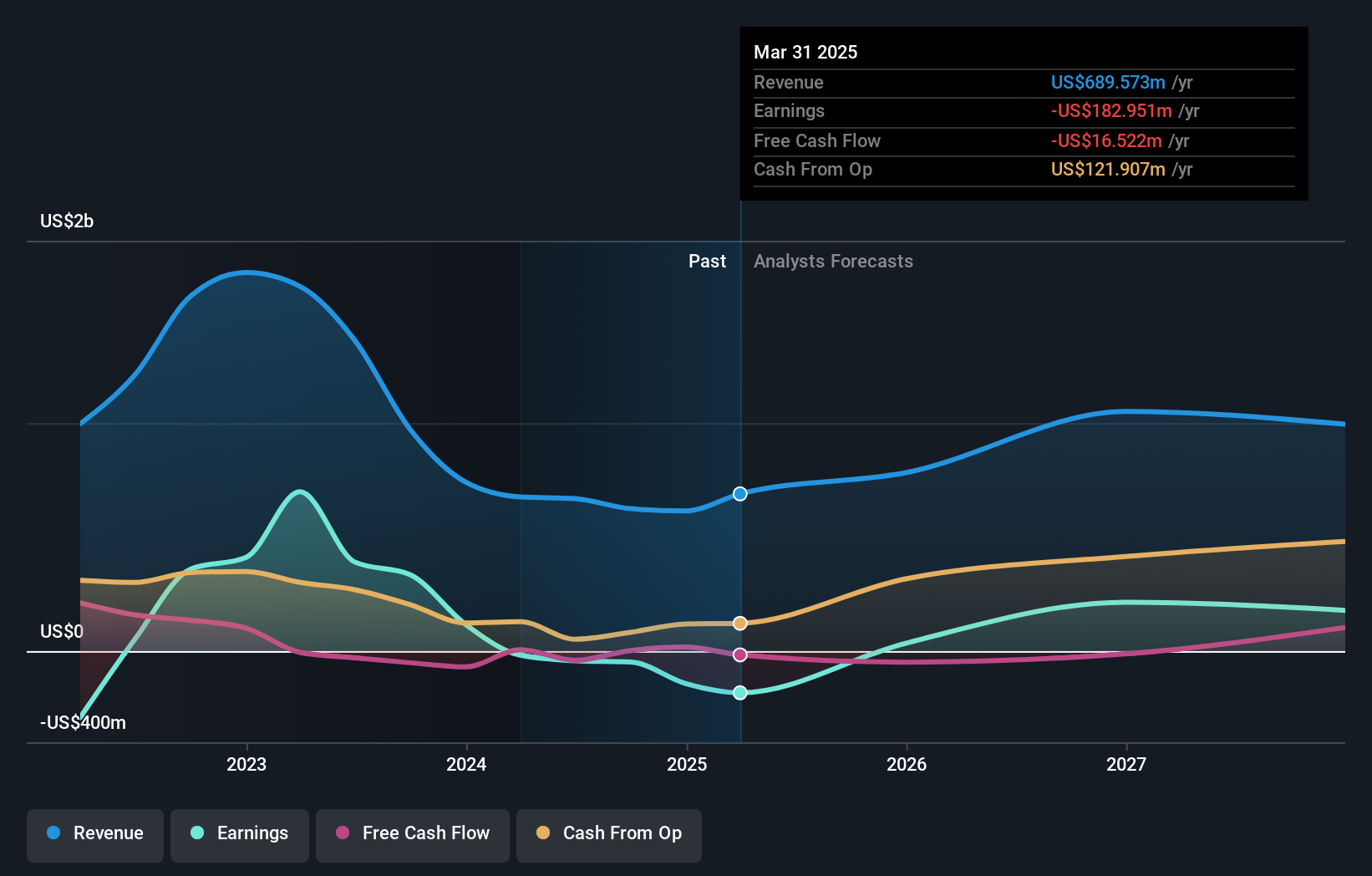

To be a BKV shareholder, you have to be optimistic about natural gas market fundamentals and the company’s move into carbon capture as a future growth driver. The recent shelf registration to raise up to US$1 billion and the sale of over 63 million shares come at a time of price pressure, BKV’s stock fell nearly 15% in a week, reflecting softer gas prices and overall market volatility. Previously, production guidance had been raised, and analysts projected significant earnings growth ahead, but these assumptions were made before the latest selloff and capital plans. While the offering could provide financial flexibility for projects like carbon capture, it also introduces short-term uncertainty around shareholder dilution and execution risks if natural gas prices remain subdued. The news recalibrates the outlook: prior catalysts linked to growth and profitability might be tempered by increased funding risks and commodity headwinds, making near-term performance more vulnerable to external shocks.

However, funding risks and uncertain gas prices are crucial caveats in the current outlook for BKV.

Exploring Other Perspectives

Explore 2 other fair value estimates on BKV - why the stock might be worth just $27.86!

Build Your Own BKV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BKV research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free BKV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BKV's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BKV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKV

BKV

Produces and sells natural gas in the Barnett Shale in the Fort Worth Basin of Texas and in the Marcellus Shale in the Appalachian Basin of Northeast Pennsylvania.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives