- United States

- /

- Oil and Gas

- /

- NYSE:BKV

Revenues Tell The Story For BKV Corporation (NYSE:BKV) As Its Stock Soars 32%

Those holding BKV Corporation (NYSE:BKV) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

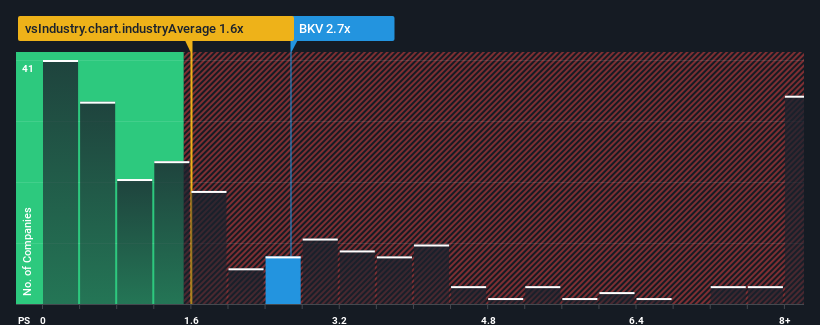

Since its price has surged higher, when almost half of the companies in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider BKV as a stock probably not worth researching with its 2.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

We check all companies for important risks. See what we found for BKV in our free report.Check out our latest analysis for BKV

What Does BKV's Recent Performance Look Like?

Recent times haven't been great for BKV as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think BKV's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like BKV's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 31% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 29% over the next year. With the industry only predicted to deliver 7.6%, the company is positioned for a stronger revenue result.

With this information, we can see why BKV is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in BKV's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that BKV maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Oil and Gas industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for BKV with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if BKV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BKV

BKV

Produces and sells natural gas in the Barnett Shale in the Fort Worth Basin of Texas and in the Marcellus Shale in the Appalachian Basin of Northeast Pennsylvania.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives