- United States

- /

- Energy Services

- /

- NYSE:AESI

Does Atlas Energy Solutions Offer Opportunity After 7% Rally Amid Sector Recovery?

Reviewed by Bailey Pemberton

If you have been watching Atlas Energy Solutions recently, you have probably noticed the stock has been on a bit of a rollercoaster. After a period of steep declines earlier this year, with the price still down nearly 50% year-to-date, the past month has shown some signs of a turnaround. The stock is up almost 7% in the last 30 days and has edged higher by 1.3% over the last week. This movement has caught the attention of both cautious investors and bargain hunters.

Some of this price action comes in the wake of broader market trends lifting energy equities and a recent uptick in demand indicators across the sector, prompting investors to reassess whether Atlas might be undervalued. But is it actually a bargain at these levels, or is the risk still outweighing the potential reward?

That is where valuation scores come in handy. For Atlas Energy Solutions, the current valuation score stands at 2 out of 6, meaning it's considered undervalued on two out of six key valuation checks. This does not exactly indicate "deep value," but it does suggest some metrics are flashing a buy signal, even if others aren't convinced just yet.

Let’s take a closer look at the different ways analysts put a price tag on Atlas, and compare how they line up. And at the end, I will share an even smarter approach to understanding valuation, one that goes beyond the usual ratios and numbers.

Atlas Energy Solutions scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Atlas Energy Solutions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting all future cash flows and discounting them back to today’s value. This approach aims to get as close as possible to the “true” intrinsic value of the business, based on its ability to generate free cash in the years ahead.

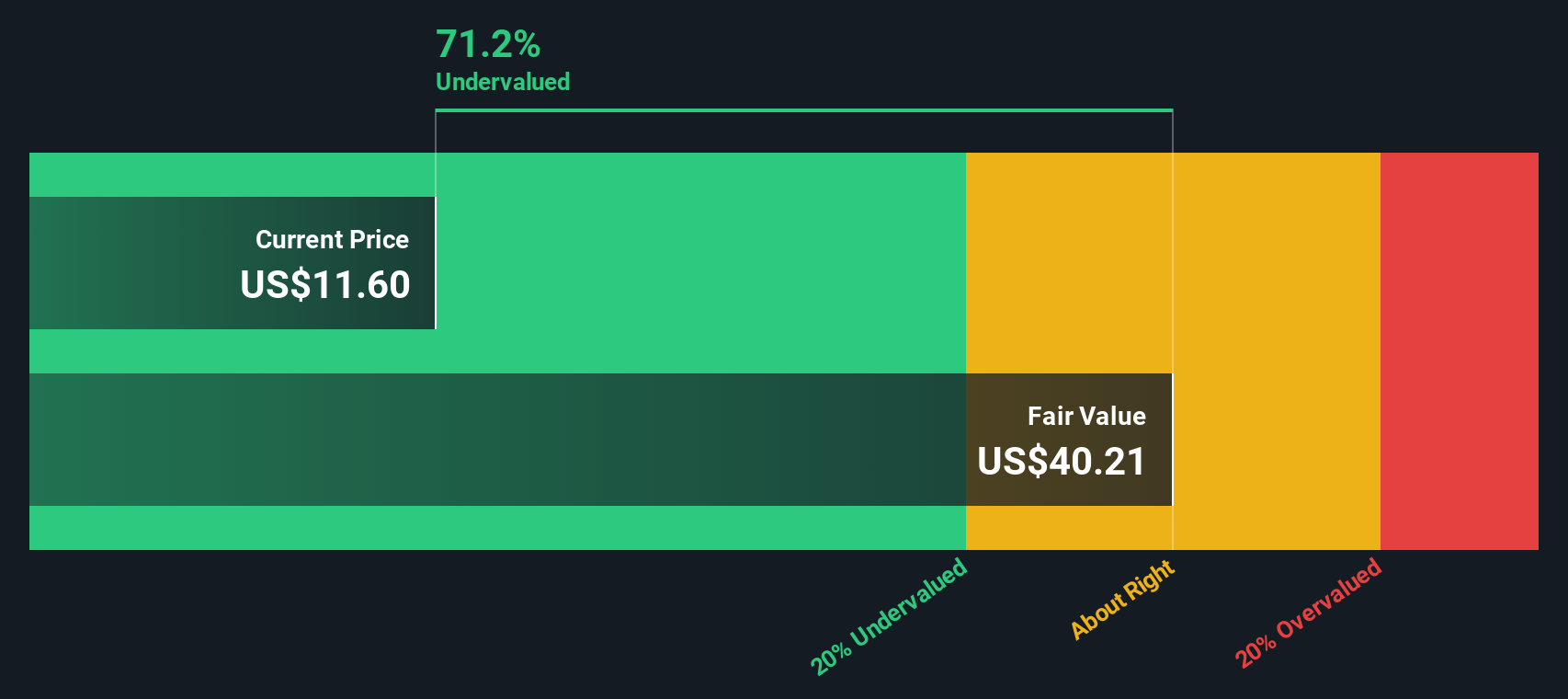

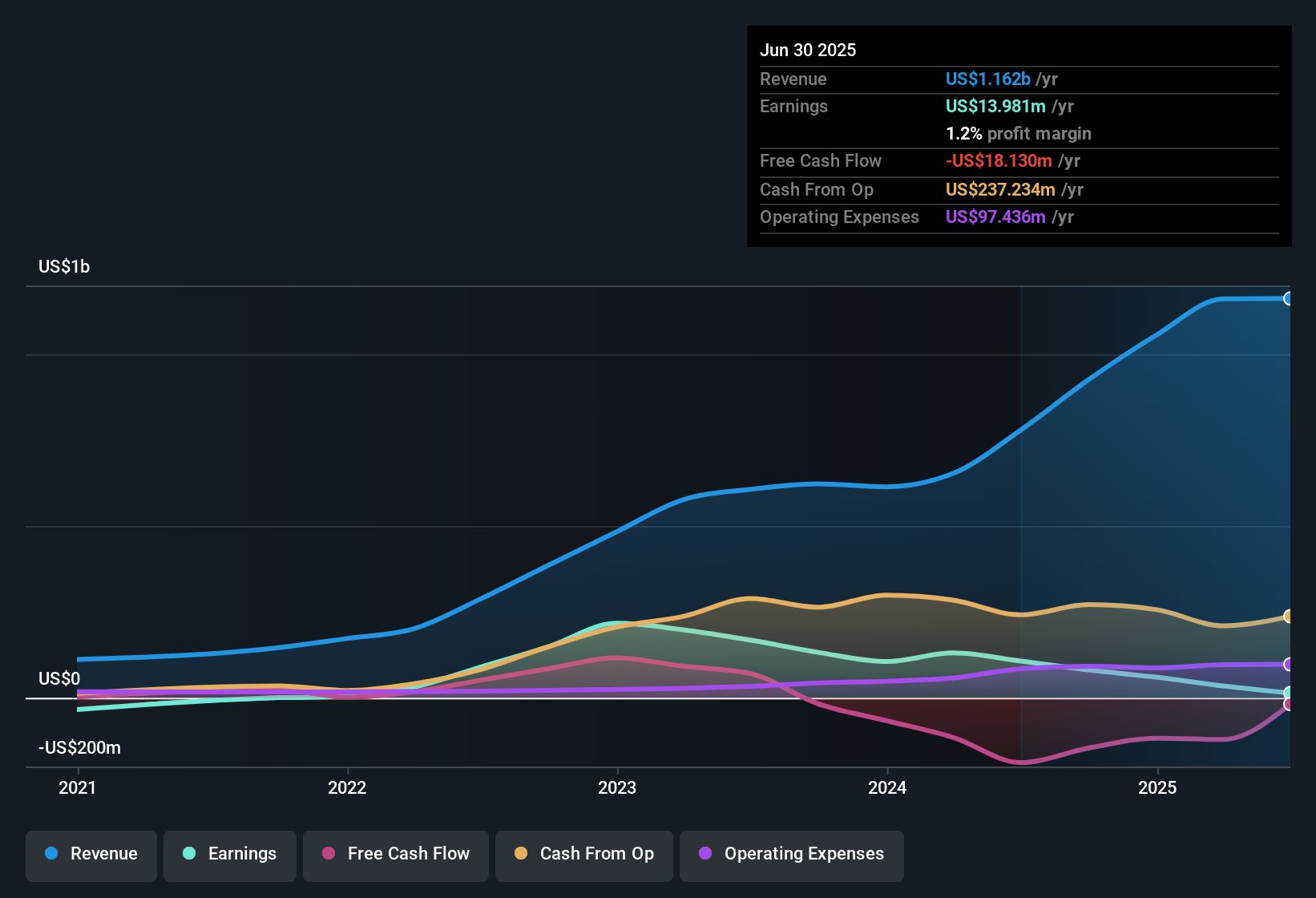

For Atlas Energy Solutions, the DCF analysis uses a two-stage free cash flow to equity model. The company’s latest twelve-month free cash flow stands at negative $174.8 million, reflecting current investments or negative operational cash, but analysts expect a turnaround. By 2028, projected free cash flow reaches $244 million, and a decade from now, estimates suggest annual free cash flows exceeding $340 million. These projections are initially derived from analyst forecasts for the first five years and then extrapolated further out.

According to this model, Atlas Energy Solutions has an estimated intrinsic value of $40.42 per share. With the current share price trading at a 71.5% discount to this DCF-based fair value, the stock appears significantly undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Atlas Energy Solutions is undervalued by 71.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Atlas Energy Solutions Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular metric for valuing profitable companies because it helps investors understand how much they are paying for each dollar of earnings. A company's PE ratio reflects both market expectations for future growth and the risks attached to its earnings. High-growth firms or those with more predictable profits often justify higher PE ratios, while riskier or slower-growing companies typically trade at lower ones.

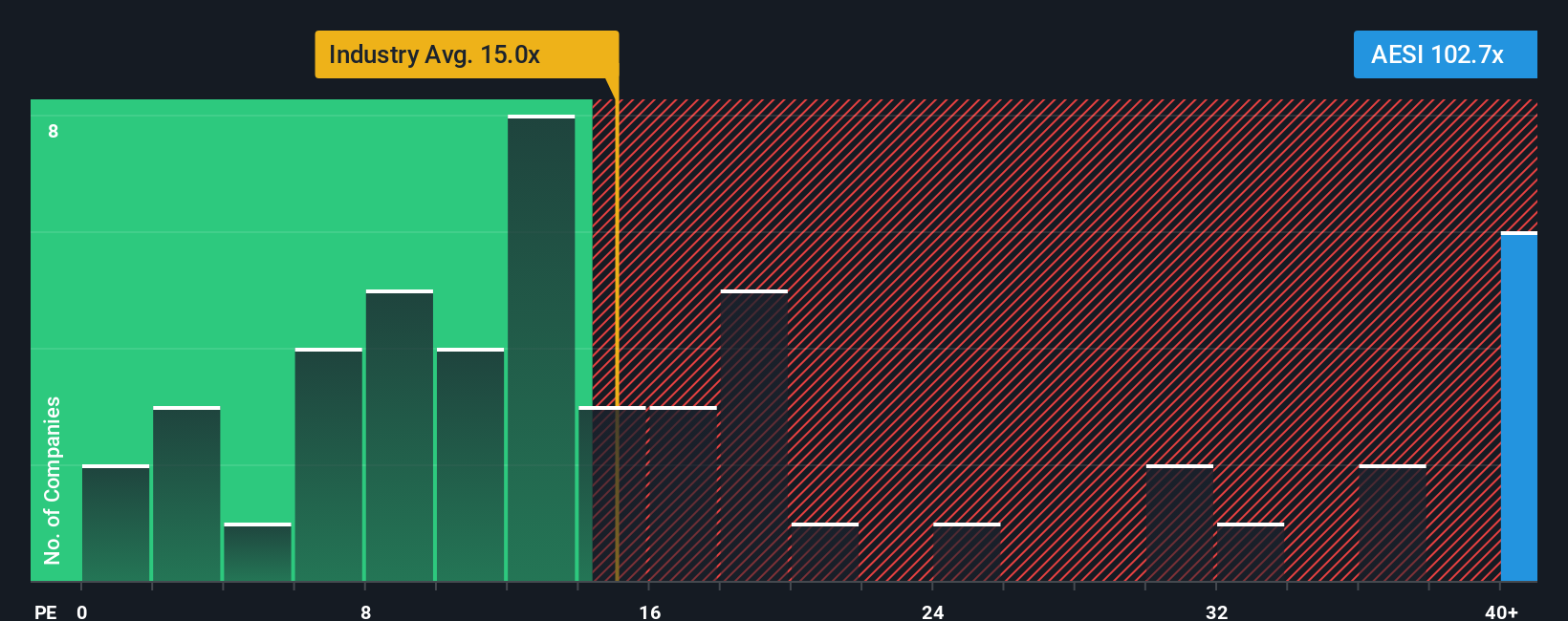

Atlas Energy Solutions currently trades at a PE ratio of 102x, which is far higher than both the peer average of 15x and the Energy Services industry average of 15x. This premium invites some tough questions about whether the market expects Atlas to significantly outpace its peers or if the price may simply be running ahead of fundamentals.

This is where the Simply Wall St “Fair Ratio” comes in. More than just a comparison to peers or the industry, the Fair Ratio incorporates factors like Atlas's expected earnings growth, profit margins, size, and perceived risks. For Atlas, the Fair Ratio stands at 34.31x. This means the current market PE of 102x is nearly three times higher than what is considered fair, even after accounting for positive company-specific dynamics.

Because the current PE is well above both the industry standard and its Fair Ratio, the stock looks overvalued by this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Atlas Energy Solutions Narrative

Earlier, we mentioned there is a better way to understand valuation. Let’s introduce you to Narratives. Narratives let investors connect a company’s story—your view of its industry trends, management, opportunities, and challenges—to a set of financial assumptions like future revenue, earnings, and margins. This creates a personal fair value estimate that reflects your perspective and not just the market’s. Available on the Simply Wall St platform within each company’s Community page, Narratives help you track your thinking and compare it to others. They also give you a fair value that updates automatically as new news or earnings arrive.

This makes it easy to spot potential buy or sell signals by comparing your Narrative’s fair value to today’s share price. It also lets you adjust your outlook as new information emerges. For example, one Atlas investor might believe that rising sand demand and long-term customers justify revenue growth and a price target of $20. Another might focus on industry headwinds or weak margins and set a more cautious $12 estimate. Narratives give you the tools to back your view with data, learn from the community, and make decisions with confidence.

Do you think there's more to the story for Atlas Energy Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AESI

Atlas Energy Solutions

Engages in the production, processing, and sale of mesh and sand used as a proppant during the well completion process in the Permian Basin of West Texas and New Mexico.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives