- United States

- /

- Energy Services

- /

- NasdaqGS:WFRD

Is Now The Time To Put Weatherford International (NASDAQ:WFRD) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Weatherford International (NASDAQ:WFRD). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Weatherford International

Weatherford International's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Weatherford International to have grown EPS from US$0.37 to US$5.78 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

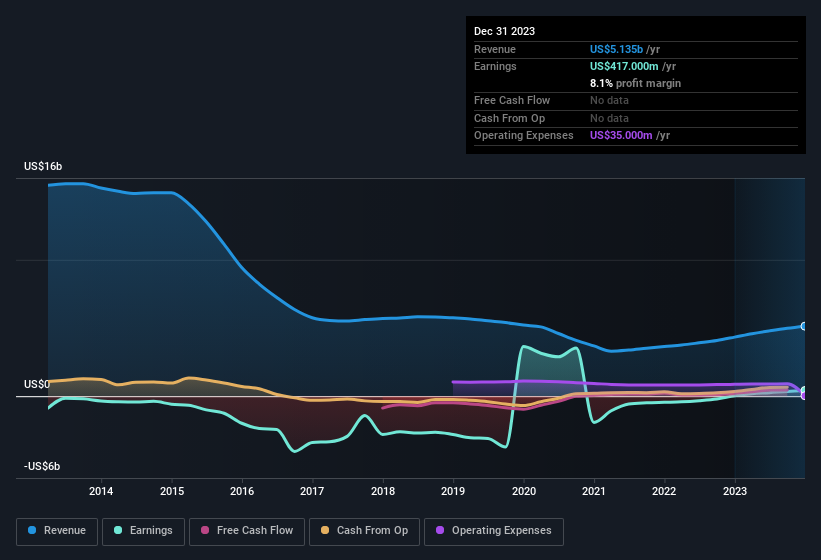

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Weatherford International is growing revenues, and EBIT margins improved by 5.9 percentage points to 16%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Weatherford International's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Weatherford International Insiders Aligned With All Shareholders?

Since Weatherford International has a market capitalisation of US$6.3b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$139m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Is Weatherford International Worth Keeping An Eye On?

Weatherford International's earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Weatherford International for a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Weatherford International you should be aware of.

Although Weatherford International certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Weatherford International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WFRD

Weatherford International

An energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives