- United States

- /

- Oil and Gas

- /

- NasdaqGS:VNOM

Assessing Viper Energy After 25% Drop and Sitio Royalties Acquisition in 2025

Reviewed by Bailey Pemberton

- Wondering whether Viper Energy is a bargain or just fairly priced? You are not alone, as investors across the board are watching closely to see if the stock's current levels mark a buying opportunity.

- After a rocky start this year, Viper Energy has dropped 25.6% year-to-date and is down 24.5% over the past 12 months. This performance hints at shifting market sentiment and possibly lower risk appetite around the stock.

- Market attention has been piqued by recent headlines, including strategic asset acquisitions that could broaden Viper Energy’s resource base. There is also continued industry chatter around consolidation in the energy sector. These moves have provided important context to the price swings and help investors gauge what is driving the stock beyond pure fundamentals.

- With a valuation score of 4 out of 6 for undervaluation checks, Viper Energy certainly deserves a closer look through multiple valuation lenses. Next, we will break down what these numbers actually mean and later introduce an even more insightful approach to stock valuation worth sticking around for.

Find out why Viper Energy's -24.5% return over the last year is lagging behind its peers.

Approach 1: Viper Energy Discounted Cash Flow (DCF) Analysis

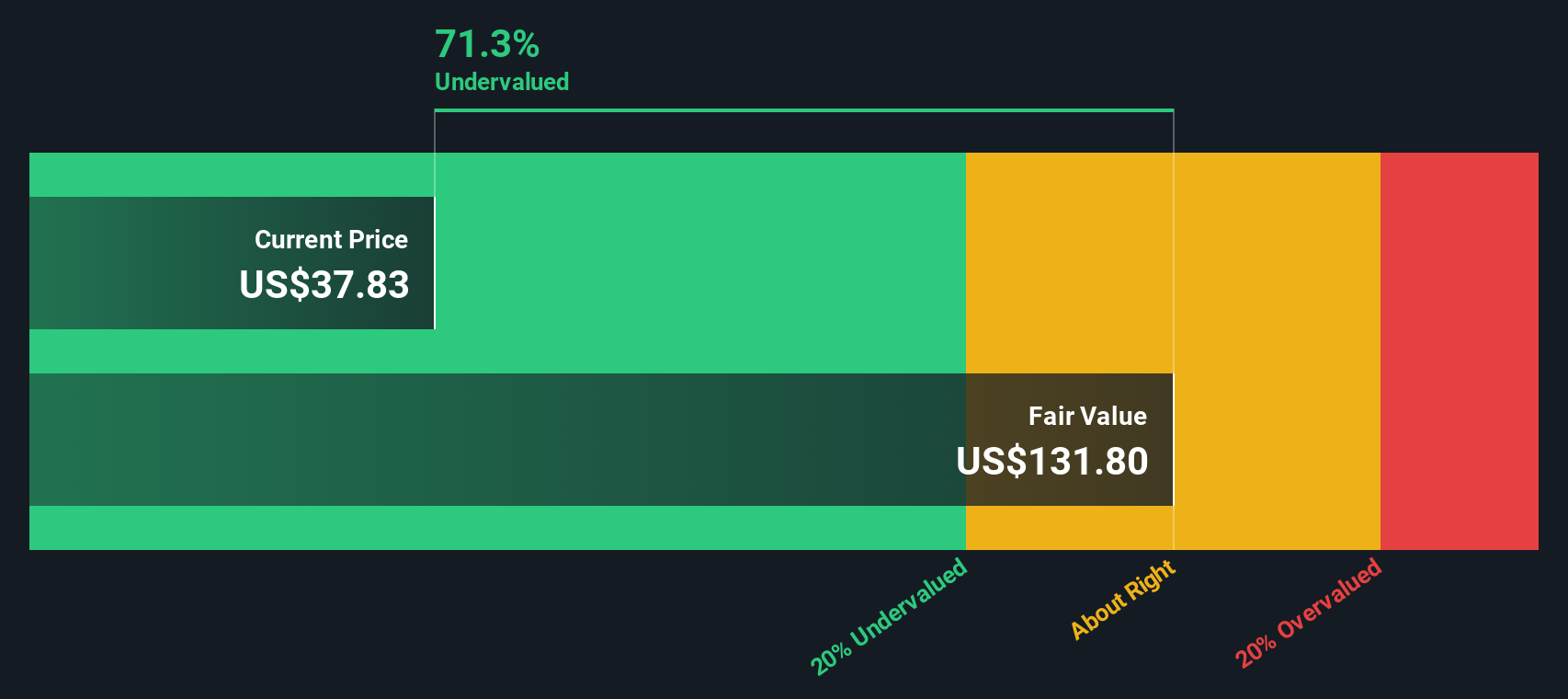

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. For Viper Energy, this model uses the 2 Stage Free Cash Flow to Equity method, drawing on both analyst forecasts and forward-looking extrapolations.

Currently, Viper Energy's trailing free cash flow sits at negative $345 million, reflecting recent operational or acquisition costs. Looking ahead, analyst forecasts suggest a significant turnaround. By 2026, free cash flow is projected to reach approximately $1.57 billion, and over the next decade, annual cash flows are anticipated to increase, eventually reaching $2.35 billion in 2035 (with estimates beyond analysts’ coverage extrapolated by Simply Wall St).

Based on these forecasts, the DCF model calculates an intrinsic value of $132.47 per share. With the stock trading at a 72.0% discount to this value, Viper Energy appears to be substantially undervalued by the market at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Viper Energy is undervalued by 72.0%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Viper Energy Price vs Earnings

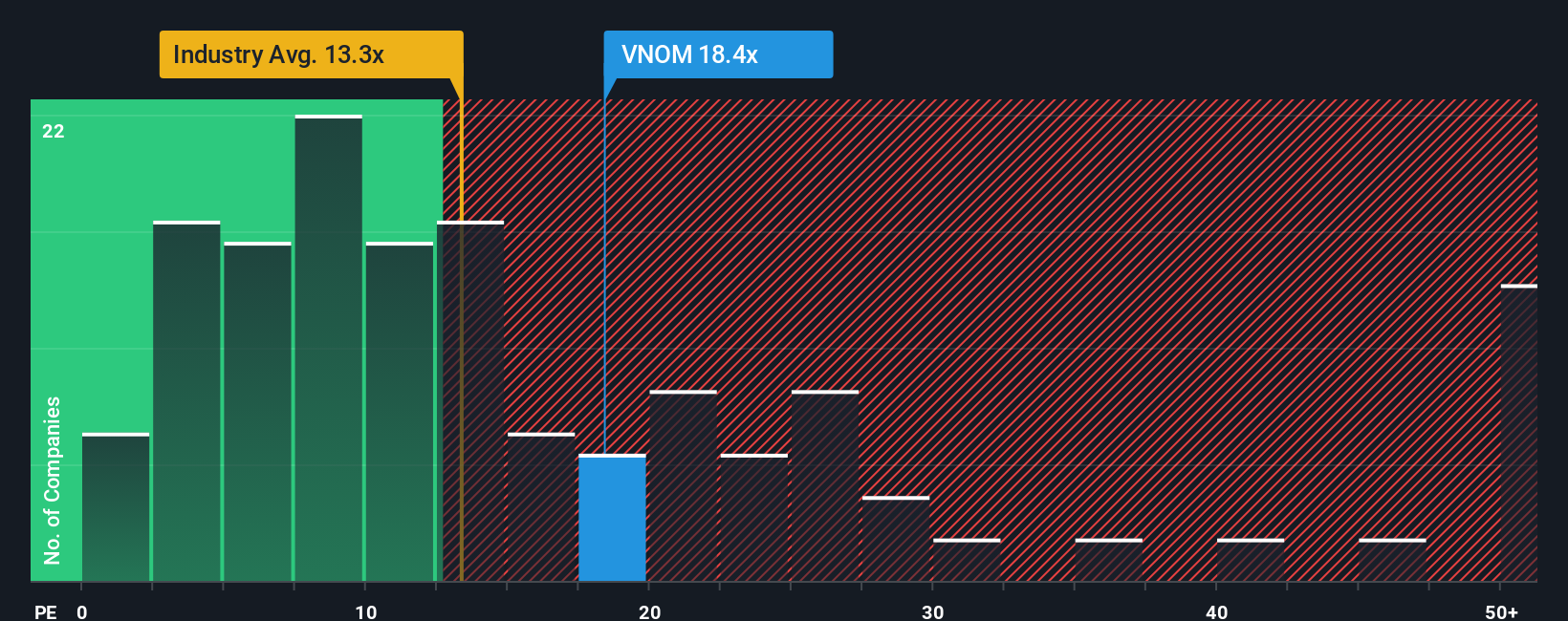

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it provides a quick snapshot of how much investors are paying for each dollar of earnings. For established companies like Viper Energy that reliably report profits, the PE ratio helps investors compare valuations across the industry and versus the broader stock market.

Growth expectations and risk play important roles in what is considered a reasonable or “fair” PE ratio. Companies with higher expected earnings growth or lower perceived risks often justify higher PE multiples. In contrast, firms facing stagnant growth or significant risks typically trade at lower ratios.

Viper Energy currently trades at a PE ratio of 16.9x. For context, the average PE ratio among industry peers stands at 19.3x, while the broader oil and gas sector averages just 12.8x. To provide even more nuance, Simply Wall St calculates a “Fair Ratio” for the company, a PE multiple of 14.3x, by analyzing factors specific to Viper Energy including its earnings growth potential, profit margins, size, risks, and the dynamics of its industry.

The Fair Ratio is a more precise benchmark than simply comparing Viper Energy to peers or industry averages, as these broader figures can overlook unique company strengths and risk factors. By tailoring the PE multiple to Viper Energy’s specific qualities, investors can make a more informed assessment of valuation.

With the current PE ratio of 16.9x sitting slightly above the Fair Ratio of 14.3x, Viper Energy appears somewhat expensive on this measure. However, the difference is not significant and falls within a reasonable range for the stock’s current outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1380 companies where insiders are betting big on explosive growth.

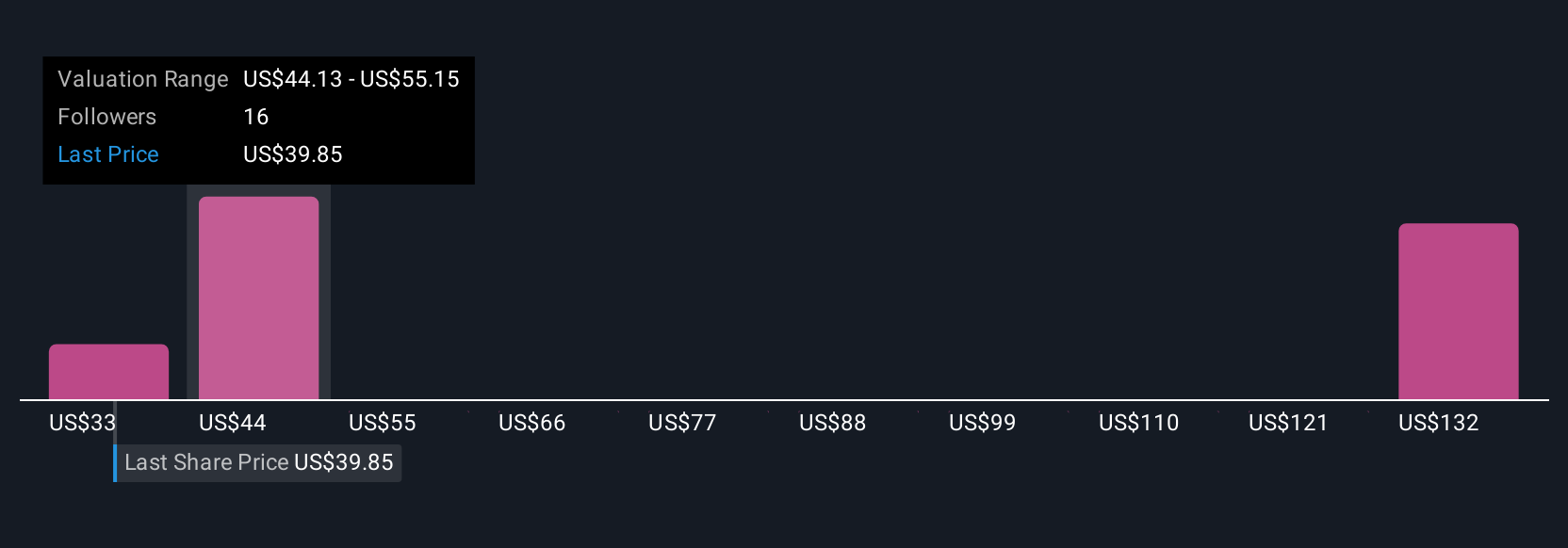

Upgrade Your Decision Making: Choose your Viper Energy Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is your own story about a company that brings together your unique view of its future with numbers, such as your assumptions about fair value, revenue, earnings, and margins. Narratives provide a bridge between the company’s story and a complete financial forecast, helping you arrive at a fair value that truly reflects your perspective.

On Simply Wall St’s Community page, millions of investors use Narratives to make smarter buy or sell decisions by comparing their own fair values to the current market price. The best part is that Narratives update automatically whenever new data, earnings, or news emerges, keeping your insights fresh and relevant. For example, with Viper Energy, some investors believe the recent Sitio Royalties acquisition and U.S. energy tailwinds could push fair value as high as $68, while others are more cautious, setting it closer to $44 due to margin pressure and market risks. Each perspective is captured as a living Narrative, letting you see the range of investor expectations at a glance.

Do you think there's more to the story for Viper Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNOM

Viper Energy

Owns, acquires, and exploits oil and natural gas properties in North America.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)