- United States

- /

- Energy Services

- /

- NasdaqCM:RCON

We Think Shareholders Should Be Aware Of Some Factors Beyond Recon Technology's (NASDAQ:RCON) Profit

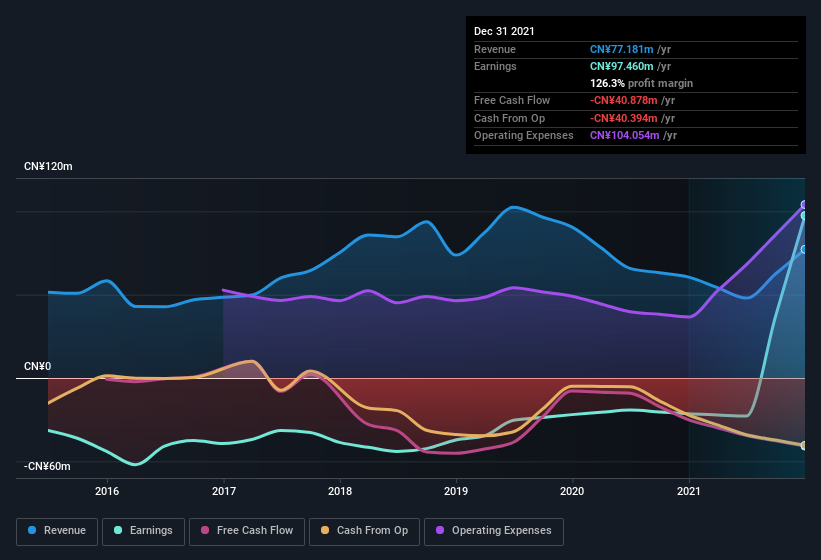

After announcing healthy earnings, Recon Technology, Ltd.'s (NASDAQ:RCON) stock rose over the last week. While the headline numbers were strong, we found some underlying problems once we started looking at what drove earnings.

Check out our latest analysis for Recon Technology

Examining Cashflow Against Recon Technology's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to December 2021, Recon Technology had an accrual ratio of 1.26. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. In the last twelve months it actually had negative free cash flow, with an outflow of CN¥41m despite its profit of CN¥97.5m, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of CN¥41m, this year, indicates high risk. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Recon Technology expanded the number of shares on issue by 85% over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Recon Technology's EPS by clicking here.

A Look At The Impact Of Recon Technology's Dilution on Its Earnings Per Share (EPS).

Recon Technology was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

If Recon Technology's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Recon Technology's Profit Performance

In conclusion, Recon Technology has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). For all the reasons mentioned above, we think that, at a glance, Recon Technology's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that Recon Technology has 5 warning signs (3 are a bit concerning!) that deserve your attention before going any further with your analysis.

Our examination of Recon Technology has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RCON

Recon Technology

Provides hardware, software, and on-site services to companies in the petroleum mining and extraction industry in China.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion