- United States

- /

- Energy Services

- /

- NasdaqGS:PTEN

Is Patterson-UTI Energy Poised for a Rebound After Last Week’s 9% Jump?

Reviewed by Bailey Pemberton

If you’re considering what to do with Patterson-UTI Energy stock right now, you’re not alone. It’s been an eventful stretch for the company. Just last week, the stock jumped 9.2%. That quick pop followed a meandering path: a modest 2.5% uptick over the last month, but notably, some serious drawdowns earlier in 2024. Year-to-date, Patterson-UTI Energy remains down 31.9%, and if you zoom out to the past year, it’s off by 28.8%. When looking even further back, the five-year return is a notable 124%.

The market’s mixed signals seem to reflect shifting investor sentiment, influenced by broader energy sector dynamics and ongoing consolidation among drilling contractors. Demand for drilling services has ebbed and flowed with commodity price volatility, contributing to the stock’s sometimes choppy performance. Recent signs suggest optimism is building around Patterson-UTI’s position in a tightening market, and risk perceptions may be changing.

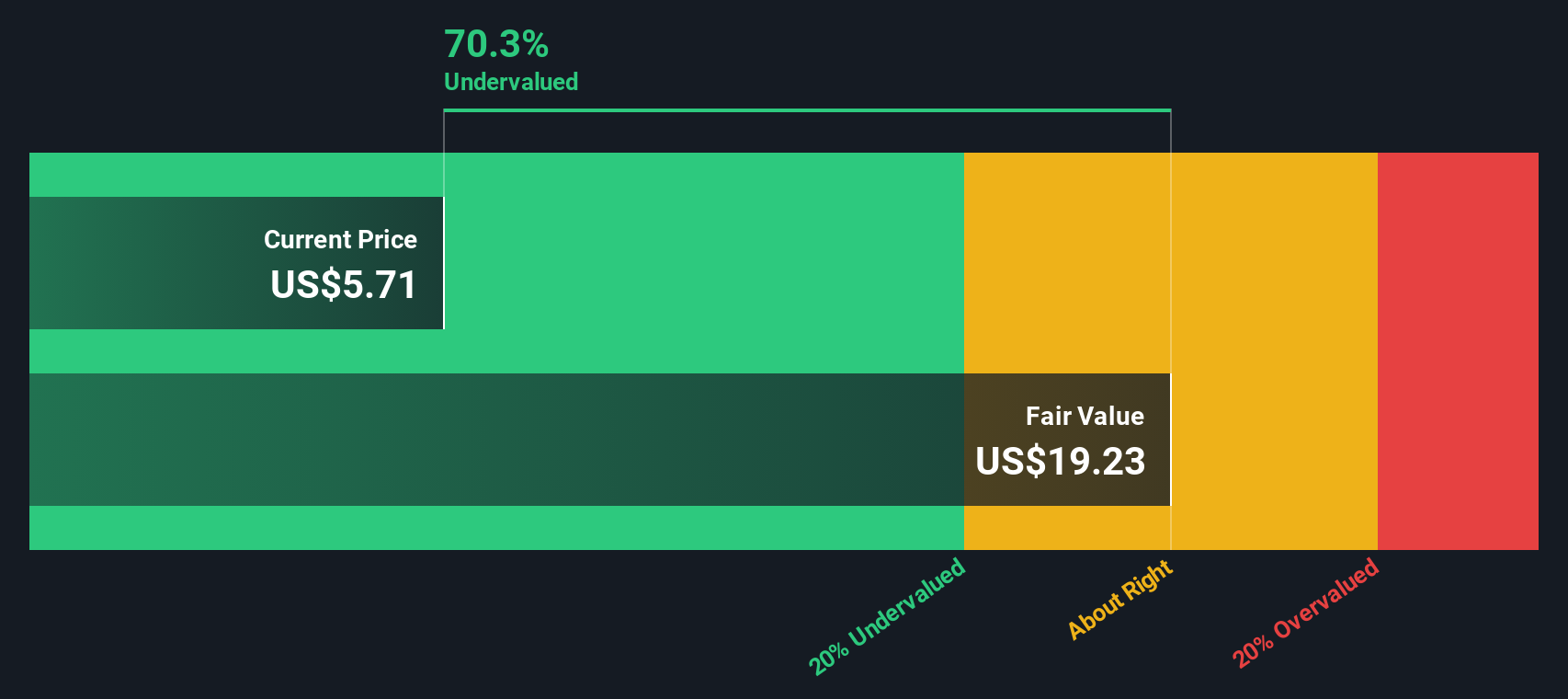

But here’s what might be on your mind: is Patterson-UTI Energy truly undervalued, or is the market telling you something different? According to a commonly used set of valuation checks, the company passes five out of six, giving it a robust valuation score of 5. That is a strong signal, but valuation is rarely one-dimensional. Let’s dig into how these different methods measure value. At the end of this article, you will find a smarter way to understand what Patterson-UTI Energy is really worth.

Why Patterson-UTI Energy is lagging behind its peers

Approach 1: Patterson-UTI Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and then discounting them to today’s value. This method looks at the cash generated by the business, rather than relying solely on current earnings or asset values.

Patterson-UTI Energy’s reported Free Cash Flow (FCF) last year was $275.8 million. According to analyst forecasts, FCF is expected to continue rising steadily, reaching $396 million by 2028. Simply Wall St provides projections through 2035, using both analyst estimates and model extrapolation, with FCF potentially climbing to over $552.7 million in ten years. These projections are all in US dollars.

Using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value of Patterson-UTI Energy’s stock comes out at $18.96 per share. This price is 69.4% higher than where the stock is trading today, indicating a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Patterson-UTI Energy is undervalued by 69.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Patterson-UTI Energy Price vs Sales

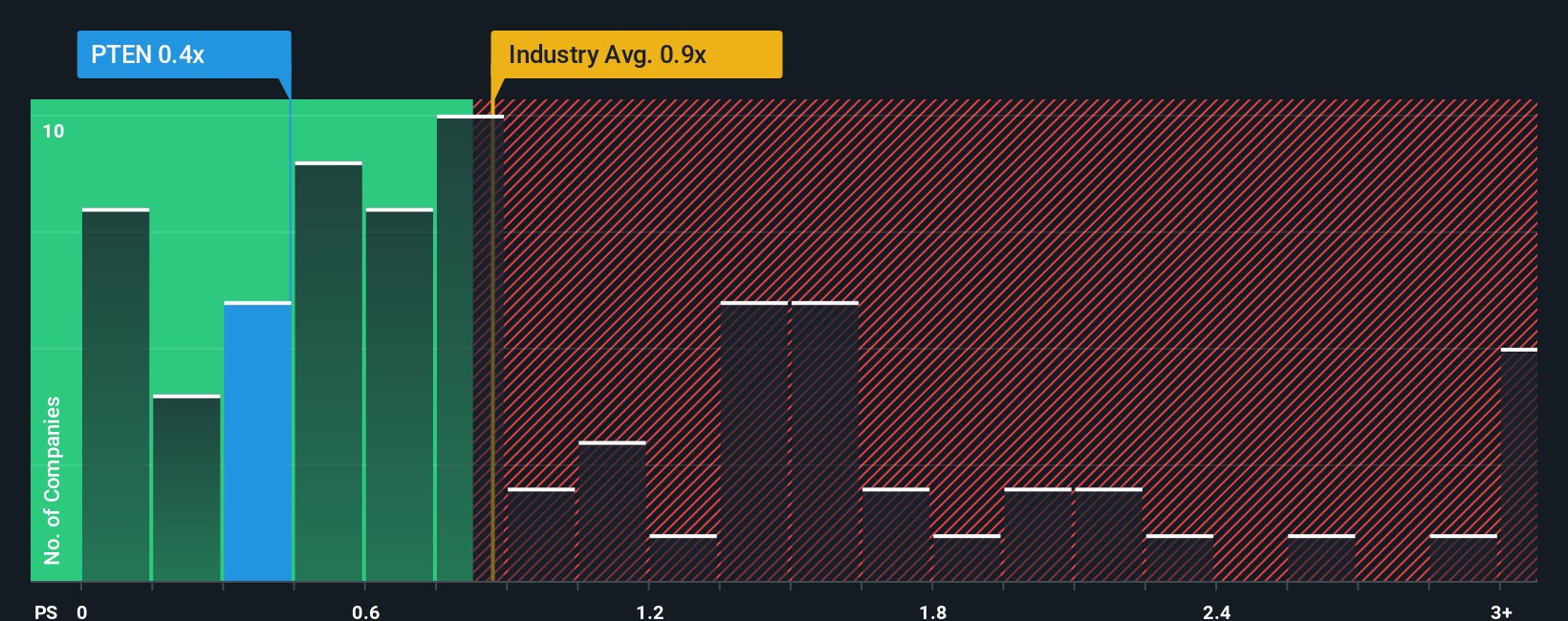

The Price-to-Sales (P/S) ratio is a go-to valuation tool for companies like Patterson-UTI Energy, especially in sectors where profits may swing due to industry cycles, but underlying revenue remains a steadier measure of performance. Because service companies can see net earnings fluctuate with commodity prices or capital investment cycles, having a reliable top-line metric gives investors a clearer sense of how a stock is valued relative to sales generated by the business.

Generally, investors accept higher P/S multiples for stocks with strong growth prospects or lower business risks, while mature or riskier companies tend to trade at lower multiples. What counts as a “normal” or “fair” P/S ratio often depends on comparing the company to its industry peers and factoring in forecasts for growth, profitability, and unique risks.

Currently, Patterson-UTI Energy trades at just 0.45x sales, which is well below both its peer group average of 1.30x and the broader Energy Services industry average of 0.90x. But there is a more tailored way to judge fair value. Simply Wall St’s Fair Ratio incorporates not only industry and peer multiples, but also growth outlook, profit margins, company size, and risks specific to Patterson-UTI Energy, setting a benchmark of 0.67x. This is a more nuanced standard than raw peer or industry comparisons, giving you a deeper, individualized reading on where the stock should trade.

With a current P/S of 0.45x against a Fair Ratio of 0.67x, the numbers indicate that Patterson-UTI Energy is undervalued by this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Patterson-UTI Energy Narrative

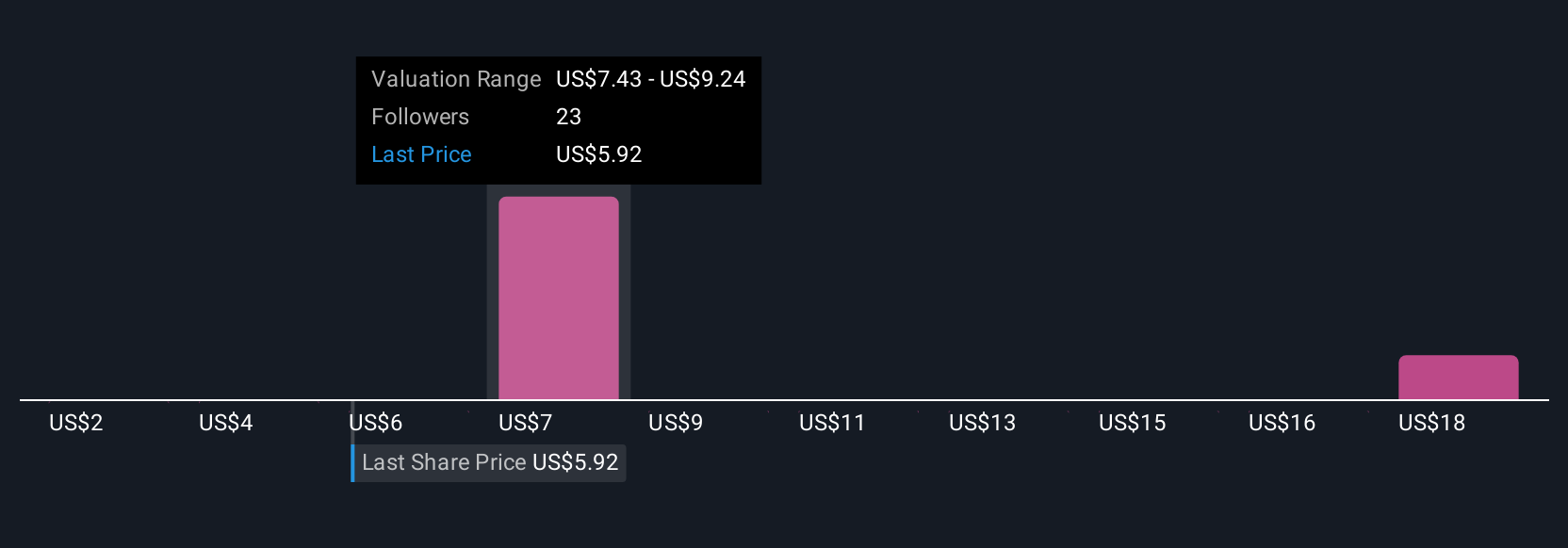

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story behind the numbers; it’s your perspective on where a company like Patterson-UTI Energy is headed, combined with your own assumptions about fair value, future growth, earnings, and profit margins.

With Narratives, anyone can connect the bigger picture of a company’s strategy, industry trends, and recent developments directly to a financial forecast and a clear view of what the stock should be worth. Narratives are not just expert analysis; they are an accessible tool built into Simply Wall St’s Community page, already used by millions of investors.

By creating your own Narrative, you can see exactly how your outlook compares with others. Narratives update dynamically whenever big news, earnings results, or key announcements arrive, helping you decide whether the current price offers value compared to your fair value estimate.

For example, with Patterson-UTI Energy, some investors believe the stock could be worth as much as $10.00 if new LNG export projects boost demand for advanced drilling services, while others set fair value closer to $6.25, pointing to earnings volatility or sector risks, all based on their unique expectations and assumptions.

Do you think there's more to the story for Patterson-UTI Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTEN

Patterson-UTI Energy

Through its subsidiaries, provides drilling and completion services to oil and natural gas exploration and production companies in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives