- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAA

Plains All American Pipeline (PAA): Revisiting Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for Plains All American Pipeline.

After a strong run in recent years, momentum for Plains All American Pipeline seems to be fading. Its share price has slipped nearly 15% over the last quarter, and the 1-year total shareholder return is slightly negative, even with some underlying earnings growth. Over the long term, though, investors who stayed the course have enjoyed impressive gains.

If this shift has you wondering where the next opportunity is, it's a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets and solid earnings growth in the background, investors are now left to decide whether Plains All American Pipeline offers genuine value at current levels, or if the market is already factoring in future gains.

Most Popular Narrative: 23% Undervalued

Compared to the last close of $15.96, the most popular narrative calculates a fair value nearly 23% higher. This puts the spotlight on what could be significant upside potential for Plains All American Pipeline and sets the context for a deeper look into the strategic conviction behind that number.

"The divestiture of the Canadian NGL business and redeployment of ~$3 billion in proceeds will allow Plains to focus on higher-growth and higher-return U.S. crude oil assets, supporting stable throughput and cash flow, which can drive revenue and long-term earnings growth."

Curious what aggressive growth strategies and margin improvements underpin this ambitious target? The core of this narrative centers on a sharper portfolio focus and operational upgrades that promise a financial transformation. Discover which bold expectations about future revenues and profitability anchor this eye-catching valuation.

Result: Fair Value of $20.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Plains' concentrated focus on U.S. crude makes it vulnerable if the energy transition accelerates or regional production unexpectedly declines, which could challenge long-term growth assumptions.

Find out about the key risks to this Plains All American Pipeline narrative.

Another View: What Do Market Ratios Say?

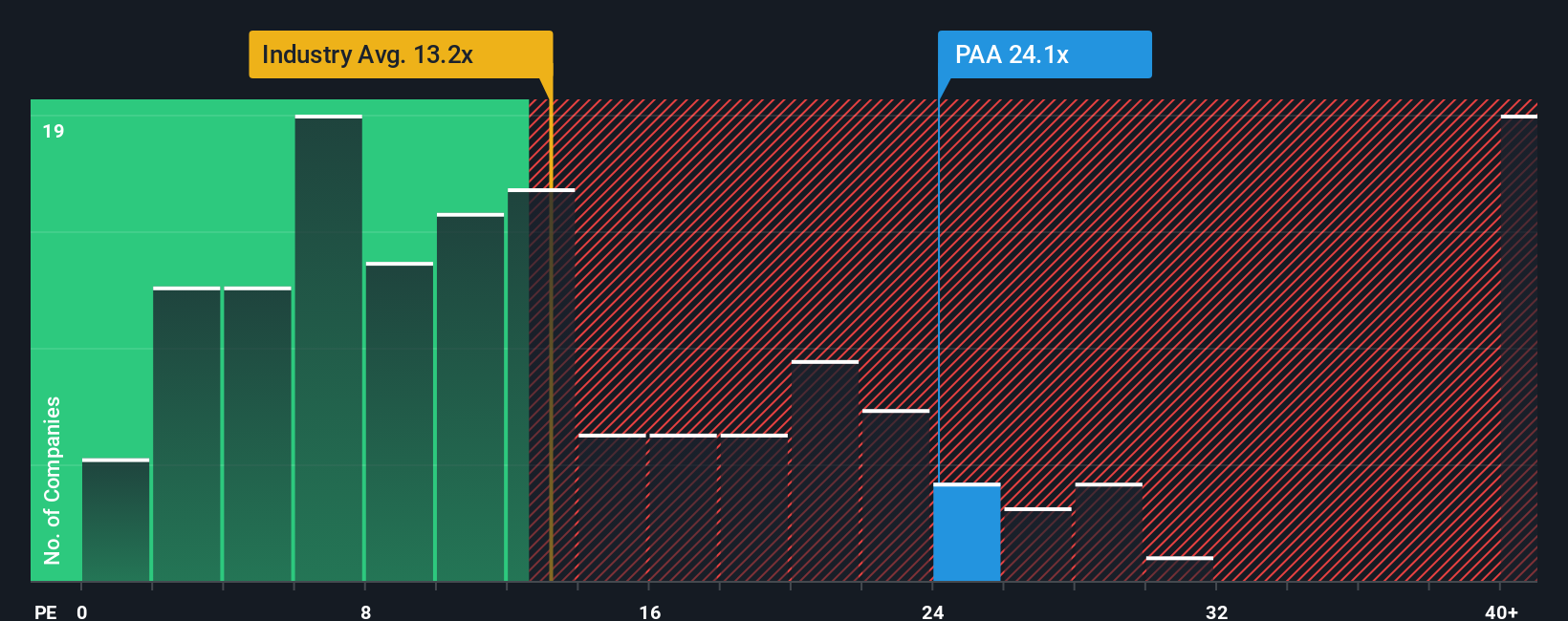

Taking a step back from analyst forecasts, PAA’s market valuation based on its price-to-earnings ratio tells a more cautious story. At 24.3x, it is noticeably pricier than both the peer average (18.8x) and the US Oil and Gas industry (13.2x), and remains above our calculated fair ratio of 21.6x. This gap hints at a possible valuation risk if investor expectations change. Could the market be overestimating its prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plains All American Pipeline Narrative

If you see the story differently or want to investigate for yourself, you can assemble your own perspective in just a few minutes. Do it your way

A great starting point for your Plains All American Pipeline research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smarter Investment Ideas?

Do not let your research stop here. Broaden your search and give yourself an edge by checking out these handpicked opportunities before the crowd catches on:

- Access rapid growth potential when you browse these 25 AI penny stocks and see which companies are powering the AI revolution.

- Boost your income with steady payers by hunting for the market’s best yields through these 18 dividend stocks with yields > 3%.

- Tap into innovation by checking these 26 quantum computing stocks and spot businesses advancing the next frontier in technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAA

Plains All American Pipeline

Through its subsidiaries, engages in the pipeline transportation, terminaling, storage, and gathering of crude oil and natural gas liquids (NGL) in the United States and Canada.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives