- United States

- /

- Oil and Gas

- /

- NasdaqGS:NFE

Here's Why We Think New Fortress Energy (NASDAQ:NFE) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like New Fortress Energy (NASDAQ:NFE), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide New Fortress Energy with the means to add long-term value to shareholders.

See our latest analysis for New Fortress Energy

New Fortress Energy's Improving Profits

Over the last three years, New Fortress Energy has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, New Fortress Energy's EPS catapulted from US$0.49 to US$0.93, over the last year. Year on year growth of 91% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of New Fortress Energy's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. New Fortress Energy shareholders can take confidence from the fact that EBIT margins are up from 21% to 34%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

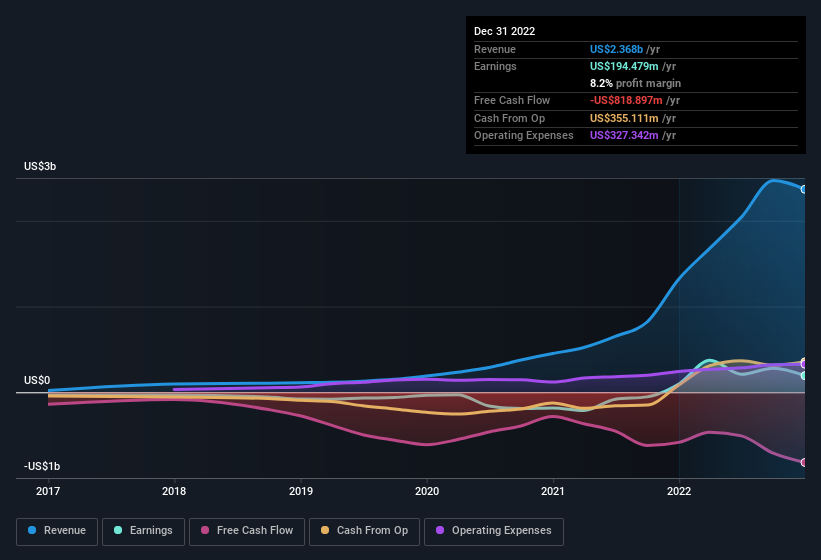

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for New Fortress Energy's future profits.

Are New Fortress Energy Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite some New Fortress Energy insiders disposing of some shares, we note that there was US$148k more in buying interest among those who know the company best On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by Independent Director C. Griffin for US$431k worth of shares, at about US$49.66 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for New Fortress Energy will reveal that insiders own a significant piece of the pie. Actually, with 48% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. At the current share price, that insider holding is worth a staggering US$2.8b. That means they have plenty of their own capital riding on the performance of the business!

Does New Fortress Energy Deserve A Spot On Your Watchlist?

New Fortress Energy's earnings per share have been soaring, with growth rates sky high. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe New Fortress Energy deserves timely attention. Still, you should learn about the 3 warning signs we've spotted with New Fortress Energy (including 1 which doesn't sit too well with us).

Keen growth investors love to see insider buying. Thankfully, New Fortress Energy isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if New Fortress Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NFE

New Fortress Energy

Operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide.

Fair value low.

Similar Companies

Market Insights

Community Narratives