- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

Will NextDecade’s (NEXT) CFO Transition Shape Market Confidence in Its LNG Ambitions?

Reviewed by Sasha Jovanovic

- NextDecade Corporation has announced the upcoming resignation of Chief Financial Officer Brent Wahl, effective October 20, 2025, with Mike Mott stepping in as Interim CFO; Wahl will stay on as a consultant through the end of the year to ease the transition.

- This leadership change arrives as the company anticipates a final investment decision on the fifth train and related infrastructure at its major Rio Grande LNG project.

- We’ll explore how the CFO transition and leadership continuity could influence confidence in NextDecade’s LNG development plans.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is NextDecade's Investment Narrative?

For anyone considering NextDecade, the big picture rests on the company's ability to bring the Rio Grande LNG project to financial close and operational success. That's a thesis built on aggressive revenue growth projections, new long-term supply agreements, and major investor backing, despite zero revenue to date and escalating losses. The resignation of CFO Brent Wahl, followed by Mike Mott stepping in as Interim CFO, comes at a pivotal moment as the company nears the final investment decision for its fifth LNG train. While the market reaction, a drop of about 4.5%, suggests some concern, Mott’s industry experience and the planned handover period limit the likelihood of major operational disruption. For now, this leadership shift is unlikely to fundamentally alter the big risk points: an ongoing cash burn, doubts over going concern, a high price-to-book valuation, and uncertainties around project financing and timelines.

But without new funding, the project’s future is far from certain. NextDecade's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

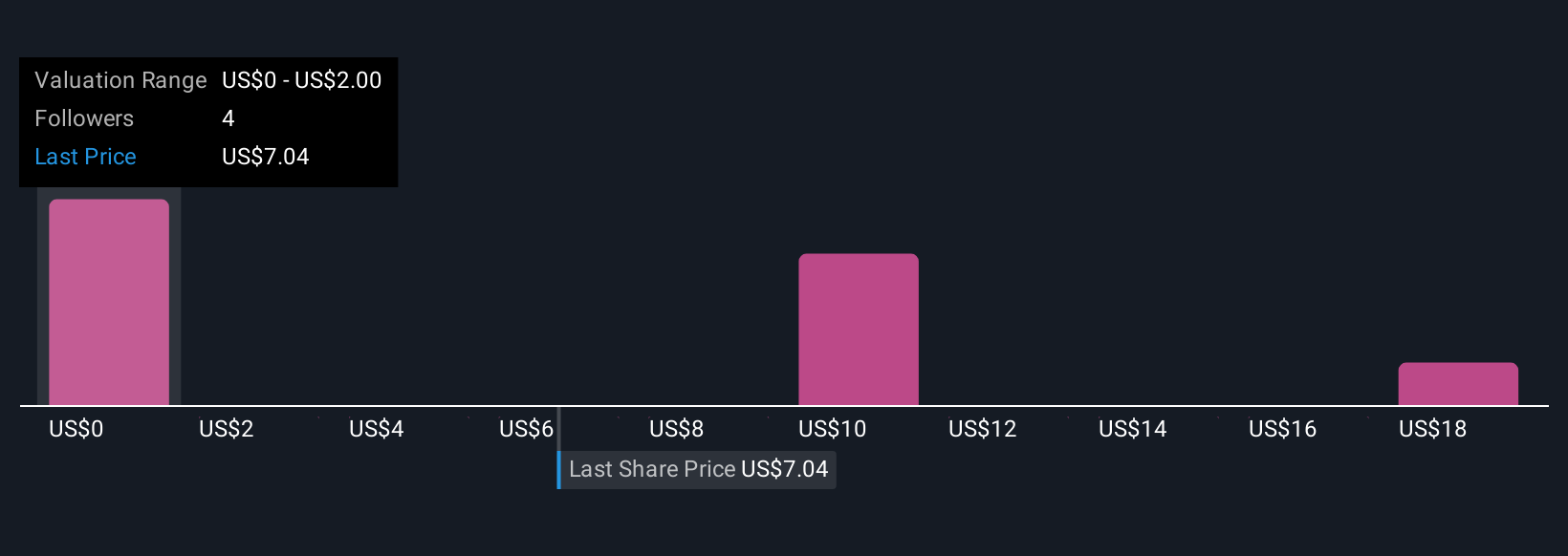

Explore 4 other fair value estimates on NextDecade - why the stock might be worth less than half the current price!

Build Your Own NextDecade Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NextDecade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextDecade's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives