- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

NextDecade (NEXT): Evaluating Valuation After CFO Transition and Approaching Major LNG Investment Decision

Reviewed by Kshitija Bhandaru

NextDecade (NEXT) is making headlines as CFO Brent Wahl steps down, with Mike Mott stepping in as interim CFO. This leadership change comes at a time when the company is nearing a key investment decision on its Rio Grande LNG project.

See our latest analysis for NextDecade.

Following the announcement of CFO Brent Wahl's departure, NextDecade's share price dropped around 5% in a single day. This extended a challenging run that has seen the stock fall more than 40% over the past three months. Despite recent turbulence, long-term holders have still enjoyed a five-year total shareholder return of over 150%. This suggests that, while sentiment has cooled lately, the company has delivered strong gains for patient investors.

If you're interested in seeing what else the market has to offer, now's the perfect time to seek out opportunities with fast growing stocks with high insider ownership.

With shares trading well below analyst targets after recent turbulence, investors now face a crucial question: Is NextDecade an undervalued opportunity, or has the market accurately factored in all the company’s future growth potential?

Price-to-Book of 6.5x: Is it justified?

NextDecade’s shares currently trade at a price-to-book ratio of 6.5x, making the stock look expensive compared to its peers and the wider industry. With a last close price of $6.46, this premium raises the question of whether investors are expecting substantial future growth or simply overpaying for exposure to the company’s LNG ambitions.

The price-to-book ratio compares a company's market value to its book value, offering insight into how the market values its net assets. For NextDecade, a company without meaningful revenue and still reporting significant net losses, its elevated ratio suggests market participants are pinning hopes on future prospects rather than current fundamentals.

Specifically, NextDecade’s 6.5x price-to-book stands far above the 1.7x average seen for its direct peers and the wider US Oil and Gas industry average of 1.3x. This stark difference indicates the market is giving the company a valuation premium relative to industry benchmarks, despite ongoing losses and no revenue.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 6.5x (OVERVALUED)

However, execution risks remain, and delays or cost overruns at the Rio Grande LNG project could quickly change investor sentiment toward NextDecade.

Find out about the key risks to this NextDecade narrative.

Another View: Discounted Cash Flow Tells a Different Story

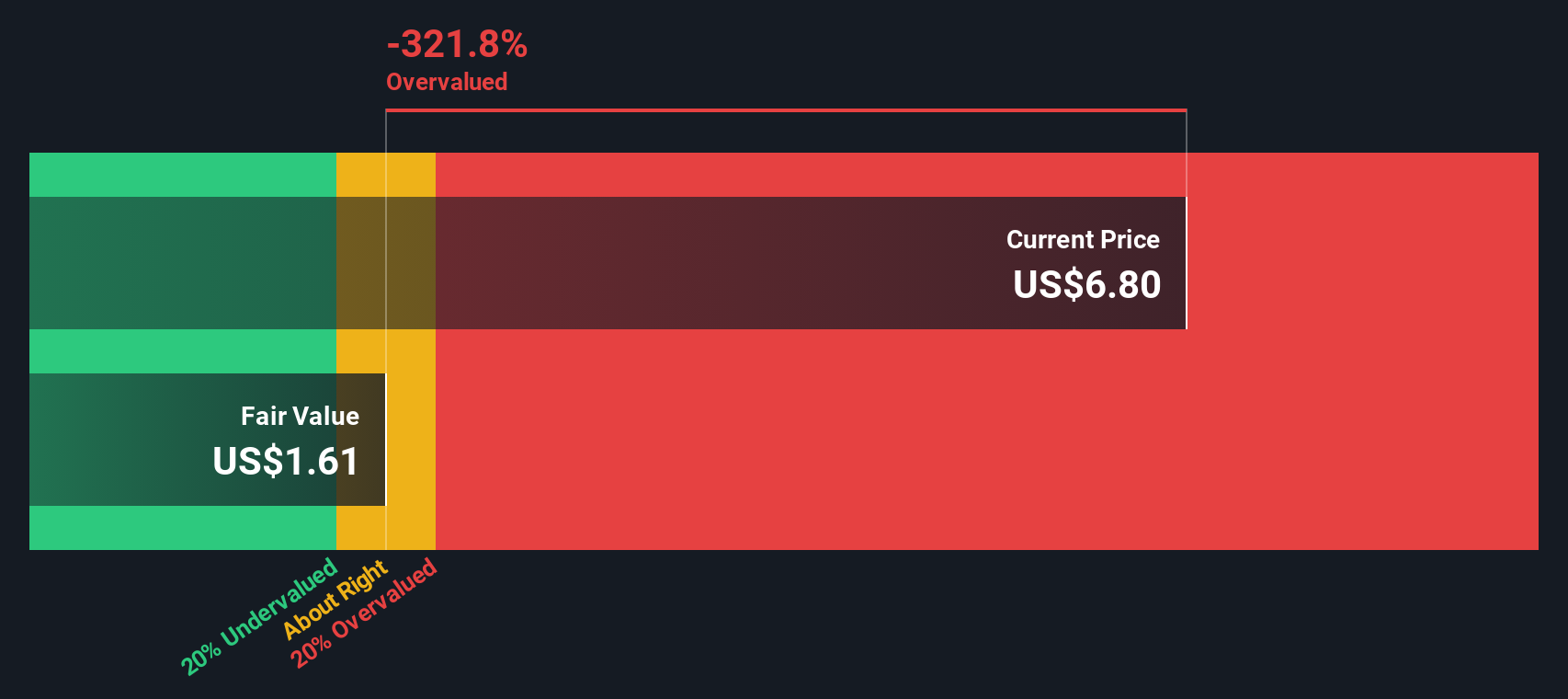

Looking at NextDecade through the SWS DCF model, the valuation picture shifts. The DCF approach estimates a fair value of just $1.61 per share, which is considerably below the current market price of $6.46. This suggests the stock is overvalued by traditional intrinsic value measures. Does the market see something the models do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextDecade for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextDecade Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can craft and test your own investment thesis quickly using Do it your way.

A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity when there is a whole world of market movers waiting for you. Make sure you are not missing out on unique growth potential and untapped opportunities with these powerful stock searches:

- Tap into next-generation tech momentum by checking out these 25 AI penny stocks, which features companies harnessing artificial intelligence to transform entire industries.

- Capture long-term income with these 19 dividend stocks with yields > 3%, where you will find leading businesses that consistently deliver strong dividend yields above 3%.

- Get ahead of the curve by researching these 897 undervalued stocks based on cash flows, packed with companies currently priced below their cash flow fundamentals and positioned for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives