- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

NextDecade (NEXT): Assessing Valuation Following Major LNG Offtake Deals and Project Milestones

Reviewed by Simply Wall St

If you have been watching NextDecade (NEXT), the recent wave of long-term LNG offtake agreements from the Rio Grande LNG project is definitely turning heads. In just a few days, major players such as EQT and now ConocoPhillips have locked in 20-year purchase commitments tied to Train 5. These deals, contingent on a positive final investment decision, signal growing commercial momentum for NextDecade’s ambitious expansion plans and are hard for investors to ignore, especially as the company clarifies commercialization targets and construction costs.

All of this comes at a time when NextDecade’s stock has been anything but quiet. Shares have more than doubled over the past year, yet experienced some pullback in the past month despite the string of contract wins. With long-term fundamentals grabbing attention and active news flow underlining the project’s viability, investors are weighing just how much of the future upside is starting to get priced in, and if the latest moves mark a shift in market sentiment or just healthy consolidation after outsized gains.

So with all this positive activity lining up behind Rio Grande LNG, is the stock now undervalued considering its growth pipeline, or is the market already assigning full value to the company’s expansion ambitions?

Price-to-Book of 10.1x: Is it justified?

NextDecade is currently valued with a Price-to-Book (P/B) ratio of 10.1x, which is significantly higher than the US Oil and Gas industry average of 1.3x. This places the stock firmly in the expensive category when benchmarked against industry peers using this metric.

The Price-to-Book ratio compares a company's market value to its book value, offering insights into how much investors are willing to pay for each dollar of net assets. In capital-intensive industries like oil and gas, a high P/B can signal strong expectations of future growth; however, it may also highlight investor eagerness that outpaces near-term fundamentals.

While the market has clearly priced in substantial growth potential for NextDecade, especially given its aggressive expansion plans and high forecasted revenue growth, this elevated valuation may reflect confidence in future profitability that is not imminent. The market could be overestimating, given that NextDecade is currently unprofitable and not forecast to achieve profitability in the short-term.

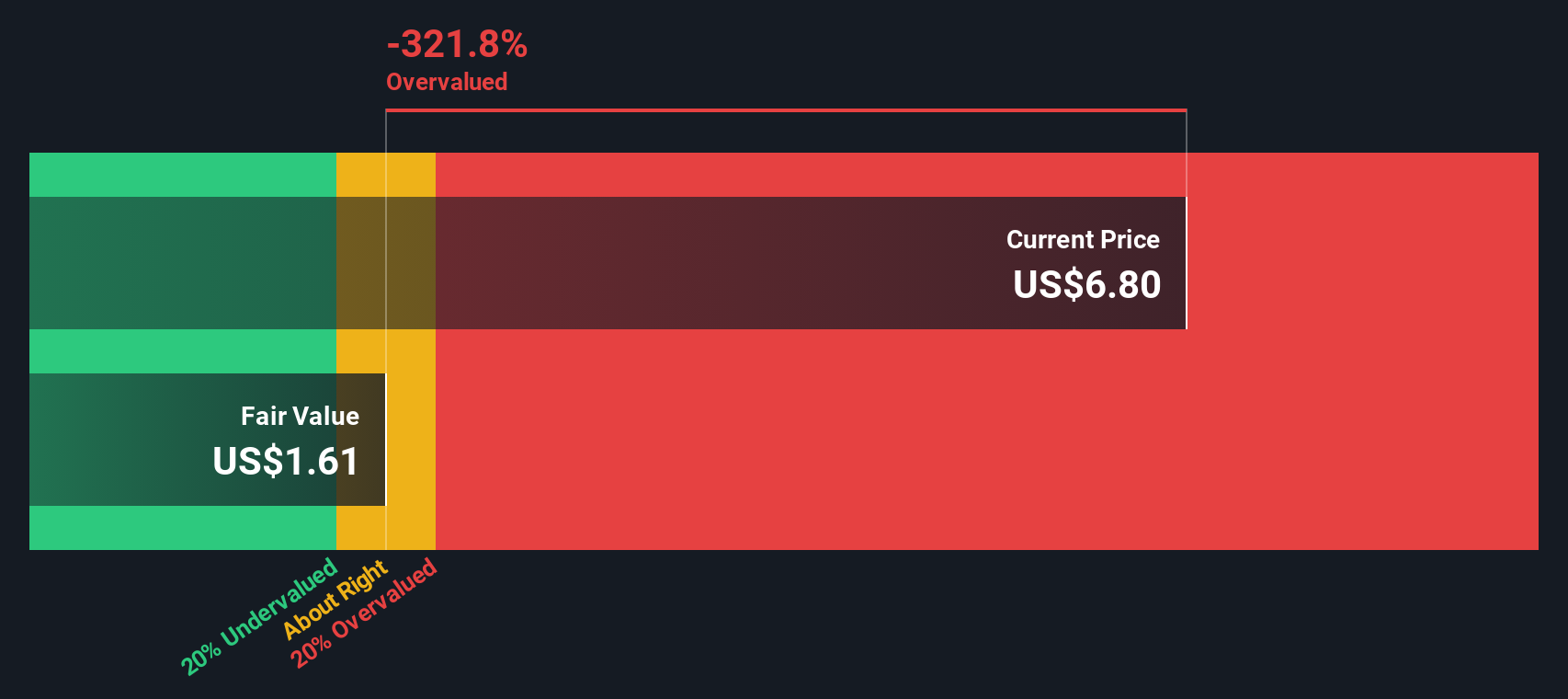

Result: Fair Value of $1.96 (OVERVALUED)

See our latest analysis for NextDecade.However, stalled project financing or delays in securing further offtake agreements could quickly erode recent momentum and bring valuation concerns back into focus.

Find out about the key risks to this NextDecade narrative.Another View: What Does the SWS DCF Model Say?

Taking a different approach, the SWS DCF model also views the stock as more expensive than its underlying value. While both methods point in the same direction, it is worth considering whether future upside could still surprise.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NextDecade Narrative

If you see things differently or enjoy drawing your own conclusions, it only takes a couple of minutes to dive in and form your own view. Do it your way

A great starting point for your NextDecade research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock exciting opportunities beyond NextDecade by checking out stocks selected for their growth potential, innovation, and stability. If you want to get ahead of the market, do not let these unique ideas pass you by.

- Grow your portfolio’s future by researching powerful innovators driving the next wave of medical breakthroughs with healthcare AI stocks.

- Boost your passive income stream and shield your investments with shares handpicked for robust returns in dividend stocks with yields > 3%.

- Unearth undervalued gems trading below their fair worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>