- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

Is NextDecade (NEXT) Pricing Reflect Its LNG Project Developments And Recent Share Slide

Reviewed by Bailey Pemberton

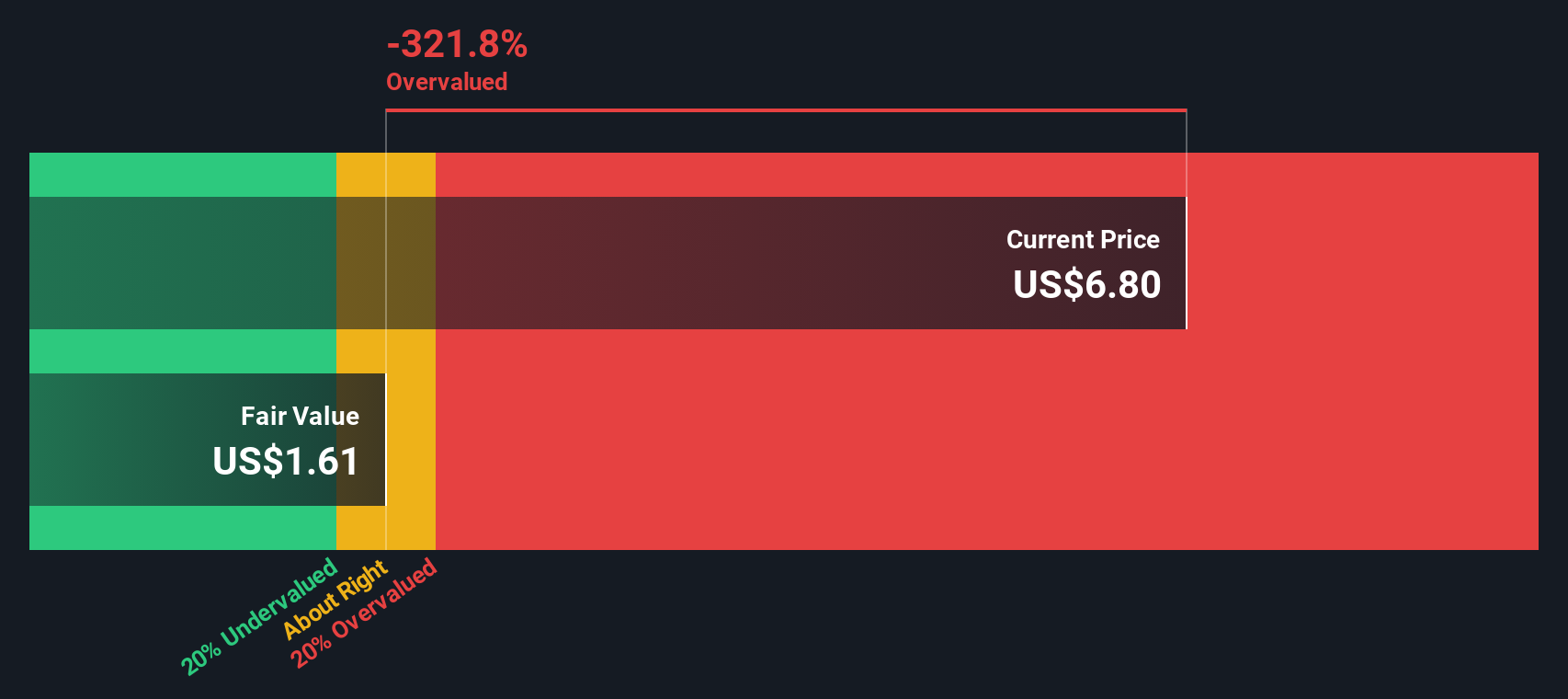

- If you are trying to work out whether NextDecade's current share price still reflects its long term potential, the key question is how the stock stacks up against its underlying value.

- The share price closed at US$4.86 recently, after a 7.4% decline over the last week and a 11.3% decline over the last month, with the one year return at a 46.3% loss and the five year return at 78.7%.

- Recent news around NextDecade has focused on its role in US liquefied natural gas projects and its efforts to progress long term development plans. This helps explain why the stock can be sensitive to updates on project timelines and financing. For investors, these headlines give important context for the recent share price swings and set the scene for thinking carefully about what the company might be worth.

- On our valuation checks, NextDecade scores 2 out of 6 on the Simply Wall St valuation scorecard, as shown here. Next we will walk through the different valuation approaches before finishing with a more holistic way to think about value.

NextDecade scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NextDecade Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company could be worth by projecting its future cash flows and then discounting those back to today using a required return. It is essentially asking what all those future dollars are worth in your hands right now.

For NextDecade, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is a loss of about $3,711.6 million. Analyst and extrapolated projections stay negative in the near term, with free cash flow estimates of $4,974 million and $4,937 million in 2026 and 2027, before turning positive later in the decade. By 2030, projected free cash flow is $1,853 million, with further growth extrapolated out to 2035.

When all these projected cash flows are discounted back, the model arrives at an estimated intrinsic value of about $121.09 per share. Compared with the recent share price of $4.86, the DCF output suggests the stock is around 96.0% undervalued on this set of assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NextDecade is undervalued by 96.0%. Track this in your watchlist or portfolio, or discover 877 more undervalued stocks based on cash flows.

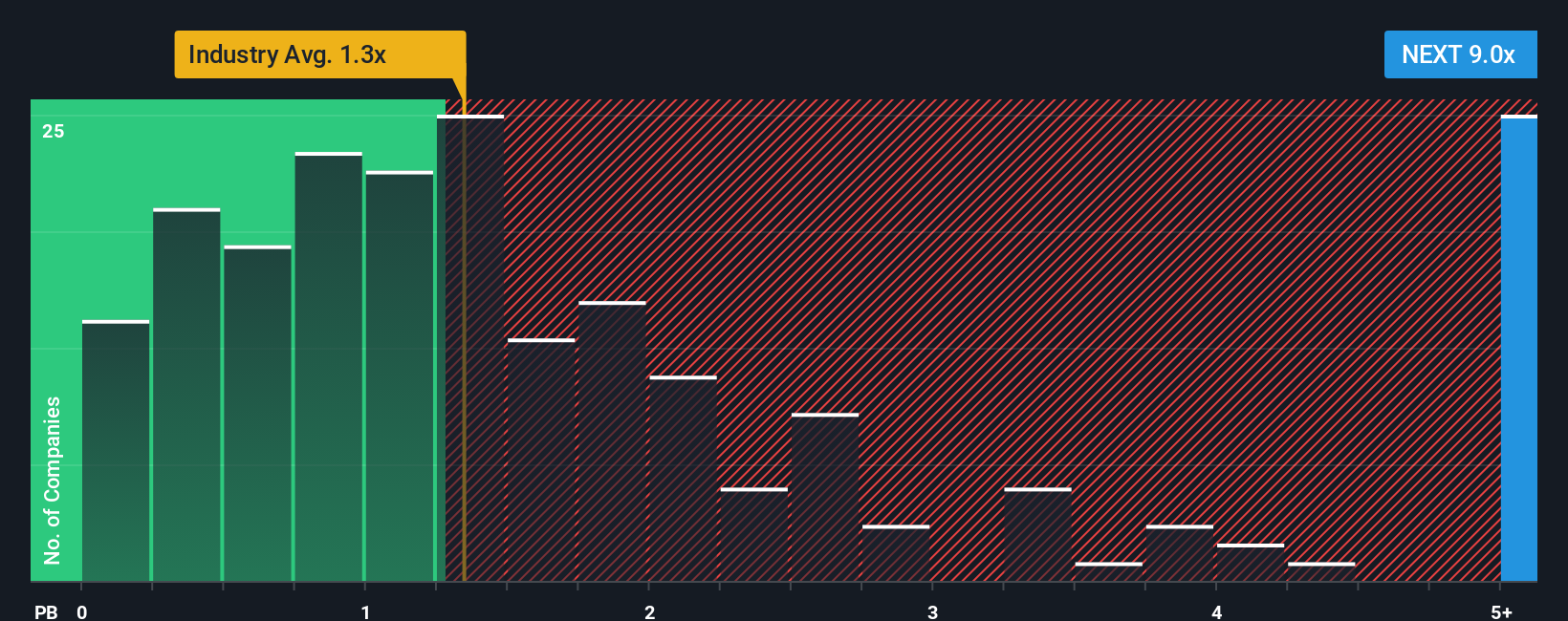

Approach 2: NextDecade Price vs Book

For companies where current earnings are not a clear guide, price-based metrics that focus on assets can be useful. The P/B ratio compares what the market is paying for each dollar of net assets on the balance sheet, which can be helpful when profits are volatile or negative.

In general, higher growth expectations and lower perceived risk tend to support a higher “normal” P/B multiple. Meanwhile, lower growth prospects or higher risk usually justify a lower one. So, the context around a company matters a lot when you look at this ratio on its own.

NextDecade currently trades at a P/B of 8.33x. This sits well above the Oil and Gas industry average of about 1.37x and also above the peer group average of about 1.63x. Simply Wall St’s Fair Ratio is a proprietary estimate of what a company’s P/B might be, based on factors like earnings growth, profit margins, industry, market cap and specific risks. Because it incorporates these fundamentals, the Fair Ratio can be a more tailored benchmark than a simple comparison with peers or the broad industry. However, a Fair Ratio figure is not available here, so this approach cannot indicate whether the current P/B suggests the shares are overvalued, undervalued or about right.

Result: ABOUT RIGHT

P/B ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NextDecade Narrative

Earlier we mentioned that there is an even better way to think about valuation, so let us introduce you to Narratives. These are simply your story about a company, tied directly to your own assumptions for fair value, future revenue, earnings and margins.

A Narrative connects three pieces in one place: the business story you believe, the financial forecast that flows from that story, and the fair value that drops out of those numbers.

On Simply Wall St, millions of investors use Narratives on the Community page as an easy, accessible way to set their own assumptions, see a fair value estimate, and compare it with the current share price to help decide whether a stock might be worth adding, trimming or watching.

Because Narratives update automatically when new information such as earnings, project updates or other news is added to the platform, your fair value view can stay aligned with what is actually happening in the business rather than a one off spreadsheet.

For example, one NextDecade Narrative on the Community page might assume very strong long term cash flows and point to a fair value far above US$4.86, while another could build in more conservative project outcomes and arrive at a fair value much closer to the current price.

Do you think there's more to the story for NextDecade? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Britam Holdings will navigate a 2.43 fair value journey to growth

An amazing opportunity to potentially get a 100 bagger

Cenergy Holdings S.A. (CENER.AT): Europe's Premier Energy Infrastructure Solutions Provider

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion