- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

Is NESR (NasdaqCM:NESR) Undervalued? Examining Valuation After New Buy Rating from Maxim Group

Reviewed by Simply Wall St

Most Popular Narrative: 22.3% Undervalued

The dominant narrative values NESR as significantly undervalued, suggesting a notable gap between its current price and what analysts believe is its fair value. This is based on future earnings growth and sector tailwinds.

“Activity in unconventional resource development, especially gas, across the Middle East is accelerating. NESR's established position in Saudi's Jafurah project and expanding contracts in Kuwait and North Africa provide strong exposure to secular increases in service intensity per well, which supports both top-line expansion and higher per-unit margins.”

What if the most important numbers for NESR's future have yet to hit the headlines? The main narrative fueling this undervaluation is built on bold financial projections about growth in key energy regions and a dramatic improvement in profitability. Analysts are betting on a transformation, but the real logic behind this fair value target is hidden in the forward-looking math. Hungry for the financial details that make this target possible? The core assumptions are more ambitious than you might think.

Result: Fair Value of $13.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, delays in contract awards or unrest in some MENA countries could quickly disrupt NESR's revenue visibility and put pressure on the bullish outlook.

Find out about the key risks to this National Energy Services Reunited narrative.Another View: Discounted Cash Flow Perspective

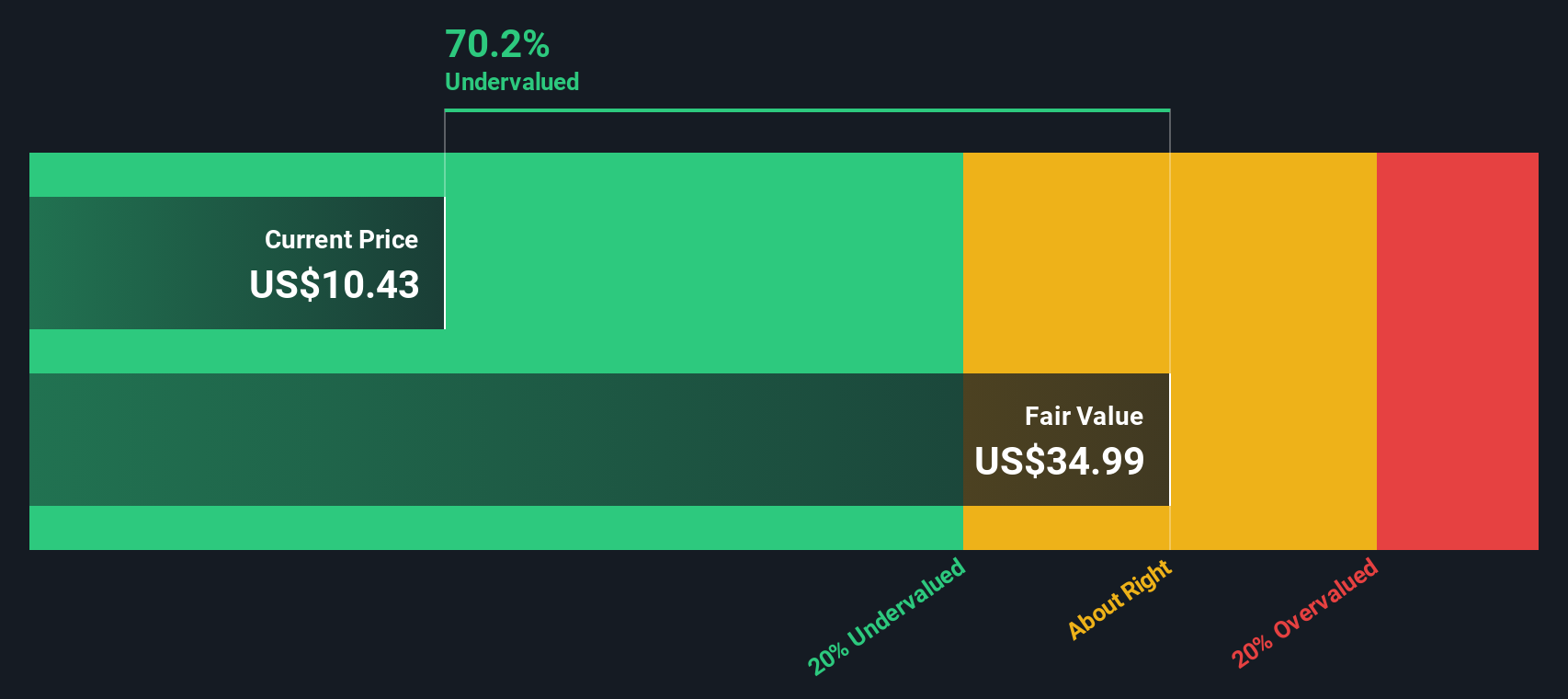

While analysts' price targets paint a bullish picture, our DCF model tells a more extreme story by indicating NESR is dramatically undervalued if future cash flows play out as modeled. Does the market see it differently?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Energy Services Reunited for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Energy Services Reunited Narrative

If you see things differently, or want to dive deeper into the numbers yourself, you can craft your own narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding National Energy Services Reunited.

Looking for more investment ideas?

Missing out on other high-potential stocks is easy if you only stick to the headlines. Take control of your investing future with handpicked opportunities waiting below.

- Supercharge your portfolio's income with companies offering market-beating yields by using our dividend stocks with yields > 3%.

- Get ahead of the curve with companies at the forefront of artificial intelligence using our exclusive AI penny stocks.

- Uncover hidden value and capitalize on stocks trading below their projected cash flow with our smart undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives