- United States

- /

- Capital Markets

- /

- NYSE:AC

Discovering Hidden Opportunities in Three Promising US Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight dip of 1.2%, yet it has shown remarkable resilience with a 30% rise over the past year and an optimistic forecast for annual earnings growth of 15%. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover hidden opportunities that may not be immediately apparent to all investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| AirJoule Technologies | NA | nan | 127.67% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

National Energy Services Reunited (NasdaqCM:NESR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Energy Services Reunited Corp. offers oilfield services in the Middle East and North Africa region, with a market capitalization of $837.69 million.

Operations: NESR generates revenue primarily from its oilfield services in the Middle East and North Africa. The company has a market capitalization of approximately $837.69 million.

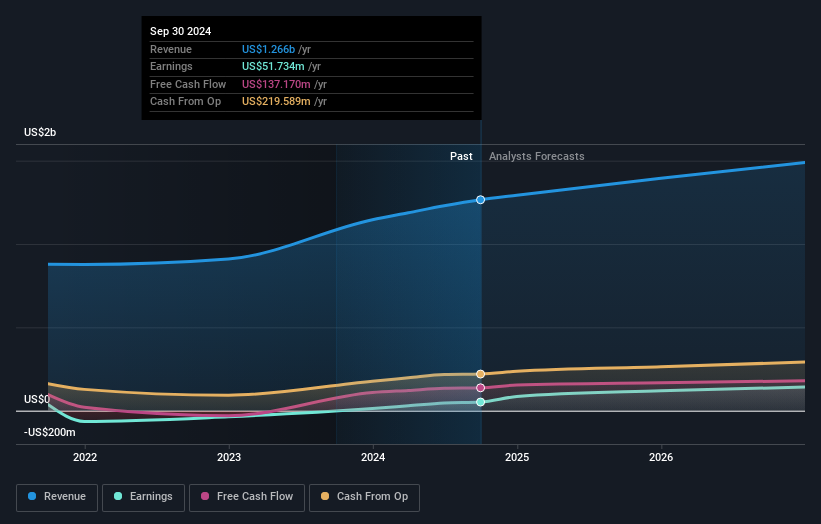

National Energy Services Reunited (NESR) recently reported impressive financial results, with third-quarter sales reaching US$336.21 million, up from US$300.08 million a year ago, and net income rising to US$20.62 million from US$14.73 million. Their earnings per share increased to US$0.22 compared to last year's US$0.16, highlighting their robust performance in the energy services sector where earnings grew by 22,460%. Despite this growth, their interest payments are not well covered by EBIT at 2.9 times coverage and shareholders faced dilution over the past year; however, NESR remains a good relative value trading significantly below its fair value estimate and maintains satisfactory debt levels with a net debt-to-equity ratio of 33.3%.

- Take a closer look at National Energy Services Reunited's potential here in our health report.

Understand National Energy Services Reunited's track record by examining our Past report.

TAT Technologies (NasdaqGM:TATT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TAT Technologies Ltd., along with its subsidiaries, offers solutions and services to the commercial and military aerospace and ground defense sectors in the United States, Israel, and internationally, with a market cap of $255.97 million.

Operations: TAT Technologies generates revenue primarily from the aerospace and defense sectors, operating in both commercial and military markets. The company has a market cap of $255.97 million.

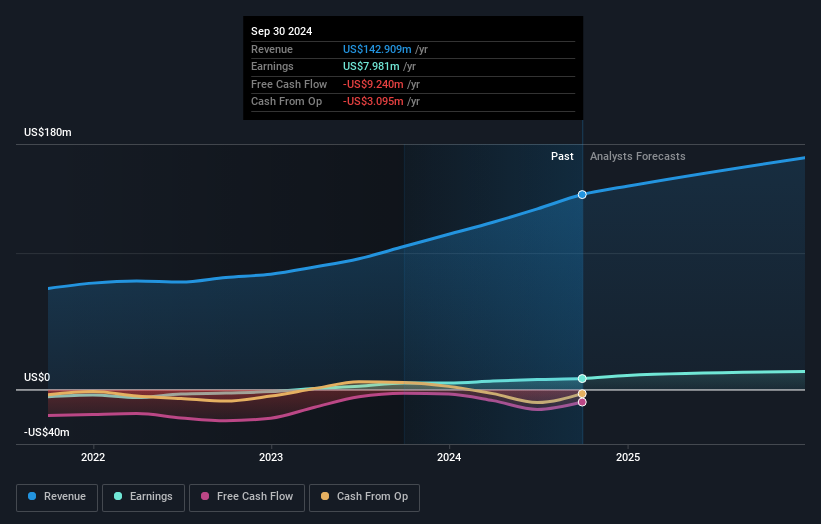

TAT Technologies, a notable player in the Aerospace & Defense sector, has shown impressive earnings growth of 67% over the past year, outpacing the industry average of 21%. With well-covered interest payments at 5.9 times EBIT and a satisfactory net debt to equity ratio of 6.9%, its financial health seems robust. Despite recent shareholder dilution through private placements, TAT's revenue for Q3 reached US$40.46 million compared to US$29.94 million last year, while net income rose to US$2.87 million from US$2.15 million—demonstrating strong operational performance and potential for continued value creation in its niche market segment.

- Click here to discover the nuances of TAT Technologies with our detailed analytical health report.

Review our historical performance report to gain insights into TAT Technologies''s past performance.

Associated Capital Group (NYSE:AC)

Simply Wall St Value Rating: ★★★★★★

Overview: Associated Capital Group, Inc. offers investment advisory services in the United States and has a market capitalization of approximately $776.39 million.

Operations: Associated Capital Group generates revenue primarily from its investment advisory and asset management services, totaling $13.66 million.

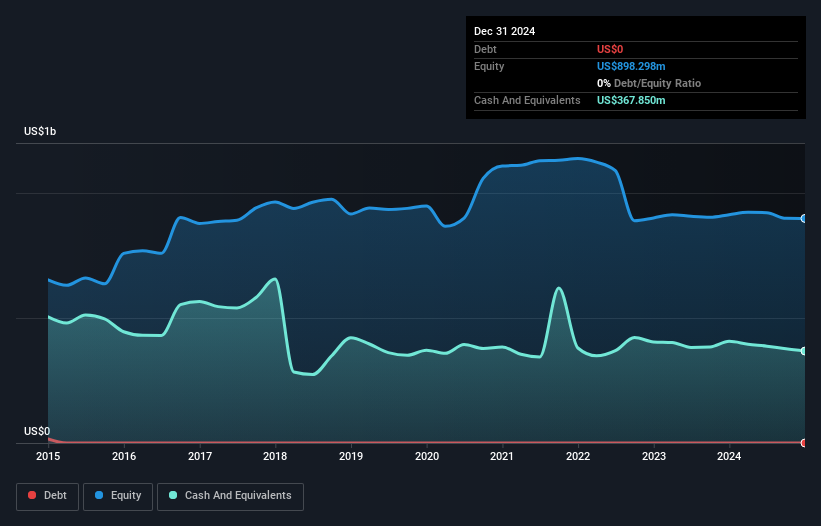

Associated Capital Group, a nimble player in the financial sector, has shown impressive earnings growth of 62.2% over the past year, outpacing the industry average of 13%. With no debt on its books for five years and a price-to-earnings ratio at 13.8x—lower than the US market's 18.8x—it offers an attractive valuation proposition. Recent results highlighted net income of US$23.24 million for Q3, bouncing back from a slight loss last year, while revenue touched US$2.42 million up from US$2.2 million previously. Notably, it declared a special dividend of $2 per share this September, reflecting strong shareholder returns strategies.

Key Takeaways

- Reveal the 229 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AC

Associated Capital Group

Provides investment advisory services in the United States.

Flawless balance sheet with proven track record.