- United States

- /

- Energy Services

- /

- NasdaqGS:KLXE

Investors in KLX Energy Services Holdings (NASDAQ:KLXE) from five years ago are still down 89%, even after 11% gain this past week

KLX Energy Services Holdings, Inc. (NASDAQ:KLXE) shareholders should be happy to see the share price up 29% in the last month. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 89% lower after that period. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for KLX Energy Services Holdings

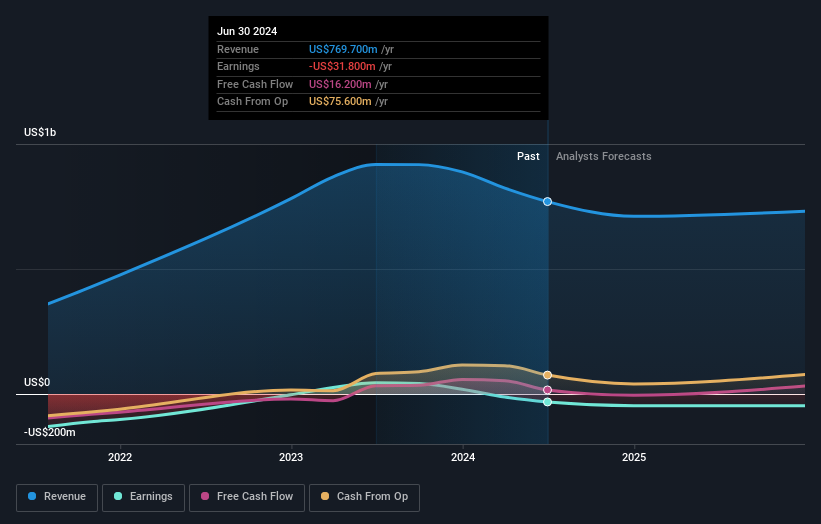

KLX Energy Services Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, KLX Energy Services Holdings grew its revenue at 18% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 14% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling KLX Energy Services Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in KLX Energy Services Holdings had a tough year, with a total loss of 43%, against a market gain of about 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 14% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for KLX Energy Services Holdings (1 is a bit concerning!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KLX Energy Services Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KLXE

KLX Energy Services Holdings

Provides drilling, completions, production, and well intervention services and products to the onshore oil and gas producing regions of the United States.

Undervalued slight.