- United States

- /

- Energy Services

- /

- NasdaqGS:KLXE

Insufficient Growth At KLX Energy Services Holdings, Inc. (NASDAQ:KLXE) Hampers Share Price

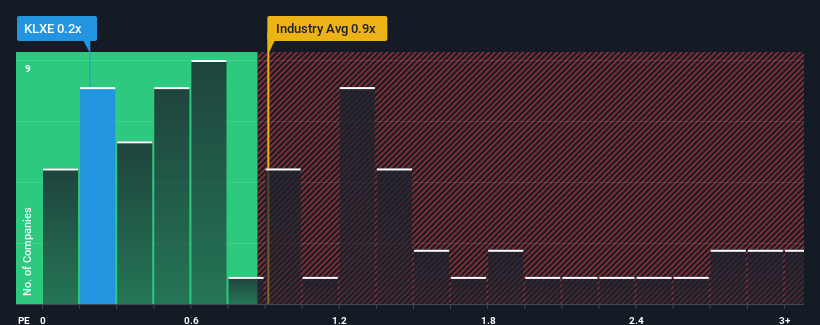

When close to half the companies operating in the Energy Services industry in the United States have price-to-sales ratios (or "P/S") above 0.9x, you may consider KLX Energy Services Holdings, Inc. (NASDAQ:KLXE) as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for KLX Energy Services Holdings

What Does KLX Energy Services Holdings' P/S Mean For Shareholders?

Recent times have been advantageous for KLX Energy Services Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on KLX Energy Services Holdings.How Is KLX Energy Services Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as KLX Energy Services Holdings' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. Pleasingly, revenue has also lifted 218% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 1.5% over the next year. That's not great when the rest of the industry is expected to grow by 13%.

In light of this, it's understandable that KLX Energy Services Holdings' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From KLX Energy Services Holdings' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of KLX Energy Services Holdings' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with KLX Energy Services Holdings (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

If you're unsure about the strength of KLX Energy Services Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if KLX Energy Services Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KLXE

KLX Energy Services Holdings

Provides drilling, completions, production, and well intervention services and products to the onshore oil and gas producing regions of the United States.

Undervalued with mediocre balance sheet.