- United States

- /

- Oil and Gas

- /

- NasdaqCM:HNRG

Market Cool On Hallador Energy Company's (NASDAQ:HNRG) Revenues Pushing Shares 26% Lower

The Hallador Energy Company (NASDAQ:HNRG) share price has fared very poorly over the last month, falling by a substantial 26%. The recent drop has obliterated the annual return, with the share price now down 2.7% over that longer period.

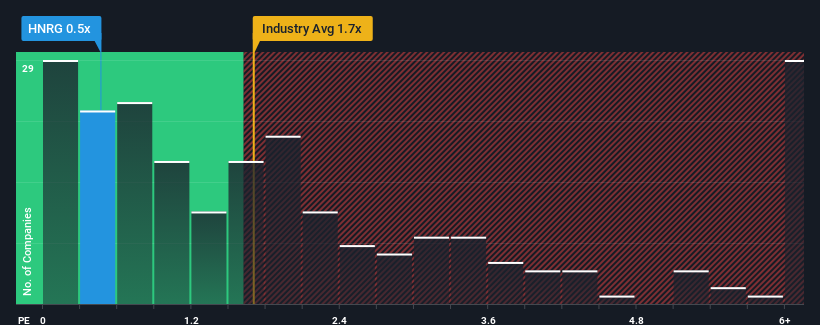

Since its price has dipped substantially, Hallador Energy may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Oil and Gas industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hallador Energy

What Does Hallador Energy's Recent Performance Look Like?

Recent times have been pleasing for Hallador Energy as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on Hallador Energy will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hallador Energy.How Is Hallador Energy's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Hallador Energy's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 142% last year. Pleasingly, revenue has also lifted 160% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 3.7% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 4.1%, which is not materially different.

With this information, we find it odd that Hallador Energy is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Hallador Energy's P/S?

Hallador Energy's recently weak share price has pulled its P/S back below other Oil and Gas companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Hallador Energy currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Hallador Energy with six simple checks on some of these key factors.

If you're unsure about the strength of Hallador Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hallador Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HNRG

Hallador Energy

Through its subsidiaries, engages in the production of steam coal for the electric power generation industry in Indiana.

Excellent balance sheet and fair value.

Market Insights

Community Narratives