- United States

- /

- Oil and Gas

- /

- NasdaqGS:GLNG

How Golar LNG’s (GLNG) Argentina Contracts and Service Model Could Shape Future Earnings Visibility

Reviewed by Sasha Jovanovic

- Earlier this month, analysts highlighted Golar LNG’s position as the only proven independent operator in the floating LNG market, emphasizing its liquefaction-as-a-service approach and US$17 billion contracted earnings backlog.

- An intriguing aspect is that Golar LNG’s long-term Argentina contracts grant a 20-year call option on global LNG prices, offering potential upside with limited downside exposure.

- We'll explore how Golar’s unique Argentina contracts and service model shape its investment narrative and future earnings visibility.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Golar LNG Investment Narrative Recap

To be a Golar LNG shareholder, you need to believe in a global shift toward floating LNG solutions, strong long-term industry demand, and the value created by infrastructure-like contracted cash flows. The recent analyst attention on Golar’s Argentina contracts and US$17 billion backlog reinforces the company’s core investment thesis, but does not materially change the short-term catalyst: the ongoing expansion and high utilization of their new FLNG units. However, risks such as market overcapacity and margins from incoming competitors remain significant.

Of the company's latest announcements, the final investment decision for the 20-year charter of Golar’s 3.5MTPA MK II FLNG in Argentina stands out. This contract’s scale and duration exemplify the type of milestone that provides visible cash flow, aligning directly with Golar’s long-term earnings narrative and the expectations for growth-driven catalysts in the near term. But, contrasting with that opportunity, investors should always be mindful that...

Read the full narrative on Golar LNG (it's free!)

Golar LNG’s outlook points to $434.8 million in revenue and $205.2 million in earnings by 2028. This is based on analysts forecasting a 17.4% annual revenue growth rate and a $211.7 million earnings increase from the current $-6.5 million.

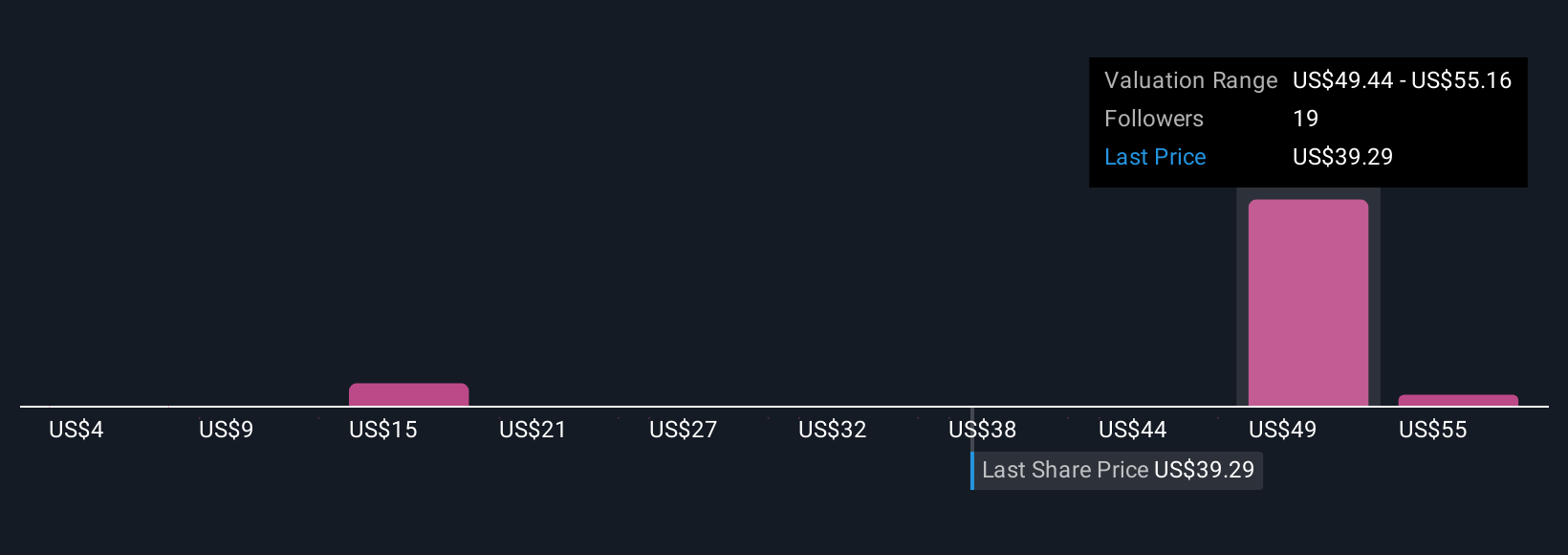

Uncover how Golar LNG's forecasts yield a $51.10 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate Golar LNG’s fair value from as low as US$3.72 to US$60.87 per share. While some highlight long-term contracts and cash flow visibility, others caution that sector overcapacity or shifting regulations could impact future revenue stability; make sure to explore several of these viewpoints for a fuller picture.

Explore 5 other fair value estimates on Golar LNG - why the stock might be worth less than half the current price!

Build Your Own Golar LNG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Golar LNG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Golar LNG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Golar LNG's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLNG

Golar LNG

Designs, converts, owns, and operates marine infrastructure for the liquefaction of natural gas.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives